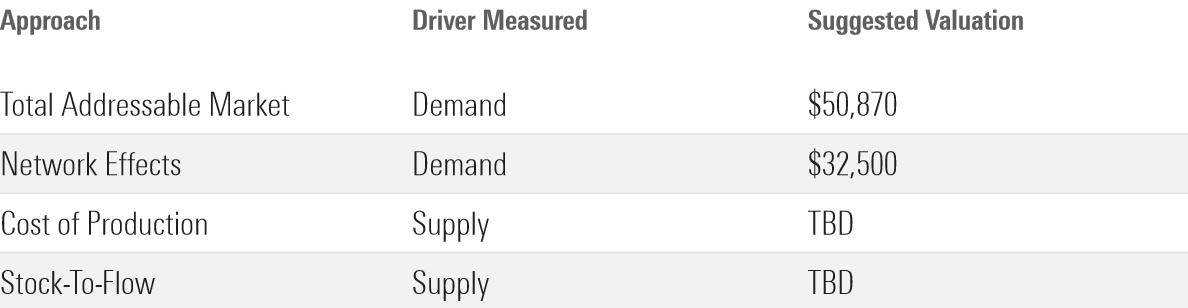

Not too long ago, we’ve been strolling by way of frequent approaches to valuing bitcoin. Final week I wrote about estimating demand utilizing the “total addressable market” methodology, which gauges a brand new product’s capability for penetrating a market. This week, partially two of this four-part collection, we’re diving into the community results mannequin.

Whereas the overall addressable market methodology is a “top-down” strategy to modeling bitcoin demand, the community results mannequin is “bottom-up.” This methodology takes its title from a phenomenon often called a community impact, which is when a services or products turns into extra helpful as extra individuals use it.

Telephones are the basic instance of a community impact. If there are solely two phone customers on this planet, every consumer solely has one different individual to name, and the phone might be not very helpful. If every consumer has 50 different individuals whom they’ll name, a cellphone turns into extra helpful.

Community results will be highly effective. Certainly, Morningstar’s fairness analysts determine community results as one in every of 5 potential “economic moat” sources that may grant an organization sturdy aggressive benefits over its friends.

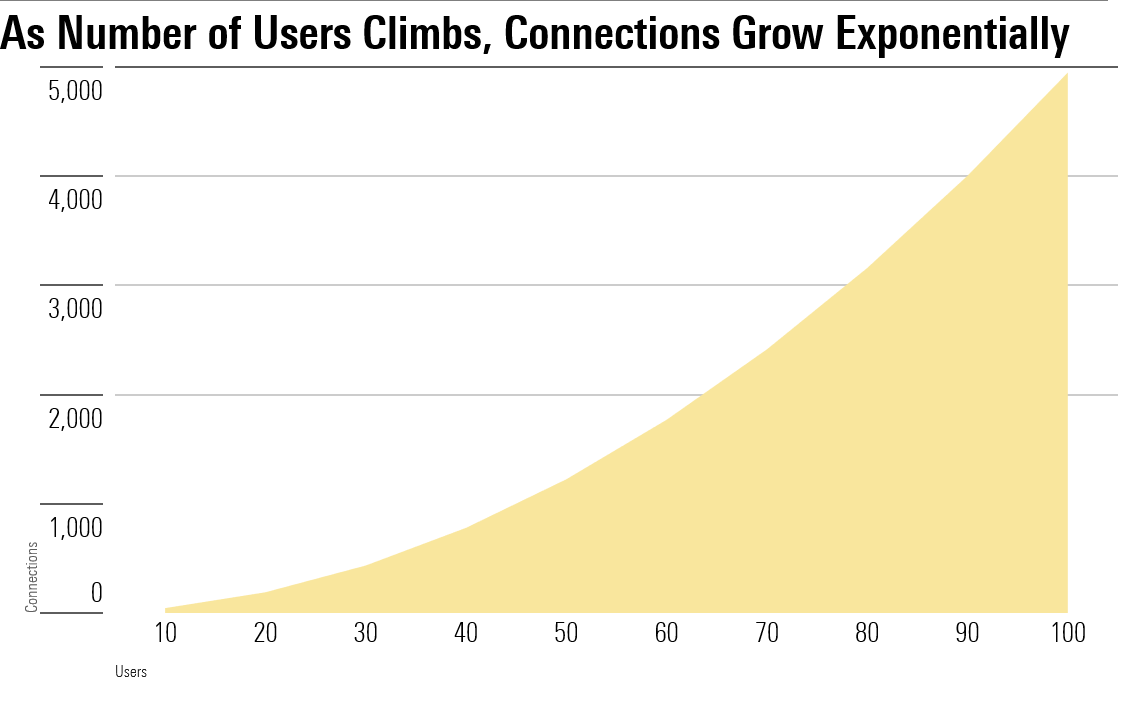

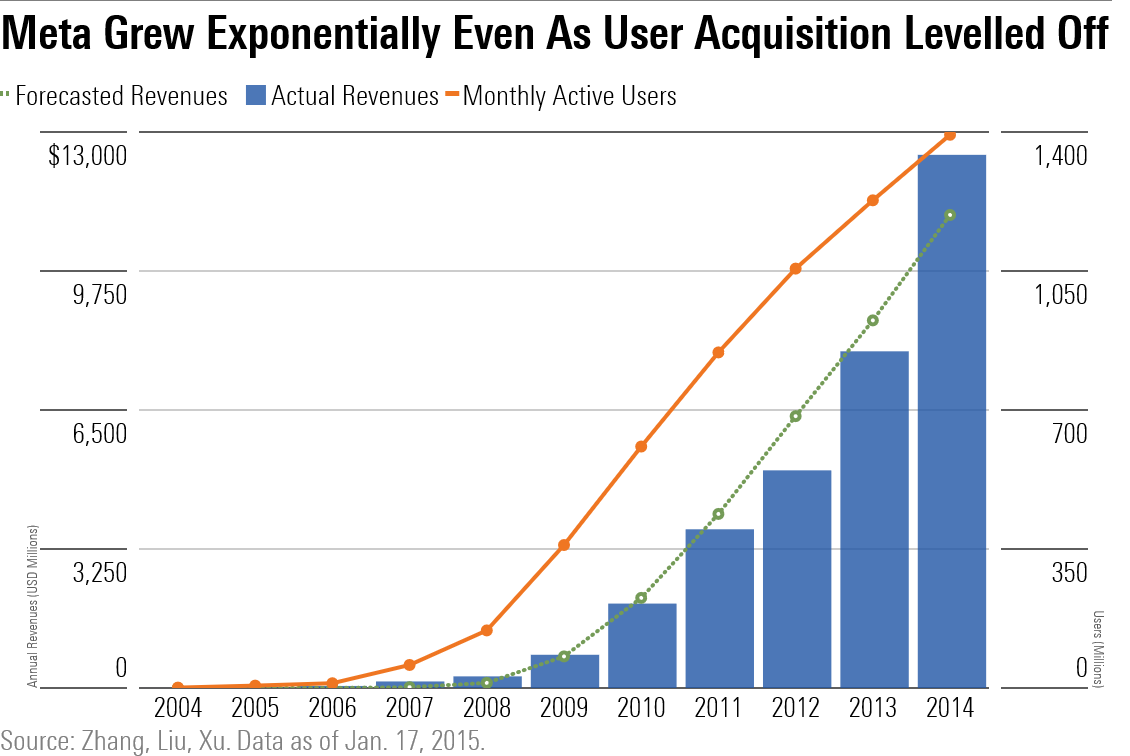

Whereas few would contest that community results exist, there’s far more debate over how a lot a community impact is value. One strategy, referred to as Metcalfe’s regulation, argues {that a} community’s worth is proportional to the attainable variety of connections that customers may make with one another. Metcalfe’s regulation additional posits that the variety of connections for a given consumer base follows a method. For small networks, the method appears like this (“N” stands for the variety of customers):

In apply, that relationship appears just a little one thing like this:

Because the community accumulates customers, the expansion in connections regularly approaches the sq. of the variety of customers within the system.

Right now, stock-pickers nonetheless normally spot community results empirically relatively than utilizing a theoretical strategy. Utilizing Metcalfe’s regulation to estimate a community’s worth to an organization continues to be comparatively untested from a tutorial perspective.

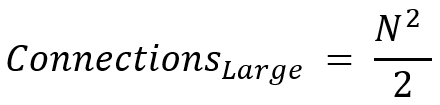

Metcalfe’s regulation is fascinating, although, as a result of it means that an organization with a community impact gained’t generate revenues which might be proportional to the quantity of customers. As a substitute, it’ll generate revenues which might be proportional to the variety of connections between customers—in different phrases, the variety of customers squared.

What this implies is an organization having fun with community results can generate exponential income progress even when their consumer base grows in a straight line. Meta, whose revenues grew exponentially in contrast with the variety of customers on its platform, is a working example.

Retooling the System for Bitcoin

Making an attempt to mannequin bitcoin with this strategy is extra difficult. An organization can monitor the variety of customers on its platform; bitcoin doesn’t. An organization has annual revenues; bitcoin doesn’t. As a result of we don’t have entry to this knowledge, we’ve got to make some substitutions.

- We use the variety of wallets on the blockchain as a proxy for customers.

- We additionally use the price of bitcoin as proxy for income.

These substituted variables, although helpful, aren’t excellent. Meaning we’ve got to tweak the mannequin in two methods.

- We don’t must know what number of shares of a inventory an organization has issued to be able to estimate its income. For bitcoin, we do: The variety of bitcoins which have been issued closely influences the price. New bitcoins are minted every single day, so we’ve got to account for a way the provision modifications over time.

- Valuations of bitcoin underneath Metcalfe’s regulation generally take the pure log of its enter variables to calculate the price. This apply hails from foreign-exchange buying and selling, the place lognormal returns are generally used to judge foreign money pairs.

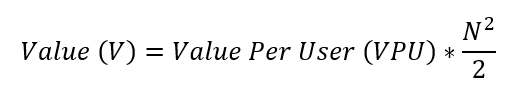

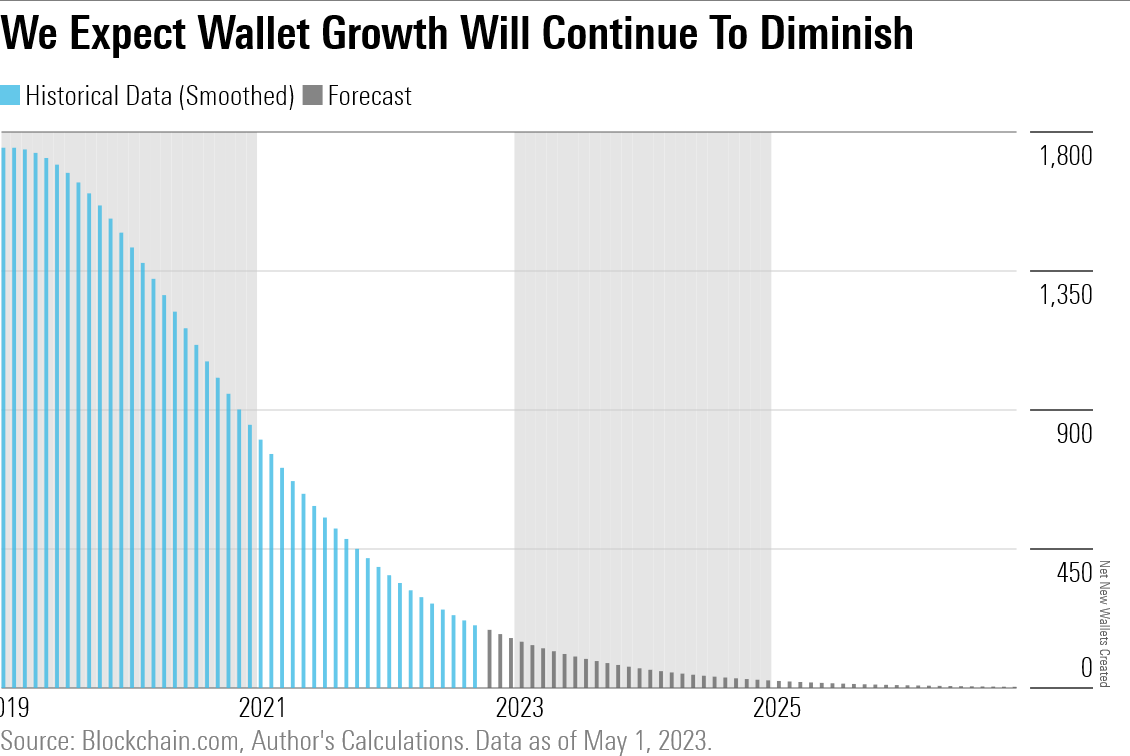

Thus, with a couple of modifications, a easy method like this:

Turns into this (“W” stands for wallets, and “S” stands for provide of tokens):

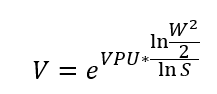

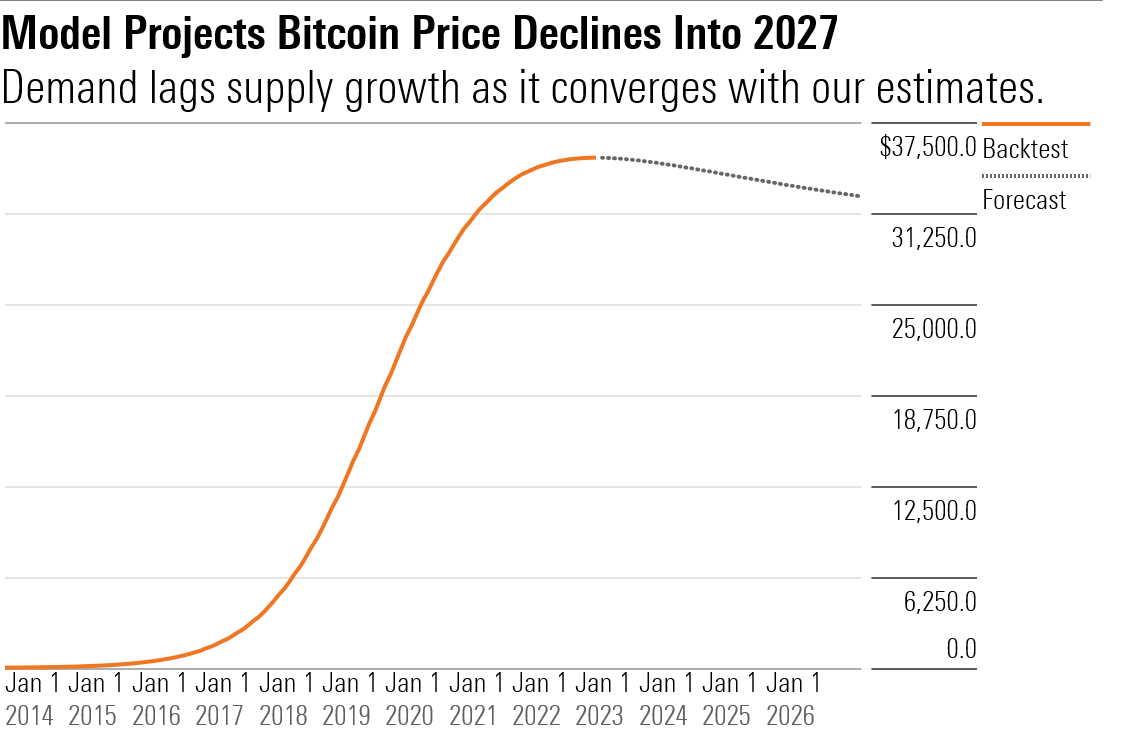

This modified mannequin does seem to have a good means to hint the arc of bitcoin’s price historical past.

“Hang on,” you may be saying. “I thought Metcalfe’s law forecast exponential growth in value.” And also you’d be proper, however crucially, Metcalfe’s regulation solely guarantees exponential progress to these networks with a steadily rising consumer base.

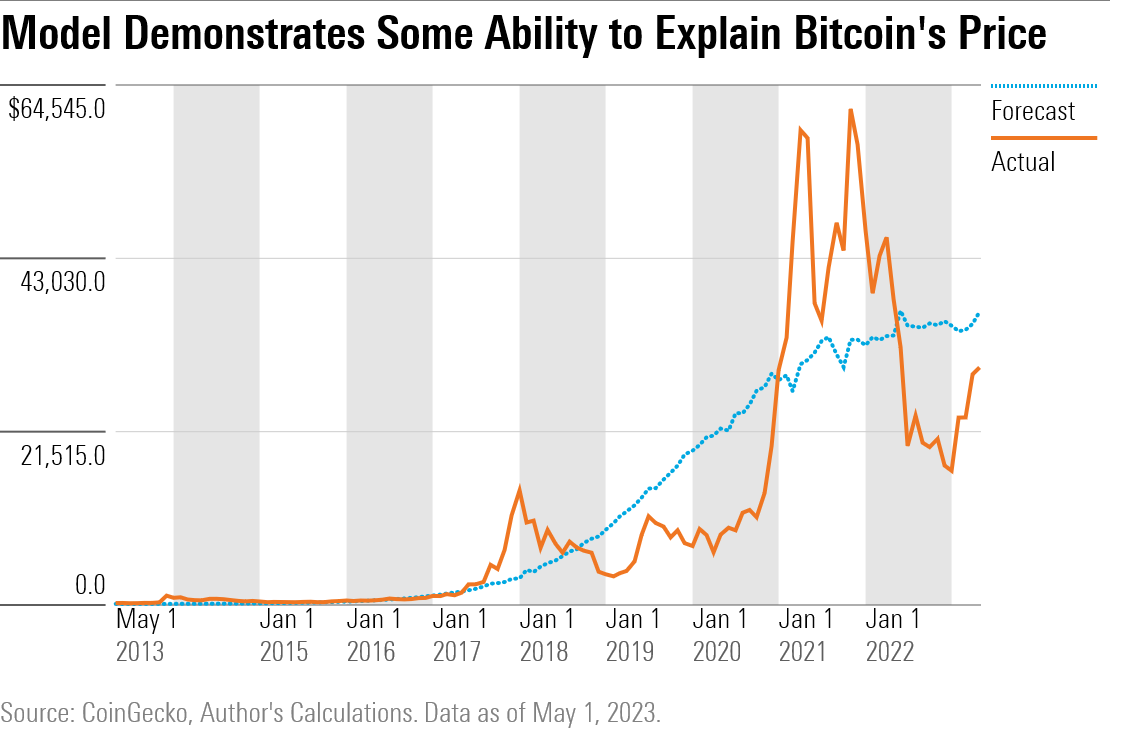

Downside is, bitcoin’s consumer base is something however. Even with some smoothing, our knowledge exhibits that the variety of new wallets created in a single month peaked in late 2019. (In apply, it peaked a few yr later amid the pandemic meme-stock frenzy.)

Placing It All Collectively

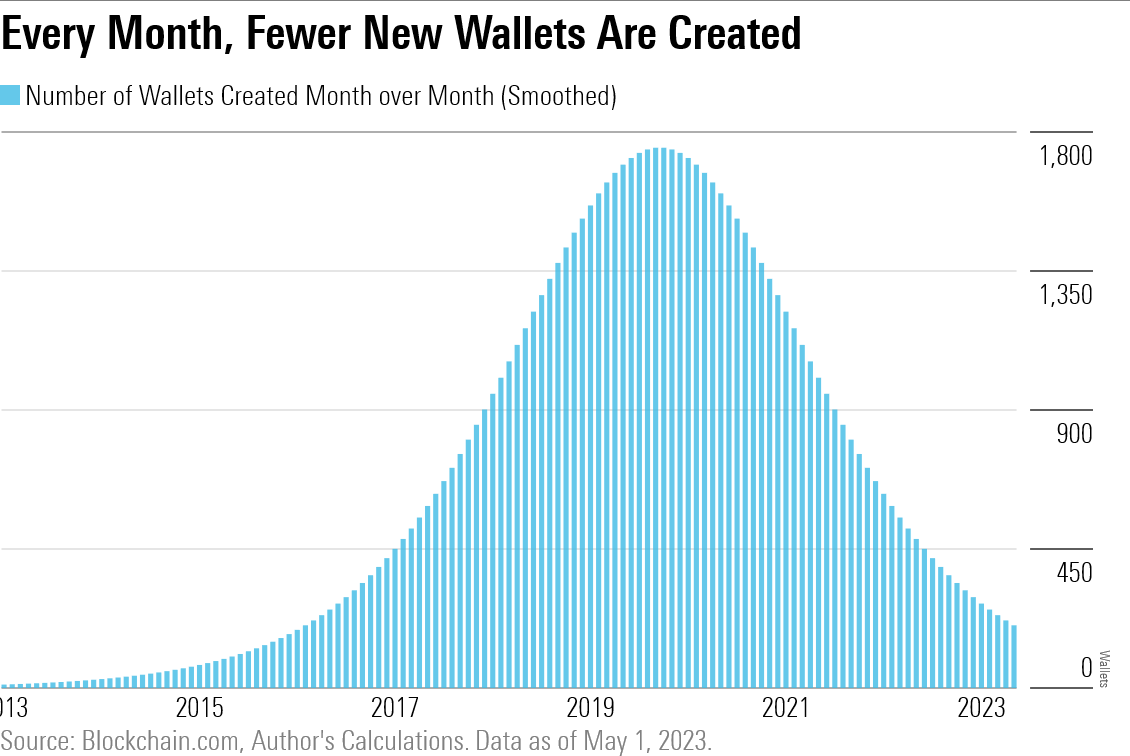

Now that we’ve got our mannequin, it’s time to plug in some assumptions. We assume that the variety of individuals opening wallets every month continues to taper off at its present fee, suggesting that the market will attain saturation at 87.5 million wallets. We anticipate that bitcoin will utterly shut that hole by 2027, 4 years from now.

Outdoors of our assumptions, we all know two issues for positive.

- A mature inhabitants of wallets, plus a beneficiant time horizon, implies a sluggish progress fee.

- It doesn’t matter what, bitcoin’s algorithm will proceed to concern tokens at a reasonably predictable clip.

That means that miners will mint new bitcoin sooner than bitcoin can entice new customers. If Metcalfe’s regulation holds, which means that, because the token provide will increase, then the price of bitcoin will drop.

How is that attainable? Keep in mind that the variety of tokens issued is the denominator in our method. That signifies that, as token issuance grows and consumer progress slows, our exponent shrinks, which causes the price to reasonable relative to its present ranges. Finally, this mannequin tasks a terminal price converging at round $32,500 in July 2027.

Limitations

Regardless that we finish up with a seemingly clear price goal, that doesn’t imply it’s time to run out to start out shorting bitcoin. For one factor, keep in mind that even in inventory analysis, Metcalfe’s regulation has solely been studied a handful of instances.

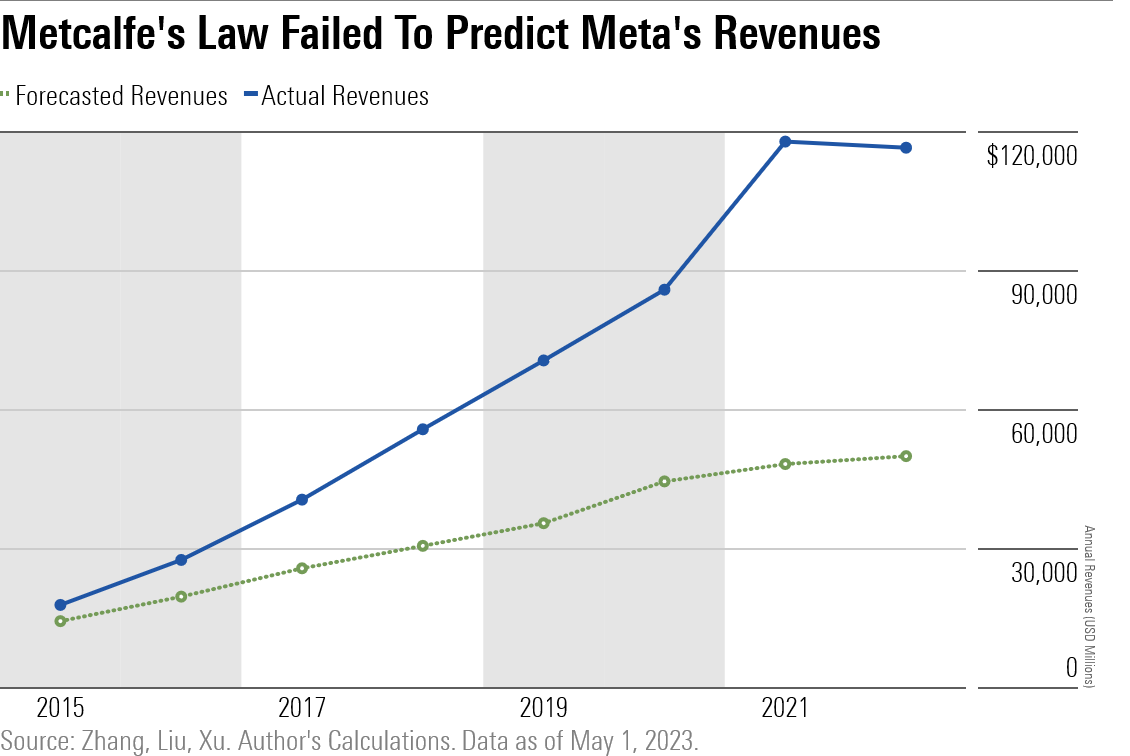

This might be not less than partly as a result of Metcalfe assumes a continuing worth per consumer, denoted VPU in our formulation. We all know this doesn’t maintain empirically—corporations are frequently looking for to maximise how a lot cash they’ll make off their customers.

This limits the mannequin’s efficacy out-of-sample. Check out how probably the most well-known Metcalfe’s regulation mannequin carried out over the following eight years after it was revealed.

Translating the mannequin from shares to crypto introduces further wrinkles. Importantly, the variety of wallets is a flawed proxy for customers. In a perfect world, we’d be capable to measure the variety of house owners of bitcoin. In apply, many traders permit exchanges like Coinbase to carry custody of their bitcoin in Coinbase’s proprietary wallets, which masks the overall consumer base.

Lastly, creating assumptions signifies that you’re at all times vulnerable to being unsuitable. Our premise of declining progress in pockets creation might be a false one. We smoothed the unique pockets progress knowledge to get a symmetrical curve, however precise pockets creation knowledge is barely uneven due to the pandemic increase in crypto funding. One other regime change is at all times attainable.

What’s the Verdict?

It’s a plain reality that neither the overall addressable market strategy nor the community results strategy goes to completely forecast demand for bitcoin. As a result of crypto is so new, these fashions are nonetheless very uncooked instruments. However they do inform us one thing fascinating concerning the apply of forecasting itself.

Normally, the overall addressable market strategy struck an upbeat tone for bitcoin’s future, whereas the community results strategy prompt a extra dour outlook.

Even outdoors of crypto, this relationship shouldn’t be uncommon. A bottom-up strategy just like the community results methodology will usually sound a extra cautionary word than a top-down strategy like the overall addressable market mannequin. It’s as true for shares as it’s for bitcoin—ask anybody who’s in contrast a multiples-based valuation with a reduced money circulation valuation.

Neither methodology is essentially extra sound. Even so, as analysts, we are likely to favor bottom-up forecasts. They’re a wholesome reminder that, in enterprise, success shouldn’t be future—it must be earned. And simply because an modern product excites you doesn’t imply that the remainder of the world underestimates its value. Generally, in investing, it pays to remain humble.

A word on the disclaimer beneath: Most digital property, together with the cryptocurrencies talked about on this article, aren’t presently categorized as shares of registered securities by the SEC and due to this fact don’t fall underneath Morningstar’s editorial insurance policies. Nevertheless, within the curiosity of full disclosure, the writer of this text does personal digital property talked about on this article.