Picture supply: Getty Photos

When the inventory market will get uneven, development shares usually get hit the toughest. And that is no accident – their future money flows are sometimes much less sure than worth shares or dividend shares.

Basically although, this stuff are usually pretty cyclical. I don’t know precisely when issues will flip round, however I believe this can be a good time to be development shares for after they do.

Progress vs worth

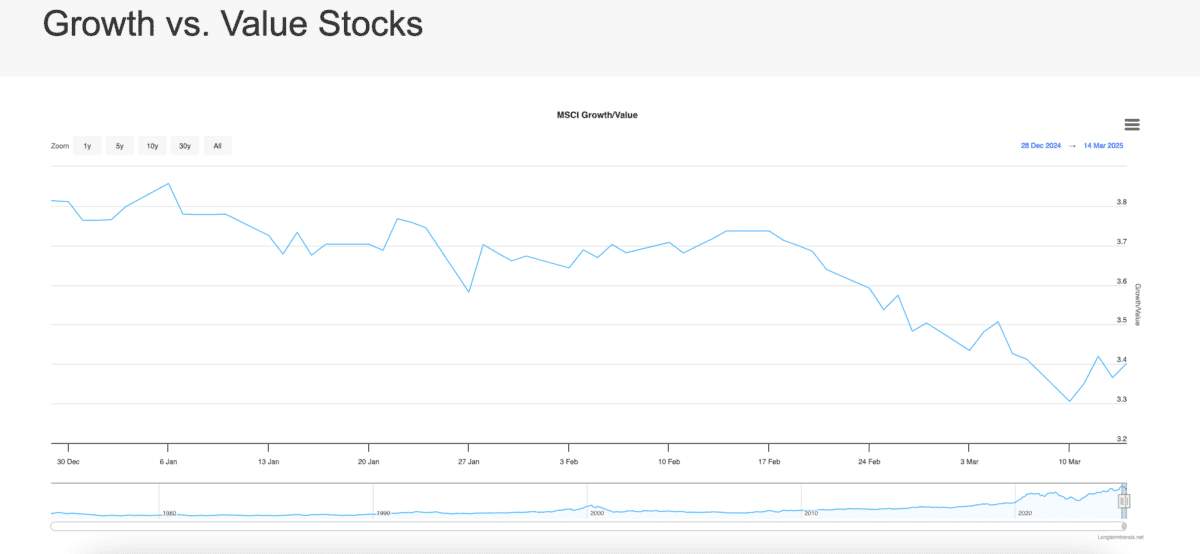

Up to now this 12 months, the ratio of the MSCI US Progress Index to the MSCI US Worth Index has fallen from 3.8 to three.4. In different phrases, US development shares have underperformed worth shares.

The identical normal development has been true elsewhere. The FTSE 100 has outperformed the S&P 500 in 2025, however an enormous cause for that is the focus of development shares within the US index.

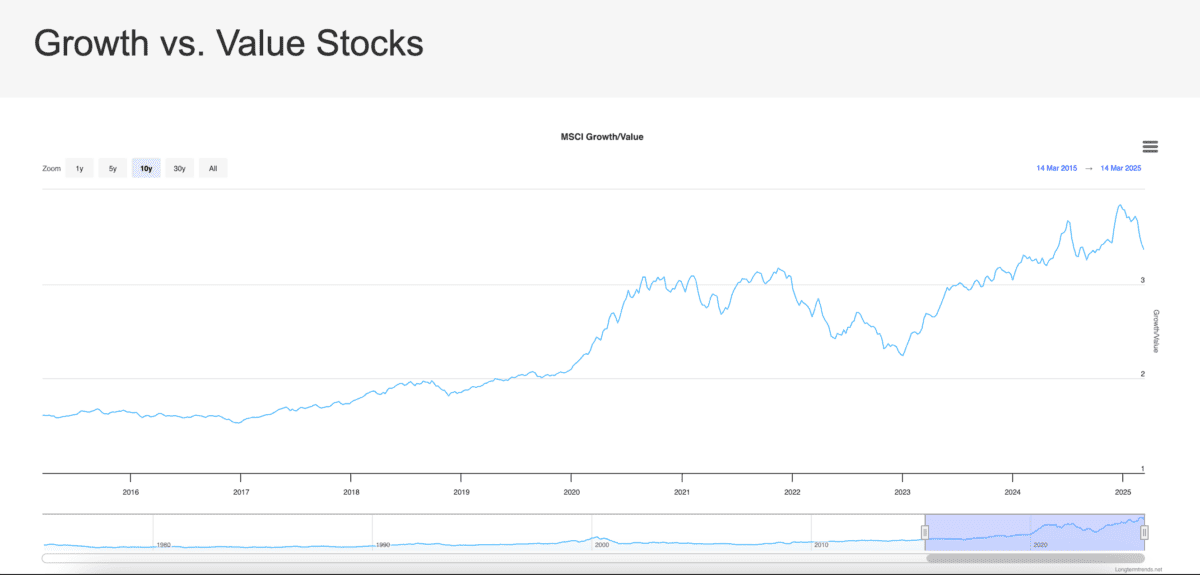

Traders nevertheless, needs to be cautious. The hole between development shares and worth shares has been closing, however it’s nonetheless in the direction of the upper finish of the place it’s been during the last decade.

Because of this, I don’t see the newest downturn within the inventory market as a time to go shopping for development shares hand over fist. However I do suppose it’s an opportunity to search for some particular alternatives.

A FTSE 100 grower

Compass Group (LSE:CPG) is a inventory that has been catching my eye lately. Shares within the FTSE 100 contract catering agency have fallen 13.5% within the final month.

Regardless of this, I believe there’s loads to love in regards to the underlying enterprise. The corporate’s scale offers it a transparent aggressive benefit with regards to negotiating bulk costs from suppliers.

On prime of this, the newest buying and selling replace reported some robust income development. Natural gross sales have been up over 9% and the agency is anticipating this to remain above 7.5% for the remainder of 2025.

Trying forward, I believe there’s additionally good potential beneath the highest line. The debt stage and the share depend are each nonetheless excessive following the pandemic and decreasing these ought to increase income.

What’s the issue?

Regardless of this, the inventory’s been falling sharply. And the newest reason for this has been a double downgrade from Outperform to Underperform by BNP Paribas Exane.

The reason being that job reductions within the US – particularly within the healthcare sector – could possibly be set to weigh on demand. And that’s a authentic trigger for concern with the enterprise.

I believe nevertheless, traders must maintain issues in perspective. Healthcare & Senior Residing within the US makes up simply over 18% of the agency’s whole revenues. Given this, a decline of over 13% looks as if an enormous drop and the present share price of £24.25 is beneath BNP’s revised price goal of £25. Because of this, I’ve added it to my watchlist.

Discovering shares to purchase

Progress shares might have carried out worse than worth shares because the begin of the 12 months. However as a gaggle, I don’t suppose they’re clearly in cut price territory simply but.

Individually although, I believe there are some shares which have fallen to engaging ranges. Compass Group isn’t my prime inventory to purchase simply but, however it’s one which I’m maintaining an in depth eye on.