Picture supply: Video games Workshop plc

Regardless of a powerful efficiency, Video games Workshop‘s (LSE: GAW) share price slipped virtually 4% immediately (14 January) after the corporate revealed its first-half 2024/2025 outcomes.

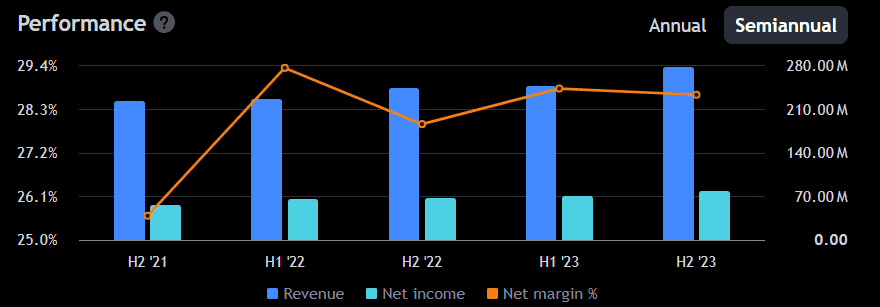

These revealed a pre-tax revenue of £126.8m, marking a 25% rise in comparison with £95.2m within the prior 12 months. Core income reached £269.4m, a ten% enhance from £235.6m in the identical interval final 12 months.

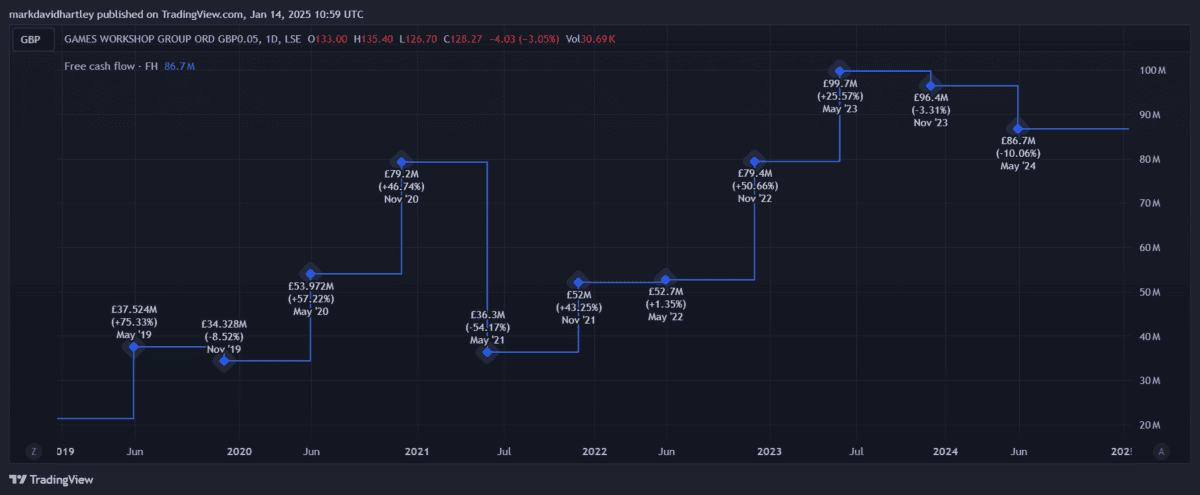

Earnings from licensing surged to £30.1m, greater than doubling from £12.1m beforehand. Nonetheless, its web enhance in money was decrease, at £79.1m, in comparison with £85.3m within the second half of 2023.

A dividend of £1.55 per share was additionally introduced, bringing the total quantity up to £4.20 for the monetary 12 months. The ex-dividend date is 23 January.

The corporate isn’t planning any share buybacks or acquisitions.

Development drivers

Famend for its Warhammer sequence, Video games Workshop’s gone from power to power. The share price rose 15% in 2023 and an extra 34% in 2024, following constant income development prior to now 5 years.

With a view to proceed increasing, the corporate’s initiated a number of key developments. Most notably, a deliberate partnership with Amazon to adapt Warhammer 40,000 right into a tv sequence might be an enormous enhance for the model.

With a devoted world fanbase and web site that draws 2.8m month-to-month guests, the deal stands in good stead to profit each events.

On the video gaming aspect, the discharge of Warhammer 40k: House Marine 2 in September helped enhance its digital footprint. Though there have been some vital critiques from on-line gaming websites, the general reception was usually beneficial.

Fundamentals and forecasts

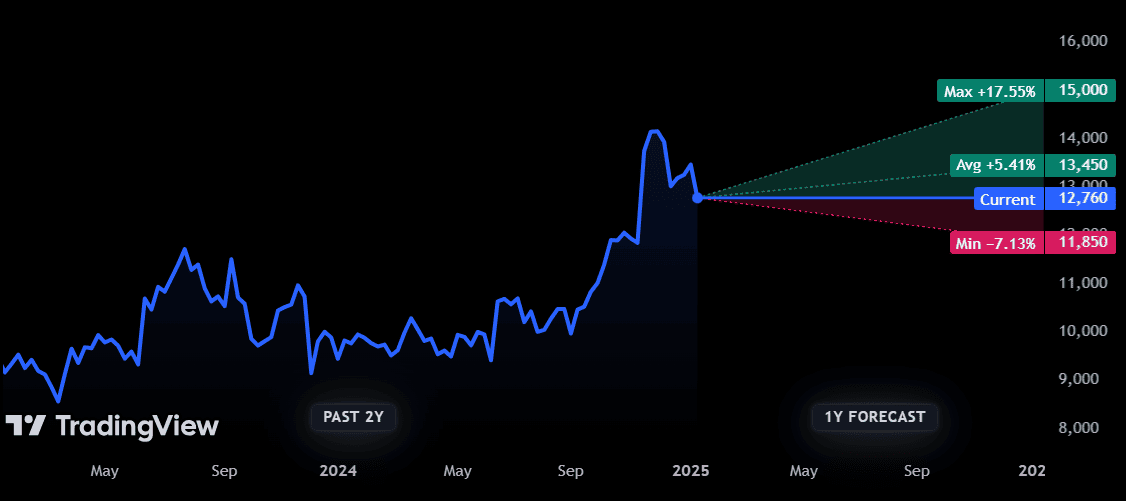

The hovering share price means Video games Workshop seems barely overvalued. It has a trailing price-to-earnings (P/E) of 28.9, nicely above the trade common. Nonetheless, with earnings forecast to develop, that is anticipated to return down.

Regardless of a slight dip in 2024, free money move has been steadily growing general. And with no debt, the danger of additional rate of interest hikes shouldn’t be a trigger for concern.

Nonetheless, it could be troublesome for the share price to see additional features from right here. Analysts watching the inventory don’t count on a lot above 5.4% development within the coming 12 months.

Threat to think about

Whether or not the corporate can proceed to seek out new prospects is the query. As a non-essential retailer, rising inflation might result in a drop in gross sales as customers prioritise their spending. Though it just lately joined the FTSE 100, it stays a relatively small outfit.

With the economic system trying unsure in 2025, buyers could go for the protection of bigger and extra well-established firms.

In immediately’s outcomes, it additionally warned of potential third-party value inflation associated to US commerce tariffs. This can be one motive the share price dipped after the information got here out. Excessive tariffs might restrict income from the US, its largest market by income.

Remaining ideas

General, Video games Workshop seems to be in a great place, each relating to funds and enterprise developments. The partnership with Amazon represents a very compelling worth proposition.

I’ve been contemplating the inventory for a while as I believe it reveals nice promise. Nonetheless, contemplating the present financial local weather, I’ll wait for more information about US tariffs earlier than deciding to purchase.