YEREVAN (CoinChapter.com) — The U.S. inventory market misplaced $3.25 trillion in in the future on April 4, based on market information. This drop was bigger than all the crypto market cap, which stood at $2.68 trillion on the time, based mostly on CoinMarketCap figures. The autumn adopted new Trump tariffs that raised commerce tensions.

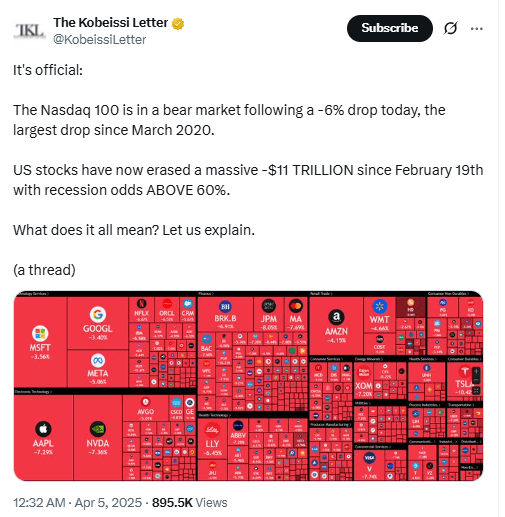

The Wall Road crash marked the worst single-day decline since March 16, 2020. The sharp drop affected main tech shares and pushed the Nasdaq 100 right into a bear market. The Kobeissi Letter confirmed the bear market label in an April 4 submit on X.

The market losses since February 19 now complete $11 trillion, with recession odds above 60%, the Kobeissi Letter added. It additionally known as the April 2 tariff announcement by Trump “historic.”

Nasdaq Bear Market Deepens with Tech Inventory Declines

The Nasdaq 100 index fell 6% on April 4. The decline pushed the index into official bear market standing. Shares within the Magnificent Seven group led the drop.

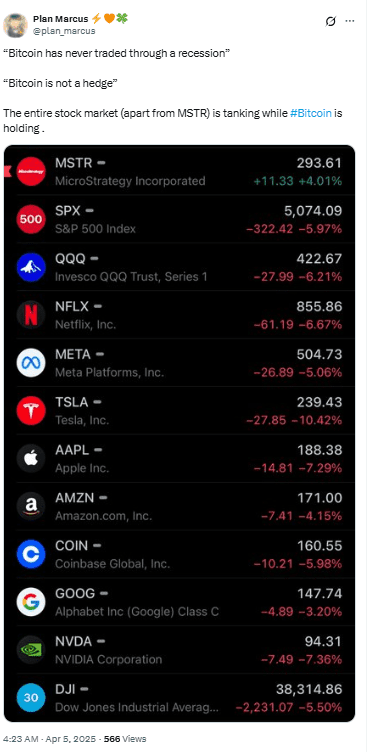

Tesla inventory fell 10.42%, making it the day’s greatest loser amongst main tech firms. Nvidia dropped 7.36%, whereas Apple shares declined 7.29%, based on TradingView information.

This sharp drop adopted Donald Trump’s government order on April 2, which added a ten% baseline tariff on all imports. Trump mentioned the reciprocal tariffs could be set at about half the speed that buying and selling companions impose on U.S. items.

Bitcoin Worth Holds Throughout Wall Road Decline

Regardless of the Wall Road crash, the Bitcoin price confirmed restricted motion. On April 4, Bitcoin traded at $83,749, down solely 0.16% over the previous seven days, based on CoinMarketCap.

Crypto dealer Plan Markus wrote on X that the inventory market was falling, however Bitcoin price remained secure. The submit mirrored what different customers observed—Bitcoin was not reacting strongly to the identical pressures affecting equities.

Technical dealer Urkel mentioned that Bitcoin

“doesn’t appear to care one bit about tariff wars and markets tanking.”

The price stage held regardless of broader financial fears tied to Trump tariffs and inventory declines.

Crypto Market Cap Nonetheless Under Wall Road Losses

The whole crypto market cap was nonetheless decrease than Wall Road’s day by day loss. On April 4, it stood at $2.68 trillion, whereas the Wall Road crash erased $3.25 trillion in worth.

Even some crypto skeptics acknowledged the distinction. Dividend Hero, who has over 203,200 followers on X, mentioned,

“I’ve hated on Bitcoin in the past, but seeing it not tank while the stock market does is very interesting to me.”

The distinction in efficiency highlighted a rising divide between crypto markets and conventional shares throughout occasions of macroeconomic volatility.

The Trump tariffs signed into impact on April 2 added a brand new layer of uncertainty. The coverage launched 10% import duties on all merchandise from all international locations, plus reciprocal tariffs for key buying and selling companions.