The Ethena ecosystem is revolutionizing the steady DeFi panorama by integrating revolutionary oracle know-how with artificial greenback mechanics. On this publish, we’ll dig into what precisely Ethena is, the way it works, and its position in ecosystem growth whereas exploring the advantages and dangers related to it and USDE. We’re additionally going to look at the ENA token’s utility and tokenomics, and why it’s a core driver for long-term development and stability inside the Ethena ecosystem.

What’s Ethena?

Ethena (ENA) is a decentralized protocol that’s designed to supply a secure digital forex answer. It creates a “synthetic dollar” setting, which supplies customers a steady medium that’s much like the US greenback however absolutely built-in into the DeFi house.

As a part of the Ethena Basis’s mission, the protocol helps mitigate price volatility and funding price fluctuations via superior mechanisms like delta hedging and brief futures positions.

Ethena in WLFI Portfolio

Ethena is a flagship undertaking within the WLFI Portfolio, acknowledged for its sturdy technical basis and forward-thinking method. The funding by WLFI highlights the protocol’s potential to create a steady, dependable digital forex answer that may interface with conventional monetary methods whereas driving decentralized finance integration.

Supply: Arkham

How does Ethena work?

Ethena operates by aggregating high-quality knowledge feeds from a number of off-chain sources and delivering them securely on-chain via a decentralized community of validators. The protocol employs superior good contracts to make sure knowledge integrity and speedy transaction settlement.

It creates an artificial greenback setting via USDe, a steady medium designed to imitate the worth of the US greenback whereas being absolutely backed by crypto collateral. This artificial USDe greenback permits customers to carry out brief positions and brief futures positions effectively, supporting each conventional banking merchandise and revolutionary DeFi protocols.

What’s USDe?

USDe is the stablecoin part of the Ethena ecosystem, designed as an artificial greenback to supply a dependable digital forex answer. USDe maintains a steady worth via collateralization and good contract governance.

How do you employ USDe?

Buying USDe

Customers should purchase USDe on supported exchanges or via built-in gateways. This provides an environment friendly different to conventional banking methods, enabling rapid entry to an artificial greenback for on a regular basis transactions.

Minting and Redeeming USDe

USDe could be minted by locking crypto belongings as collateral, creating an artificial digital asset pegged to the US greenback. Redemption reverses the method, returning collateral to the consumer.

Staking USDe

By staking USDe, customers earn yields whereas contributing to community safety. Staking rewards are distributed in broadly accepted crypto belongings, offering a beautiful choice for buyers seeking to earn passive earnings within the crypto house.

Advantages of Ethena

- Low volatility ensures predictable buying and selling and funds

- Decentralized oracles and sturdy good contracts guard towards manipulation

- Seamlessly combines oracle know-how with DeFi, enabling versatile purposes

- Rewards mechanisms assist participation and long-term development

Dangers of Ethena & USDe

- Code bugs or exploits may compromise funds

- Competitors and integration hurdles could gradual development

- Altering regulatory frameworks may alter the trade quickly

The ENA token

Utility

- Governance: ENA permits decentralized decision-making by permitting token holders to suggest and vote on strategic adjustments to the Ethena protocol.

- Staking & Rewards: Customers can stake ENA (and even USDe) to earn dynamic APY rewards, reinforcing community safety and long-term dedication.

- Transaction Charges: ENA is used because the native forex for paying transaction charges, decreasing operational prices and guaranteeing easy service supply throughout the ecosystem.

Tokenomics

Whole Provide: 15 billion ENA tokens

As of March 2025, ENA’s market cap was roughly $1.64 billion, with a circulating provide of 1.425 billion tokens, reflecting its rising adoption in decentralized finance and steady digital asset options.

Token Distribution

- Core Contributors: 30% of the full allocation, locked with a 1-year 25% cliff after which launched linearly over 3 years.

- Buyers: 25% of the tokens, topic to the identical vesting schedule as core contributors.

- Ethena Basis: 15% allotted to assist initiatives that widen the attain of USDe and scale back reliance on conventional banking methods.

- Ecosystem Growth & Airdrops: 30% reserved for neighborhood incentives, together with an preliminary 10% airdrop to reward early customers and ongoing funding for cross-chain initiatives and alternate partnerships managed by a DAO-controlled multisig.

Supply: Cryptorank

The way to purchase ENA

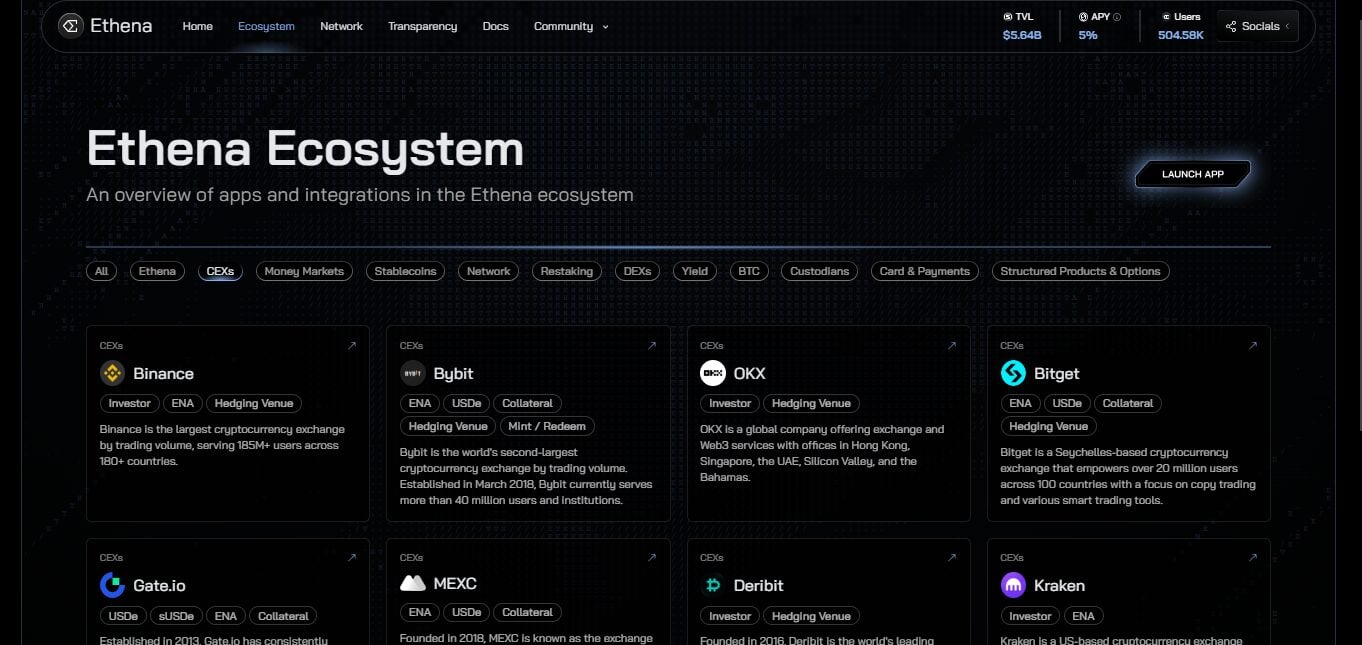

- Create an account on a supported crypto alternate, resembling Binance, Coinbase or Gate.io.

- Full the verification course of required by the alternate.

- Deposit a supported cryptocurrency or fiat forex.

- Find the ENA buying and selling pair and place a purchase order.

- Switch your bought ENA tokens to a safe pockets.

How do you retailer ENA?

- DEX Wallets: Some decentralized exchanges supply built-in pockets options that allow you to retailer and handle ENA tokens immediately on-chain. This feature permits you to work together with DeFi protocols whereas sustaining full management over your non-public keys.

- CEX Custody: Centralized exchanges present pockets storage for comfort, however these wallets maintain your tokens for you, which implies you relinquish management over non-public keys.

- {Hardware} Wallets: For enhanced safety, retailer ENA tokens offline utilizing gadgets like Ledger or Trezor to guard towards hacks.

- Software program Wallets: Devoted wallets resembling MetaMask, Belief Pockets, or multi-chain wallets supply sturdy interfaces for managing your ENA tokens securely.

Remaining ideas

By offering a steady medium via USDe and a strong native token in ENA, Ethena provides buyers and customers a dependable digital forex answer that bridges conventional monetary methods and revolutionary blockchain know-how. Its refined integration of delta hedging, brief positions, and good contract-driven safety measures positions it as a frontrunner within the crypto house.

FAQs

Is Ethena a stablecoin?

No, Ethena is a protocol that comes with an artificial greenback (USDe) stablecoin and a local token in the identical ecosystem.

What’s the distinction between Terra and Ethena?

Terra centered on algorithmic stablecoins, whereas Ethena makes use of superior oracle and collateral mechanisms to keep up stability and assist decentralized finance.

Will Ethena collapse like Terra?

Ethena’s sturdy tokenomics, together with delta hedging and correct collateral administration, goal to mitigate dangers and preserve long-term stability, decreasing collapse probability.

Does Ena Coin have a future?

With sturdy utility in governance, staking, and price funds, ENA is designed for long-term development inside the Ethena ecosystem, interesting to each buyers and customers.

How a lot is the ENA coin value?

On the time of writing, March 7, 2025, 1 ENA is value roughly $.44 in line with knowledge from CoinGecko.

What chain is Ena on?

ENA is carried out as an ERC-20 token on the Ethereum blockchain, guaranteeing compatibility with different crypto belongings and integration with DeFi protocols.