Picture supply: Getty Photographs

Shares in Dividend Aristocrat Rio Tinto (LSE:RIO) have been falling. However a sensible acquisition this week has caught my consideration.

The agency has introduced an settlement to purchase Arcadium Lithium – one of many world’s largest lithium mining producers. That’s put it on my record of shares to purchase.

Renewable power

Like lots of mining corporations, Rio Tinto’s trying to concentrate on metals that shall be necessary for the transition to renewable power. The obvious are copper and lithium.

Rio Tinto does have copper operations. However its output in 2023 was decrease than the likes of Anglo-American, Antofagasta, or Glencore and solely made up 12% of the agency’s total gross sales.

The acquisition of Arcadium Lithium – one of many world’s largest lithium producers – provides one other dimension to the corporate’s portfolio. And it’s arguably coming at an excellent time.

Rio Tinto’s set to pay $5.85 per share – a 90% premium to the price the inventory was buying and selling at when the deal was agreed. That looks like quite a bit, however buyers ought to look nearer.

A sensible acquisition?

Rio Tinto’s CEO Jakob Stausholm stated of the settlement:

It is a counter-cyclical growth aligned with our disciplined capital allocation framework, rising our publicity to a high-growth, enticing market on the proper level within the cycle.

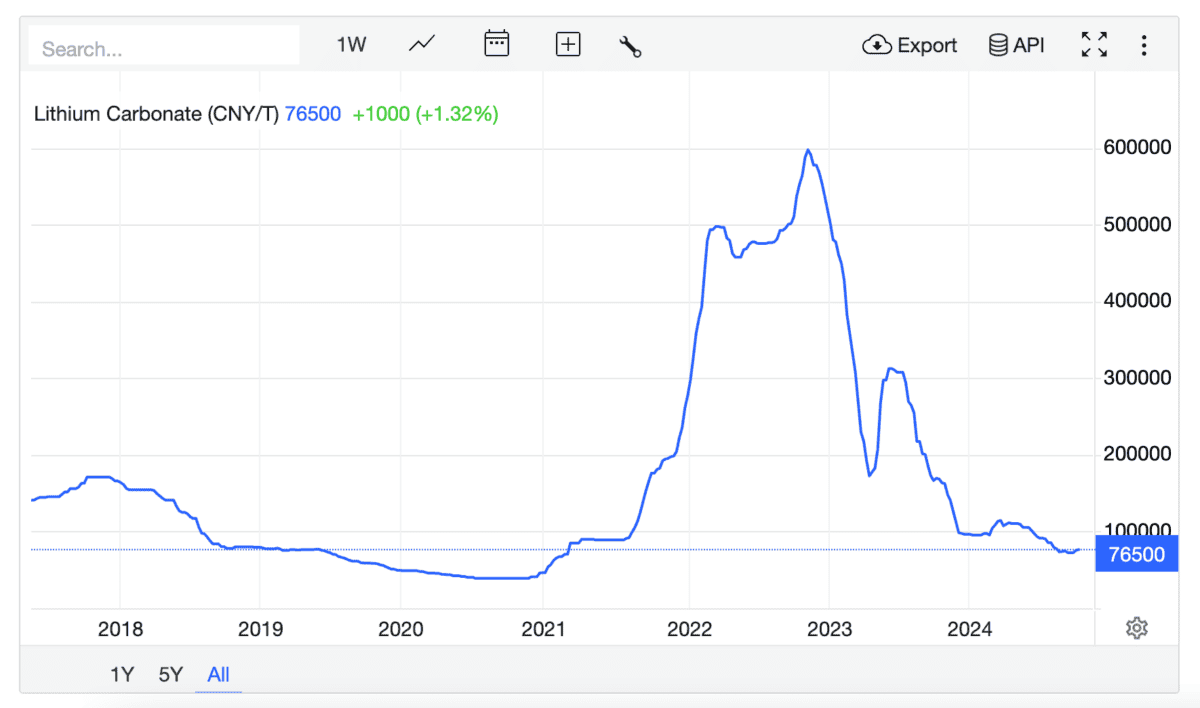

In different phrases, it’s trying to reap the benefits of lithium costs being under their pre-pandemic ranges to amass a lithium miner whereas its inventory is unusually low cost.

Lithium Carbonate Worth 2017-24

Supply: Trading Economics

Arcadium was solely shaped at the beginning of 2024, however the inventory started buying and selling at $6.81 per share. Which means Rio Tinto’s deal represents a 15% low cost to the place the inventory was in January.

I feel it’s onerous to not be impressed with the transfer from the FTSE 100 miner, which is paying money for the transaction. In a cyclical business, it’s very a lot the definition of shopping for low.

Dangers and alternatives

Precisely how properly the deal works out over the long run will rely upon the price of lithium. And whereas there are causes for optimism, it’s additionally value noting why this collapsed currently.

One cause is that electrical autos (EVs) have been slower to take market share than anticipated. That is partly to do with issues about vary and the dearth of charging infrastructure.

One other situation is oversupply from China. Earlier this week, US officers reported issues that this can be a transfer to attempt to drive the price down within the brief time period to remove opponents.

Each of those are challenges for lithium producers. However I feel with the price Rio Tinto has paid for the acquisition, the chances are in its favour over the long run.

Dividend revenue

Rio Tinto has a superb report of accelerating its shareholder distributions over time and I count on this to proceed. And the dividend yield‘s presently a pretty 6.75%.

There are by no means any ensures in relation to dividends. And buyers ought to notice that 60% of its revenues presently come from China, the place industrial output appears weak.

Nonetheless, with the share price at £50.15, I feel there might be a possibility right here. If I had £1,000 to take a position proper now, 19 shares in Rio Tinto can be my alternative.