NOIDA (CoinChapter.com) — Litecoin (LTC) price is rallying, outperforming a number of altcoins as bullish sentiment returns to the crypto market. A number of components, corresponding to renewed ETF hypothesis and broader macroeconomic components could possibly be why Litecoin price is up at this time.

The most recent inflation knowledge within the U.S. suggests the Federal Reserve would possibly maintain off on price hikes, pushing merchants towards threat belongings like cryptocurrencies. Bitcoin’s current price motion, fueled by ETF inflows, has had a spillover impact on altcoins, with LTC among the many key beneficiaries. The rising curiosity in various crypto investments amid expectations of regulatory readability has put Litecoin within the highlight.

Moreover, analysts level to a strengthening LTC/BTC pair, suggesting that Litecoin’s lengthy downtrend in opposition to Bitcoin might have ended. With a possible Litecoin ETF approval and a extra favorable macro setting, merchants are flocking towards LTC, anticipating additional positive factors.

ETF Hype Fuels Litecoin’s Value Development

Hypothesis over a possible Litecoin ETF is a serious driver behind LTC’s price improve. Social media discussions and analyst predictions spotlight that main companies like Grayscale, Canary Capital, and CoinShares have submitted ETF functions. Bloomberg analysts estimate a 95% likelihood of SEC approval this 12 months.

A Litecoin ETF would create institutional demand, much like what was noticed in Bitcoin’s current ETF approval rally. Buyers view LTC as one of the decentralized and safe proof-of-work cash, making it a lovely candidate for an funding car. The historic price response to ETF narratives suggests Litecoin might expertise an prolonged rally if approval is granted.

On-chain knowledge and market sentiment additionally replicate rising optimism, with merchants accumulating LTC in anticipation of an ETF-driven breakout. If authorized, Litecoin’s price might see vital upside, with some analysts eyeing a possible run towards $800 by the tip of the cycle.

LTC/BTC Pair Reveals Indicators of Reversal

Litecoin’s efficiency in opposition to Bitcoin has been in a multi-year downtrend, however current price motion suggests a backside might have fashioned. The LTCBTC pair has proven larger lows, indicating accumulation and a doable development reversal.

The TradingView analysis by EXCAVO highlights that LTC’s lengthy decline in opposition to BTC has slowed, with key assist ranges holding agency. Traditionally, a reversal in LTCBTC precedes robust rallies in LTC/USD. As merchants rotate funds from BTC to altcoins, Litecoin might outperform within the brief time period.

The breakout from the downward development would sign a shift in market dynamics. Buyers who beforehand favored BTC over LTC might now reallocate funds towards Litecoin, anticipating larger returns. If Litecoin continues gaining energy in opposition to Bitcoin, it might entice extra capital, pushing LTC price larger in each USD and BTC phrases.

With ETF hypothesis driving momentum and the LTCBTC pair stabilizing, Litecoin seems poised for additional positive factors.

Litecoin Value Trying To Break Out Of Bullish Sample

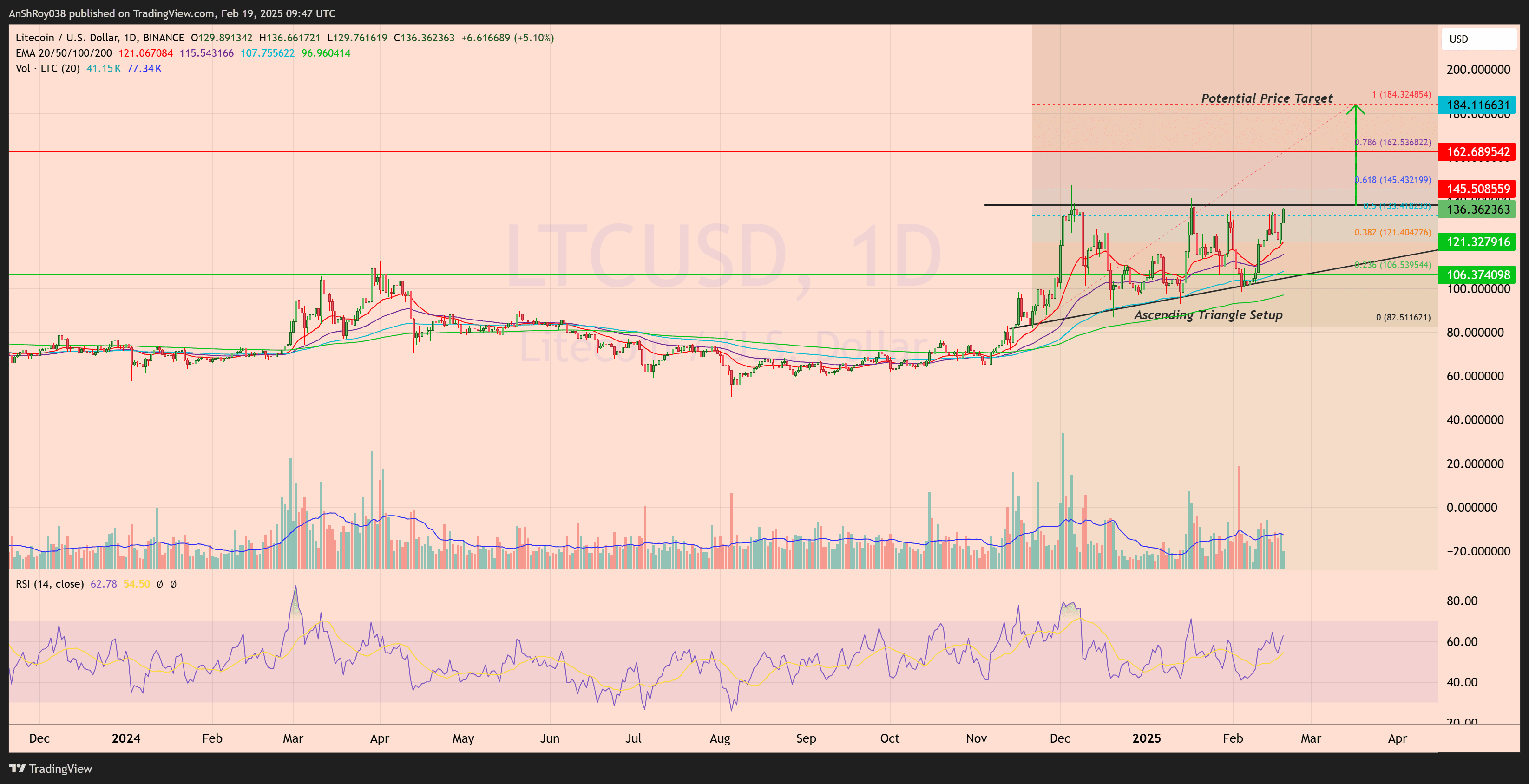

Litecoin (LTC) is consolidating inside an ascending triangle sample, a bullish continuation sample characterised by a horizontal resistance degree and a rising trendline of upper lows. This formation suggests rising shopping for strain as sellers at resistance weaken with every retest, indicating a possible breakout towards larger price ranges. The bullish setup could possibly be one more reason why Litecoin price is up at this time.

LTC price has repeatedly examined the sample’s horizontal resistance whereas forming larger lows, a basic bullish continuation setup.

The 100-day EMA (blue line) at $106 and the 20-day EMA (purple line) at $121 present robust assist, reinforcing the bullish construction. A confirmed breakout might set off a pointy transfer towards Fibonacci extension targets, with the 0.618 degree close to $162 as an interim resistance. The ultimate price goal is $184.

A transfer from the breakout level to the projected price goal represents a possible 35% rally from present ranges. The RSI at 62 stays under overbought territory, suggesting room for additional upside with out instant exhaustion.

Quantity tendencies present rising accumulation, indicating robust demand at assist ranges. A failed breakout might see LTC retesting $121 earlier than one other try. Nevertheless, bullish momentum stays dominant given the ETF hypothesis and the LTC/BTC ratio enchancment. If Litecoin clears resistance with quantity affirmation, the $180+ goal stays in play, marking a major transfer inside this market cycle.