Picture supply: Getty Pictures

The UK inventory market is heading decrease this morning (3 February) and issues don’t look a lot better throughout the Atlantic. US tariffs are weighing on share costs just about throughout the board.

There are some exceptions, however the sell-off is broader than final week’s decline in synthetic intelligence (AI) shares. So what ought to buyers do?

Is it truly that unhealthy?

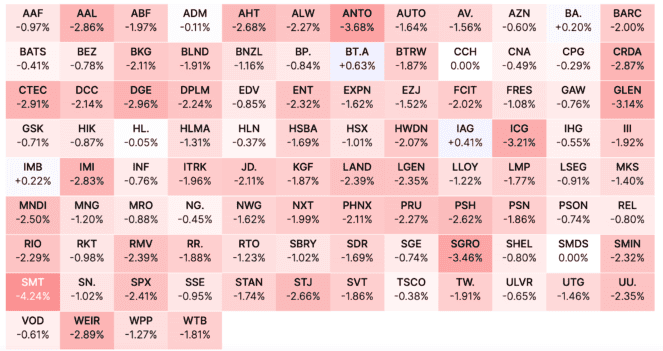

A fast have a look at the FTSE 100 this morning signifies share costs are heading decrease throughout the board. And whereas there are a number of outliers both facet, the median inventory appears to be down round 2%.

FTSE 100 heatmap 3 February 2025

Supply: Hargreaves Lansdown

First issues first – buyers must hold this one in context. For instance, Diploma (LSE:DPLM) shares have fallen virtually 3%, however they’re nonetheless buying and selling above the place they have been every week in the past.

Sudden actions in inventory costs could make ups and downs really feel extra dramatic than they’re. When a inventory climbs or falls steadily for 5 days, it may be onerous to note, in comparison with a similar-sized bounce or fall in a day.

That’s to not say shares can’t fall farther from right here. They completely can, however buyers ought to be cautious about overreacting to a decline that may really feel larger than it truly is.

What if it will get worse?

US tariffs are the explanation share costs are falling this morning and I wouldn’t wish to forecast what the end result will probably be. It’d trigger inflation, forex fluctuations, neither, or each.

In these conditions, I feel one of the best factor to do is to hope for one of the best and plan for the worst. When it comes to the inventory market, which means specializing in shares in high quality firms.

If issues worsen, one of the best companies are those which can be the most certainly to show resilient. And in the event that they get higher, the strongest operations ought to have the ability to discover methods to take benefit.

With share costs falling throughout the board, I consider that specializing in no matter they assume the very best high quality firms are offers buyers one of the best probability of doing effectively over the long run. That’s what I’m doing.

Diploma

Diploma is a distributor of commercial elements. The danger of gross sales faltering in a weak manufacturing surroundings is one to take critically, however there’s rather a lot to love about the way in which the enterprise is about up.

The corporate makes an attempt to tell apart itself from different distribution companies by including worth for patrons. One of many methods it does that is by holding an enormous stock.

That is handy for patrons, who know they received’t must go searching round once they want one thing in a rush. And the corporate’s scale means it might get elements delivered shortly and reliably.

In consequence, Diploma is ready to keep sturdy margins whereas increasing additional via acquisitions. This makes it a really troublesome enterprise to disrupt and one I feel is price taking note of.

What to do?

Seeing shares promoting off throughout the board can seem like an enormous shopping for alternative. However speeding into shopping for shares might be harmful, particularly when costs are nonetheless greater than they have been every week in the past.

Diploma is a superb illustration of this. The falling share price makes me tempted to leap in, however I’m being cautious to keep watch over the larger image for the time being.