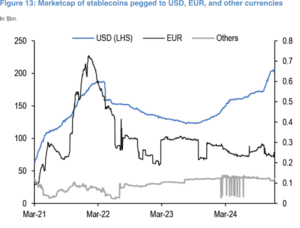

YEREVAN (CoinChapter.com) — JPMorgan analysts anticipate elevated adoption of euro stablecoins following the implementation of the EU’s MiCA rules on Dec․ 30, 2024. At present, euro-denominated stablecoins characterize simply 0.12% of the worldwide stablecoin market. The brand new framework is anticipated to drive monetary establishments and banks in Europe to make the most of euro stablecoins for blockchain-based settlements and buyer transactions.

Nikolaos Panigirtzoglou, who led the report, acknowledged that MiCA-compliant stablecoins will probably be prioritized for buying and selling pairs in regulated EU markets. Consequently, exchanges throughout the EU will modify their choices to align with the MiCA rules.

Outstanding examples of euro-pegged stablecoins embrace Societe Generale’s EURCV and BBVA’s deliberate stablecoin developed with Visa. Each initiatives mirror rising institutional curiosity in compliant stablecoins.

MiCA’s Affect on World Stablecoin Issuers

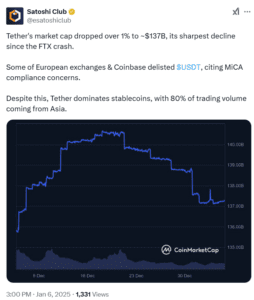

The MiCA rules require stablecoin issuers to safe licenses throughout the EU and preserve ample reserves in European establishments. Non-compliant stablecoins are already dealing with challenges. For example, Coinbase just lately delisted Tether’s USDT, citing issues over its compliance with MiCA guidelines.

Circle’s EURC has gained traction beneath the brand new rules as a result of its compliance, whereas Tether’s EURT has struggled to satisfy the requirements. Regardless of these difficulties, Tether stays a big participant within the world stablecoin market, significantly in Asian markets the place regulatory calls for are much less stringent.

To take care of its presence within the EU, Tether has invested in MiCA-compliant platforms resembling Quantoz Funds and StablR, a European stablecoin issuer. These strikes sign efforts by non-compliant issuers to adapt to the stricter regulatory panorama.

MiCA’s Ban on Algorithmic Stablecoins

The MiCA rules have banned algorithmic stablecoins, excluding them from the asset-referenced token (ART) classification. These stablecoins lack the required reserves tied to traditional belongings, which is a key compliance requirement beneath MiCA.

The framework mandates that stablecoins preserve a 1:1 liquid reserve ratio. Issuers should additionally search authorization earlier than providing or itemizing digital cash tokens (EMTs) or ARTs within the EU. This consists of publishing an authorized whitepaper and assembly the standards set by EU authorities.

The European Banking Authority (EBA) could classify issuers as “significant” based mostly on particular standards, subjecting them to stricter oversight. These guidelines are designed to guard the EU’s monetary stability and financial sovereignty.

Rising Institutional Curiosity in Euro Stablecoins

As MiCA enforces clear compliance pointers, establishments like Societe Generale and BBVA are main efforts to combine euro stablecoins into their operations. These rules intention to advertise belief within the EU’s monetary markets whereas enhancing the adoption of euro-denominated stablecoins.

By making certain compliance, MiCA rules could step by step develop the market share of euro-pegged stablecoins, significantly by institutional use. The framework emphasizes monetary stability whereas fostering a regulated setting for blockchain improvements.