-

Bitcoin hit a two-week excessive above $71,000 earlier than paring positive aspects, up 1.5%.

-

Could ISM manufacturing knowledge confirmed a slowing U.S. economic system, buoying charge minimize expectations.

-

Bitcoin miners CORZ, WULF, BTDR booked double-digit positive aspects.

A number of altcoins led the price motion Tuesday because the broader crypto market climbed increased with bitcoin {{BTC}} hitting a two-week excessive.

Decentralized change Uniswap’s governance token {{UNI}} surged over 20% throughout the day following a cryptic social media submit by protocol growth group Uniswaps Labs teasing an announcement.

Ethereum layer-2 community Starknet’s token {{STRK}} additionally rallied over 10% after StarkWare, the event agency behind the chain, laid out its imaginative and prescient to make use of Starknet to scale the Bitcoin community. The token price might come beneath strain as some $85 million price of STRK will probably be launched from vesting subsequent week, rising its provide.

Bitcoin’s largest problem is scalability. StarkWare has a imaginative and prescient to alter that.

The idea of STARK scaling for blockchains was first launched by @EliBenSasson at a Bitcoin convention in early 2013.

It is now time to scale Bitcoin with ZK-STARK, making it extra accessible… pic.twitter.com/sdx7sQJzur

— StarkWare 🐺🐱 (@StarkWareLtd) June 4, 2024

The native token of the BNB Good Chain {{BNB}}, initially began by crypto change Binance, superior 7% approaching its all-time document price and surpassing $100 billion in market capitalization. The token is benefiting from elevated Binance launchpool and launchpad actions, the place customers can lock up BNB to take part in airdrops and new token launches.

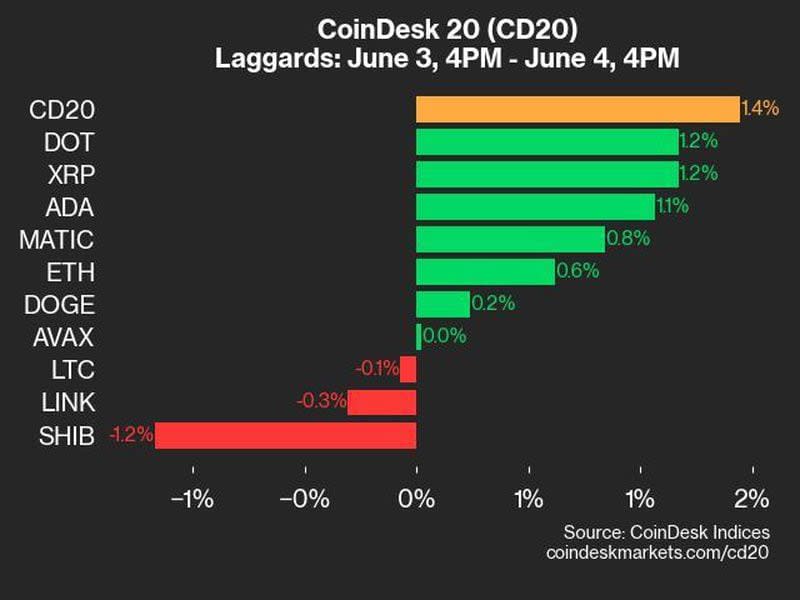

These tokens outperformed the broad-market crypto benchmark CoinDesk 20 Index, which was up 1.8% over the previous 24 hours. Seventeen of the twenty constituents had been within the inexperienced throughout this era, highlighting the optimistic pattern in crypto costs.

Trying on the largest digital asset, bitcoin topped $71,000 for the primary time since Could 20 earlier than paring positive aspects and reversing to the low $70,000s. A recent set of U.S. manufacturing knowledge Monday hinted at a cooling economic system, doubtlessly placing rate of interest cuts again on the Federal Reserve’s view later this yr to loosen monetary circumstances.

“We expect a further boost to this bullish momentum with NFP [non-farm payroll] this Friday,” crypto hedge fund QCP stated in a Tuesday replace. “The markets are pricing in 0% chance for a rate cut in June and July. A weaker NFP number might change that.”

The second-largest crypto asset, ether {{ETH}} modified palms at round $3,800, up 0.3% and underperforming BTC’s 1.5% advance. Crypto analytics agency K33 Analysis forecasted that upcoming U.S. spot ETH ETFs might see $4 billion inflows in 5 months, resulting in price appreciation and ETH gaining relative to BTC.

Learn extra: Ether Value Poised for Provide ‘Shock’ as ETFs Could Appeal to $4B Inflows in 5 Months, K33 Analysis Says

A number of U.S.-listed bitcoin miners booked substantial positive aspects, led by Core Scientific (CORZ) 40% surge following a take care of cloud computing agency CoreWeave to host synthetic intelligence (AI) providers. CoreWeave additionally reportedly provided to purchase the corporate in an all-cash supply for $5.75 price per share.

Bitcoin miner shares have been battered down after the quadrennial bitcoin halving in April minimize mining rewards by half decreasing the principle income supply for miners. The deal is a sign that smaller mining corporations could possibly be targets for acquisitions as mergers warmth up within the sector or diversify to journey the red-hot AI pattern.

Massive-cap Marathon Digital (MARA) superior 5%, whereas smaller-cap TeraWulf (WULF), Bitdeer (BTDR) and Hive Digital Applied sciences (HIVE) gained 22%, 12% and eight%, respectively.