Picture supply: Getty Pictures

The Barclays (LSE:BARC) share price has been one of many excellent FTSE 100 performers of this 12 months. The inventory’s up 84% because the begin of January.

Regardless of the sharp climb, the mix of dividends and share buybacks means the inventory nonetheless seems to be enticing heading into 2025. I believe traders ought to suppose critically about shopping for it at at present’s costs.

Dividends and share buybacks

Barclays is within the early phases of a plan to return vital amount of money to its shareholders. Earlier this 12 months, it stated it goals to distribute £10bn by way of a mixture of dividends and share buybacks.

To this point, the financial institution’s accomplished £1bn in share buybacks and began on one other £750m, in addition to sending out £1.2bn in dividends. That’s an enormous chunk, nevertheless it nonetheless leaves fairly a bit over the following couple of years.

By my calculations, that leaves roughly £7bn left to be distributed to shareholders. And with a market-cap of almost £39bn, that may very well be round 9% a 12 months for the following couple of years.

I’m not anticipating the FTSE 100 to handle this type of return, so I believe Barclays shares seem like good worth. However traders considering of shopping for the inventory ought to have a look at the larger image.

Outlook

Past capital returns, I believe there are causes for traders to be optimistic concerning the underlying enterprise. Not like different UK banks, Barclays has a big funding banking operation.

Throughout the Atlantic, each Citigroup and JP Morgan predict funding banking revenues to develop strongly within the close to future. In the event that they’re proper, I’d count on this to be optimistic for the UK financial institution as nicely.

Speculatively, I’m wondering concerning the long-term way forward for this a part of the enterprise. Barclays reorganised itself into 5 divisions earlier this 12 months, with funding banking considered one of them.

Administration stated the intention was to offer traders higher perception into how the totally different components of the organisation are performing. However I wouldn’t be shocked if this isn’t the entire story.

A possible spin-off?

When firms reorganise like this, it’s typically an indication they’re trying to divest a unit. Whereas I’ve no proof Barclays is planning this, the funding banking enterprise has achieved decrease returns lately.

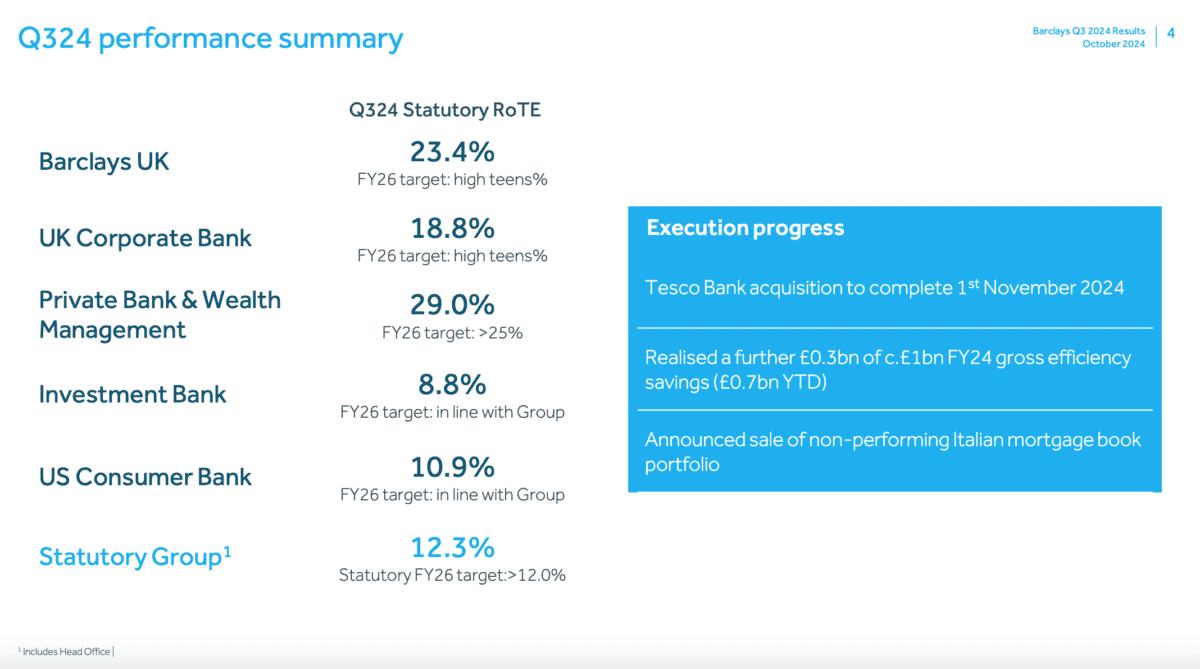

Supply: Barclays Q3 2024 Outcomes Presentation

A part of that is because of the trade being in a cyclical downturn after the surge introduced on by detrimental actual rates of interest. However it’s price maintaining a tally of this division to see if issues enhance.

One other factor traders ought to take note of is the continuing automobile mortgage investigation. Whereas Lloyds seems to be the main financial institution with essentially the most publicity, Barclays isn’t considered totally immune.

It could be a pity for traders to see some attractive-looking capital returns offset by some vital liabilities. However the threat’s one which must be taken critically.

Nonetheless undervalued?

It appears unusual {that a} inventory is perhaps undervalued when it’s climbed 85% in just below a 12 months. However I believe there’s a very good argument to be made that that is the case with Barclays shares.

If the continuing automobile mortgage subject doesn’t create an excessive amount of bother, the inventory may supply a greater return than the FTSE 100 over the close to time period. I believe traders ought to contemplate shopping for at first of 2025.