Picture supply: Getty Photographs

On the lookout for rock-solid shares to purchase for a second earnings? Listed here are two I’d purchase with spare money to speculate. And I’d anticipate them to pay massive dividends, no matter financial situations.

The PRS REIT

The PRS REIT (LSE:PRSR) share price has gone gangbusters on rising hopes of huge and sustained rate of interest cuts. At 97.8p per share, it’s now buying and selling at its costliest for 2 years.

Actual property funding trusts (REITs) like this may be dividend lifeboats in troubled occasions. They sometimes have their tenants locked down on long-term contracts. And to allow them to anticipate a gentle stream of earnings in any respect factors of the financial cycle.

PRS REIT presents an additional layer of safety to traders. Okay, rental contracts won’t be as lengthy. However it specialises within the ultra-defensive residential property market, the place rents are much more safe. Assortment right here was 100% between April and June, whereas occupancy was a powerful 96%.

One different motive I like REITs is that they’re obliged to pay a minimal of 90% of rental income out in dividends. They do that in alternate for sure tax benefits (like exclusion from company tax).

As a consequence, PRS REIT carries massive dividend yields of three.5% and 4.5% for the subsequent two monetary years.

On the draw back, residential rental progress within the UK’s cooling. This dropped to three-year lows of 5.4% in September, in accordance with Zoopla. It could average additional within the years forward if authorities plans to construct 300,000 new houses a 12 months to 2029 don’t stay up to expectations.

Nevertheless, the speed of inhabitants progress means PRS ought to proceed paying a big and rising dividend, in my view. And it’s constructing its property pipeline to maintain earnings and dividends on an upward slant (it’a a pipeline that sits at roughly £3bn).

Please notice that tax remedy relies on the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

Pan African Assets

Buying gold’s a traditional technique throughout robust and unsure financial intervals and occasions of excessive inflation. Demand for the safe-haven asset tends to choose up significantly in these situations.

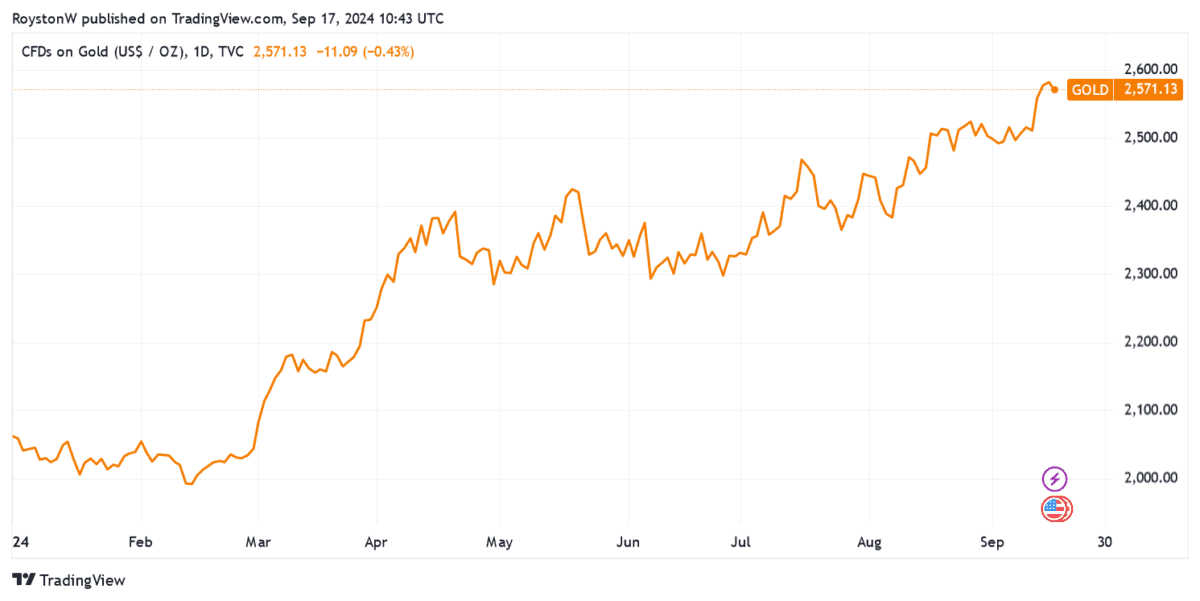

This has actually been the case in 2024. The yellow steel has hit repeated document highs, and has touched one other peak round $2,600 per ounce in current days.

I wouldn’t purchase bodily steel or a gold-tracking exchange-traded fund (ETF) to capitalise on this although. By shopping for a mining inventory as a substitute, I may additionally have an opportunity of receiving a dividend.

For this reason Pan African Assets (LSE:PAF) can be on the high of my very own procuring record. For the subsequent two years predicted dividends truly sit at eye-popping ranges. These are 3.6% and 6.6% for the monetary intervals to June 2025 and 2026 respectively.

Investing in miners can carry further risks. Specifically, Pan African Assets’ share price could plummet if it experiences manufacturing issues at its South African operations.

Nevertheless, I consider this risk’s baked into the corporate’s rock-bottom valuation. At 32.5p per share, it trades on a ahead price-to-earnings (P/E) ratio of simply 6.5 occasions.