Not too long ago, VanEck submitted a proposal for a BNB ETF—changing into the primary to suggest an ETF for the token behind the Binance alternate. Buyers imagine this transfer may spark constructive momentum for BNB and the BSC ecosystem, following VanEck’s success with its Bitcoin and Ethereum ETFs.

The First BNB ETF Proposal from a Main Wall Road Fund

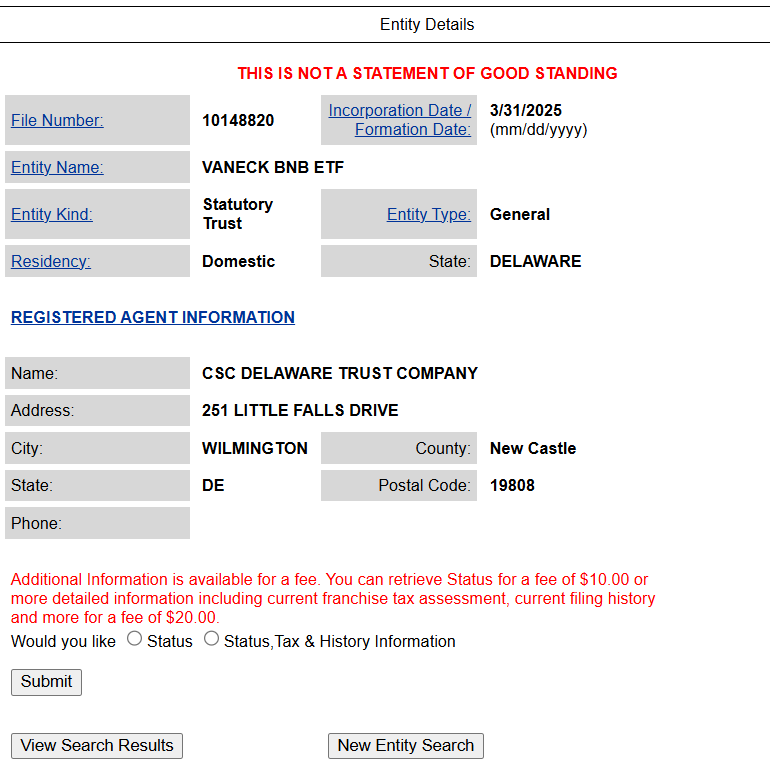

The crypto market has witnessed one other vital milestone as VanEck, a outstanding Wall Road funding agency, lately registered a BNB exchange-traded fund (ETF) in Delaware. This submitting marks the primary try to launch a BNB-specific ETF in america, including to the growing record of crypto-based monetary merchandise gaining traction in conventional markets. Proper after that, CZ – ex-Binance CEO, confirmed this information on his official X account:

BNB ETF submitting by VanEckhttps://t.co/4GuXMDkzCc

— CZ 🔶 BNB (@cz_binance) April 2, 2025

With this transfer, BNB BNB turns into the fifth token to have an ETF registration initiated by VanEck in Delaware, becoming a member of the ranks of Bitcoin, Ether, Solana, and Avalanche. The ETF, if accredited, would appeal to an enormous wave of liquidity and inflows from conventional establishments and retail to the BNB and BSC ecosystem.

Supply: The Delaware Division of Companies web site

VanEck’s determination to pursue this submitting highlights its confidence in BNB’s long-term potential and its rising relevance within the crypto market. As a number one Wall Road agency, VanEck’s involvement additionally lends credibility to BNB, probably paving the way in which for better adoption of altcoins in conventional funding portfolios.

This improvement alerts the growing acceptance of digital property in mainstream finance and underscores VanEck’s pioneering function in bridging the hole between conventional investing and the crypto ecosystem.

Learn extra: Binance Evaluate 2025: Options, Charges, Safety, Professionals & Cons

What’s New on BNB?

Binance Coin BNB was initially launched in 2017 as a utility token for the Binance platform, providing customers reductions on buying and selling charges and different advantages. Over time, BNB has developed considerably, particularly with the introduction of the Binance Good Chain (BSC) in 2020, a blockchain designed for dApps and sensible contracts. This enlargement has remodeled BNB right into a key participant within the DeFi area, with its worth and utility extending far past the Binance alternate.

Not too long ago, BNB and the BSC ecosystem have drawn growing consideration from institutional and conventional buyers, particularly following the announcement that USD1 from Trump’s World Liberty Finance can be launched on BSC. Backed by assist from conventional markets and former CEO CZ, BNB, and the BSC ecosystem have emerged as one of the crucial vibrant and promising ecosystems within the crypto area.

About VanEck

VanEck isn’t any stranger to the world of progressive investing. Based in 1955, the New York-based asset administration agency has constructed a repute for providing forward-thinking funding merchandise, managing billions of {dollars} in property throughout numerous sectors.

In recent times, VanEck has emerged as a frontrunner within the cryptocurrency ETF area, constantly pushing the boundaries of what’s attainable in regulated markets. The agency was among the many first to file for a Bitcoin ETF and has since expanded its choices to incorporate Ether, Solana, and Avalanche ETFs—all registered in Delaware.

VanEck’s experience in navigating advanced regulatory landscapes and its dedication to offering buyers with entry to rising asset courses make it a pure match for spearheading the BNB ETF initiative. With this newest submitting, VanEck continues to exhibit its imaginative and prescient of integrating digital property into mainstream finance, probably reshaping how buyers method cryptocurrencies within the years to return.

In conclusion, VanEck’s registration of a BNB ETF in Delaware is a landmark second for each the agency and the broader cryptocurrency trade. This ETF, being the primary of its variety within the U.S., has the potential to create new alternatives for BNB and altcoins on the whole, merging the realms of conventional and digital finance in a manner by no means seen earlier than.