Picture supply: Getty Photos

My Shares and Shares ISA portfolio took a little bit of a pounding on Friday (21 February). This was after the US market offered off closely on account of considerations about progress and inflation.

Among the many sea of pink in my portfolio, nonetheless, there was one valiant riser: MercadoLibre (NASDAQ: MELI). Shares of the Latin American e-commerce and fintech big rose 7% to $2,260, bringing the year-to-date return above 33%.

Why did it spike?

Latin America-based MercadoLibre is a mash-up of Amazon, eBay, PayPal, and Shopify. Final 12 months, gross merchandise quantity (GMV) on its e-commerce market surpassed $50bn for the primary time, whereas its logistics arm (Mercado Envios) dealt with virtually 1.8bn gadgets.

In the meantime, there at the moment are over 61m month-to-month energetic customers on its fintech app (Mercado Pago). In addition to with the ability to switch cash and pay payments and companies, prospects utilizing Pago get enticing yields on deposits and entry to credit score.

The explanation for the inventory’s leap final week was the agency’s blowout This fall outcomes. Income grew 37% 12 months on 12 months to $6bn (96% on a constant-currency foundation), which was barely larger than Wall Road’s expectations. However earnings per share (EPS) of $12.61 demolished estimates for round $8.

In its shareholder letter, MercadoLibre stated: “Retention and frequency on our marketplace are at record levels, as are payments and deposits per user in our digital account, and the number of merchants borrowing from us is higher than ever.”

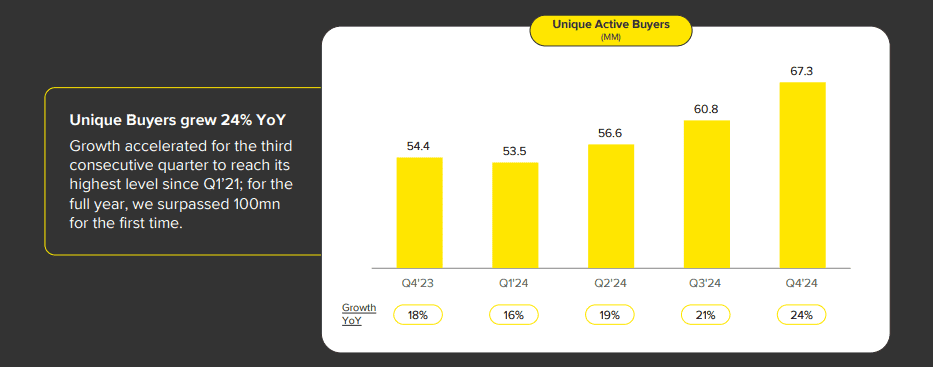

One determine that impressed me was that the variety of folks going to buy on its e-commerce platform is accelerating. Distinctive energetic consumers grew 24% to 67.3m in This fall, which was the third consecutive quarter of accelerating progress.

Dangers

As bullish as I’m on the way forward for the corporate, there are dangers to keep in mind right here. An inescapable one within the area is semi-regular financial instability. Argentina, for instance, continues to be recovering from its crippling inflation disaster.

That stated, MercadoLibre simply retains on getting stronger regardless of all of the political and forex crises thrown its method. And regardless of the huge infrastructure challenges throughout Latin America, almost half of its shipments in This fall had been delivered on the identical or subsequent day.

One other potential concern is the corporate’s quickly increasing credit score portfolio. It lends to each retailers and people, elevating the opportunity of rising non-performing loans if financial circumstances worsen. Because the agency scales its digital banking ambitions over the following decade, this will likely be one thing I’ll be maintaining an eye fixed one.

After all, the corporate is conscious of this danger. Final week, it stated: “We will closely monitor the health of our credit portfolio, and if we detect any signs of deterioration, we will swiftly adjust and scale back as needed — just as we have done in the past.”

Valuation

The corporate continues to be in progress mode, so I desire to take a look at the price-to-sales (P/S) ratio to shortly choose valuation. Proper now, the P/S a number of is 5.5, which I don’t see as outrageous. Due to this fact, I believe the inventory continues to be price contemplating for traders.

MercadoLibre is at the moment my second-largest holding. However I anticipate to maintain holding for a lot of extra years as e-commerce and digital funds mushroom throughout Latin America. The agency is on the epicentre of those mega-trends.