NAIROBI (Coinchapter.com)— XRP price hovered close to $2.06 on Apr. 4 after days of intense volatility pushed main altcoins towards key help zones. Whereas Bitcoin price in USD phrases held above $83,000, Ripple’s XRP examined the $2.00 threshold a number of occasions, elevating issues over its short-term course.

A bullish chart sample now presents a potential 73% upside, however bearish alerts and weak on-chain metrics recommend a possible 68% crash stays in play.

XRP $2 Help Holds—for Now

XRP stabilized close to $2.06 after recovering from a pointy 5.3% drop triggered by U.S. President Donald Trump’s new reciprocal tariffs. The ‘Liberation Day’ coverage, which imposes a ten% base cost on imports, rattled world markets, inflicting $3.94 million in XRP liquidations alone.

XRP derivatives liquidation. Supply: Coinglass

In response to Coinglass, $2.94 million in lengthy positions have been worn out inside 24 hours. The cryptocurrency’s present bounce comes as broader threat markets digest Trump’s commerce stance and await regulatory readability.

Regardless of the bounce, XRP stays on shaky floor. The token retested its $2.00 help at the very least thrice over the previous two weeks. Analysts warn that repeated assessments may exhaust purchaser curiosity, probably resulting in a breakdown.

XRP Value Chart Patterns Trace at Diverging Paths

A symmetrical triangle breakout on XRP’s every day chart suggests a 70% upside goal close to $3.55, based mostly on the sample’s measured transfer. The breakout follows weeks of price compression between the 50-day and 200-day exponential shifting averages.

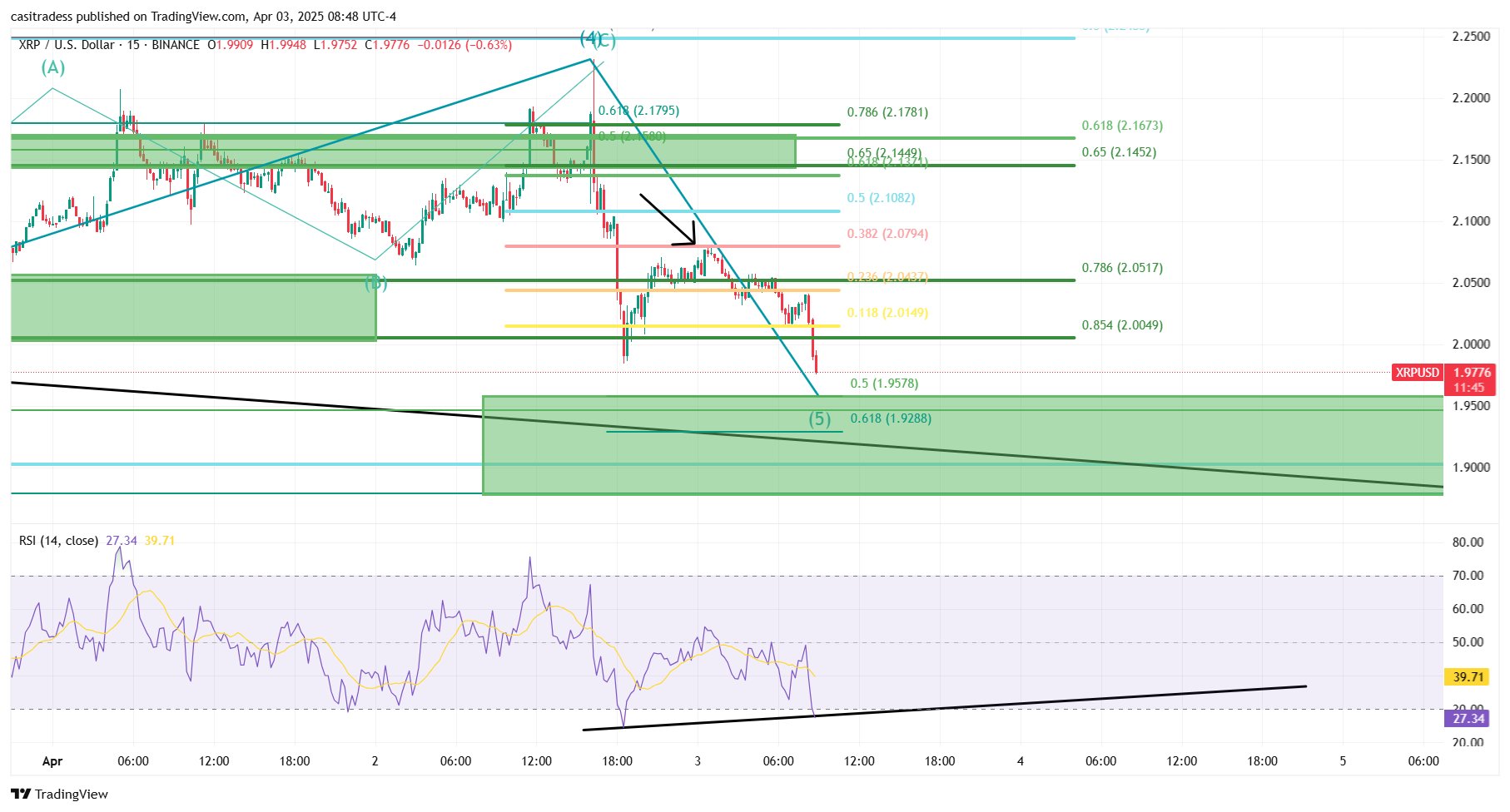

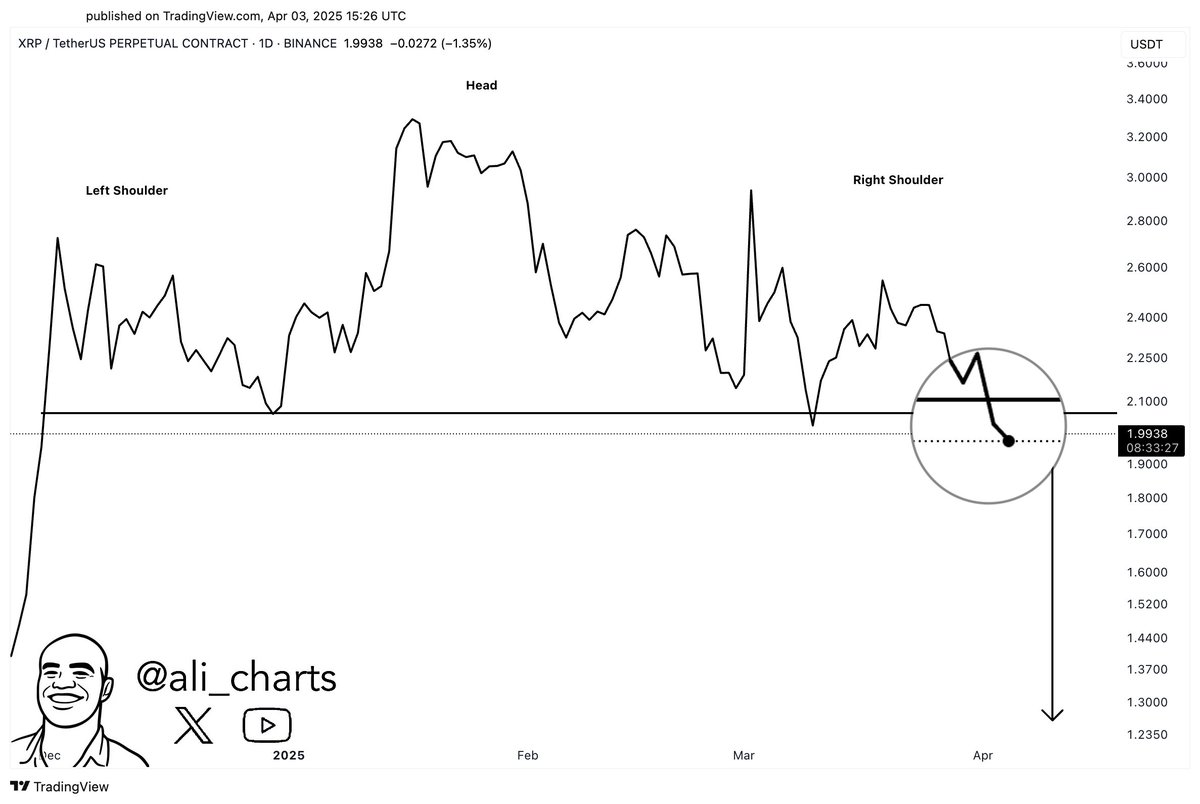

On the identical time, fashionable analyst Ali Martinez famous a bearish head-and-shoulders sample. He warned of a potential drop to $1.30, tweeting,

“$XRP is breaking out of a head-and-shoulders pattern, setting the stage for a potential move to $1.30!”

Retail FOMO Dropping Steam?

XRP’s explosive 600% rally up to now 12 months got here with a surge in speculative curiosity. However that momentum now seems to be fading. Information from Glassnode reveals the variety of lively addresses fell from 10,200 in Jan. to only 4,388 as of Apr. 4.

Realized revenue/loss ratios proceed to say no. Analysts at Glassnode attribute this to retail merchants going through unrealized losses, saying:

“Retail investor confidence in XRP may be slipping… this may also extend across the broader market.”

The XRP realized cap surged from $30.1 billion to $64.2 billion since late 2024, with over $30 billion coming from new holders. Nonetheless, many of those addresses now face losses, which may strain the price additional if sentiment continues to bitter.

Ripple’s Stablecoin Push and Utility Enhance

Ripple’s integration of its USD-pegged stablecoin, RLUSD, into its cross-border funds system may provide some help. The corporate confirmed the transfer on Apr. 2, stating that RLUSD will improve liquidity and adoption alongside XRP.

RLUSD’s market cap rose by 87% in March alone to $244 million, in response to rwa.xyz. Alva, a crypto insights platform, famous on Apr. 3:

“Ripple’s $RLUSD integration is a pivotal move for cross-border payments… optimism around $RLUSD soaring, with eyes on its ripple effect on XRP.”

Pairing RLUSD with XRP on the XRP Ledger may drive buying and selling quantity on its decentralized change, decreasing circulating provide.

Whale Promoting Clouds Lengthy-Time period Outlook

Nonetheless, long-term holders seem like decreasing publicity. CryptoQuant information reveals over $1 billion value of XRP moved out of whale addresses within the final 14 days. These positions have been offloaded at a median price of $2.10, suggesting even giant traders see restricted upside close to present ranges.

On-chain provide information from Santiment additionally highlights rising issues. The full provide of XRP continues to rise resulting from Ripple’s month-to-month token releases, including downward strain on price.

Community progress can also be in decline, dropping from 514 to 42 since Feb., a sign of waning consumer adoption.

Bitcoin Value USD and Macro Sentiment

Whereas XRP struggles close to $2.00, Bitcoin price in USD phrases stays rangebound above $83,000. The macro backdrop, together with Trump’s tariffs and world market nervousness, continues to weigh on crypto sentiment.

With XRP now squeezed between conflicting technical setups and deteriorating fundamentals, the $2.00 degree turns into a key pivot. A decisive transfer above $2.35 may validate the bullish breakout, whereas a dip beneath $1.95 could invite aggressive promoting.