The market is all crimson as soon as once more.

Over the previous week, Bitcoin has shed almost $5,000 from its worth, plummeting from a cushty perch above $66,000 to hover across the $61,000 mark (on the time of writing). This sudden plunge has left traders and analysts confused.

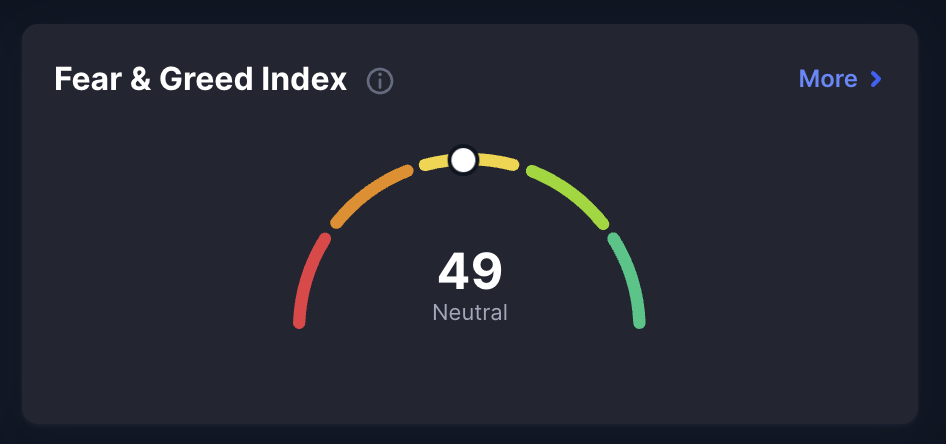

This sharp decline coincided with a major shift in market sentiment. The Crypto Concern and Greed Index fell from 60 to 49 in simply 13 days, transferring from “Greed” to the sting of “Neutral” territory.

The sudden price drop and sentiment shift have left many questioning concerning the underlying causes.

A number of key occasions in crypto seem to have influenced this market motion.

Let’s jumpt to the main points of what is been taking place within the Bitcoin market and discover the components behind this latest plunge.

Cause #1: German Authorities’s Bitcoin Sale

The crypto market skilled important turbulence following information that the German authorities is getting ready to liquidate a considerable Bitcoin holding.

The German Federal Legal Police Workplace (BKA) held roughly 50,000 BTC, seized from a piracy website in 2013, now valued at over $3 billion.

This information, which got here to mild just a few days in the past, possible triggered Bitcoin’s preliminary drop from $66,000 to $63,000 – as might be seen on CoinMarketCap.

The prospect of such a lot of Bitcoin doubtlessly coming into the market has understandably induced concern amongst traders.

Reviews recommend that the German authorities have already begun the method, promoting round 3,000 BTC in latest days. Nonetheless, the majority of the holding—47,000 BTC—stays to be offered.

The federal government seems to be taking a measured method to reduce market affect, however investor nervousness persists.

Cause #2: Massive Gamers Hitting the Brakes

The second main issue behind Bitcoin’s latest price slide includes the market’s greatest fish – the “whales.”

Here is what’s taking place: Whales have immediately turn out to be a lot much less energetic. Information from Santiment reveals that large transactions (over $100,000) dropped by 42% in simply a few days. That is a major change in conduct.

So why does this matter? Properly, when whales gradual down their buying and selling, it typically alerts warning. This whale conduct is very attention-grabbing because it’s taking place proper after a interval of heavy promoting.

What does this imply for the market? It could possibly be that these giant traders are ready to see if costs will drop additional earlier than they begin shopping for once more. Or they could be holding off on promoting extra to keep away from pushing costs down too shortly.

Both means, when the whales get quiet, it is typically an indication that the market is at a crossroads. Their subsequent strikes may give us clues about the place Bitcoin’s price would possibly head within the coming weeks.

Cause #3: Mt. Gox Returns With Repayments

The defunct alternate has resurfaced and shaken issues up as soon as once more. Greater than a decade after its collapse, Mt. Gox has introduced that it’ll start repaying its collectors – and the information has despatched ripples by the Bitcoin market.

Mt. Gox’s Rehabilitation Trustee, Nobuaki Kobayashi, introduced that repayments in Bitcoin and Bitcoin Money will begin in early July.

Why is that this such an enormous deal?

Properly, Mt. Gox was as soon as the largest alternate in crypto earlier than its dramatic closure in 2014.

This is not a small change we’re speaking about. The three Mt. Gox wallets mixed maintain 141,686 BTC, value roughly $8.71 billion.

The concern is straightforward: as collectors lastly get their fingers on their long-lost Bitcoin, many would possibly rush to money out. This potential flood of Bitcoin hitting the market has traders on edge.

The affect was nearly fast. Bitcoin’s price took a nosedive to $61,060, marking a 6.5% drop in simply 24 hours. Whereas it is since recovered barely to round $61,300, the market stays jittery.

It is not simply Bitcoin feeling the warmth. Bitcoin Money (BCH) additionally took a success, dropping 9% within the wake of the announcement.

Whereas the reimbursement course of is about to start quickly, it is value noting that it may stretch out over a number of months. The deadline for repayments was beforehand prolonged to October 2024, giving the market some respiratory room.

Cause #4: Domino Impact

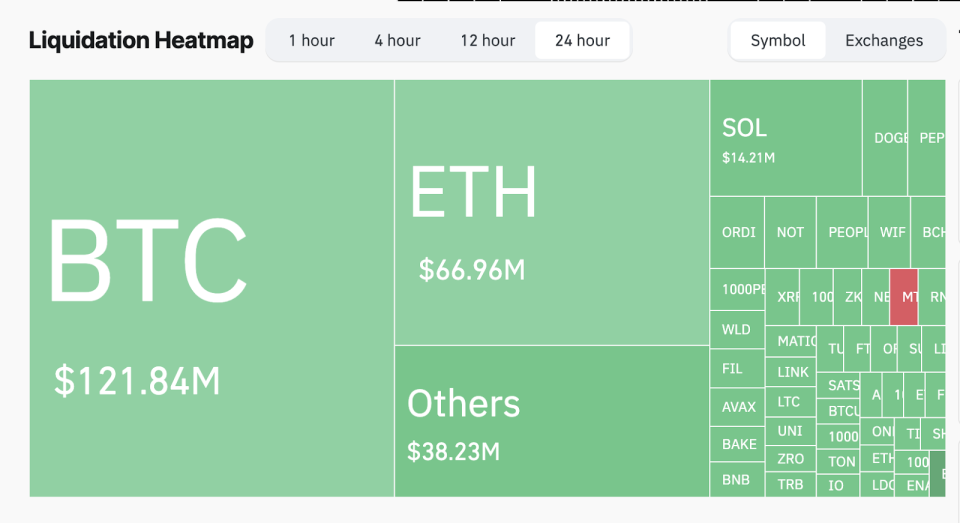

The latest Bitcoin price drop wasn’t nearly exterior components. A major inner market mechanism performed a vital position in amplifying the decline: cascading liquidations within the derivatives market.

Consider it because the crypto world’s model of a domino impact, and it has been in full swing over the previous 24 hours.

Here is what went down: As Bitcoin’s price began to slide, it triggered a series response within the derivatives market. In response to knowledge from Coinglass, $311.3 million value of crypto positions have been liquidated in simply 24 hours.

Out of this $305.89 million, $275.75 million have been lengthy positions. In plain English, meaning the overwhelming majority of those liquidations hit merchants who have been betting on crypto’s price to go up.

This cascade of liquidations is not the basis explanation for Bitcoin’s price drop, but it surely definitely did not assist issues.

Because the market navigates by these points, it is clear that a number of components are at play. The German authorities’s Bitcoin actions, whale conduct shifts, Mt. Gox reimbursement plans, and cascading liquidations have all contributed to the latest price volatility.

Whereas short-term fluctuations might be unsettling, additionally they present helpful insights into market dynamics. Because the mud settles, market individuals will likely be keenly watching how these components evolve and affect Bitcoin’s trajectory within the coming weeks and months.