UFC star Khamzat Chimaev, identified for his formidable presence within the ring, just lately ventured into cryptocurrency, meaning to capitalize on his reputation.

Nonetheless, he faces allegations of insider buying and selling associated to his newly launched meme coin. He additionally has drawn the ire of the crypto group and raised critical questions on his monetary actions.

Chimaev’s SMASH Coin Crashes After Preliminary Hype

Initially, Chimaev engaged his followers on X (previously Twitter) by asking which cryptocurrency he ought to spend money on. The very subsequent day, Chimaev launched his SMASH meme coin on the Solana (SOL) blockchain. He inspired his followers to purchase the SMASH meme coin, leveraging his well-known catchphrase, “Smash ’em all.”

Learn extra: Crypto Rip-off Initiatives: How To Spot Pretend Tokens

Regardless of preliminary hype and promotional efforts on his social media, the asset’s price fell to zero quickly after its launch. The crypto group shortly accused Chimaev of orchestrating a pump-and-dump scheme. Within the crypto market, a pump-and-dump scheme entails artificially inflating an asset’s price earlier than promoting off at a peak, leaving later consumers with devalued investments.

Knowledge from GeckoTerminal revealed a staggering 72% drop in SMASH’s worth inside 24 hours, with a short lived plunge exceeding 96%. The meme coin’s market capitalization now stands at solely $82,000. Furthermore, its buying and selling quantity barely surpasses $116,000.

Furthermore, all associated tweets had been deleted on the time of writing. These add extra suspicion surrounding the meme coin.

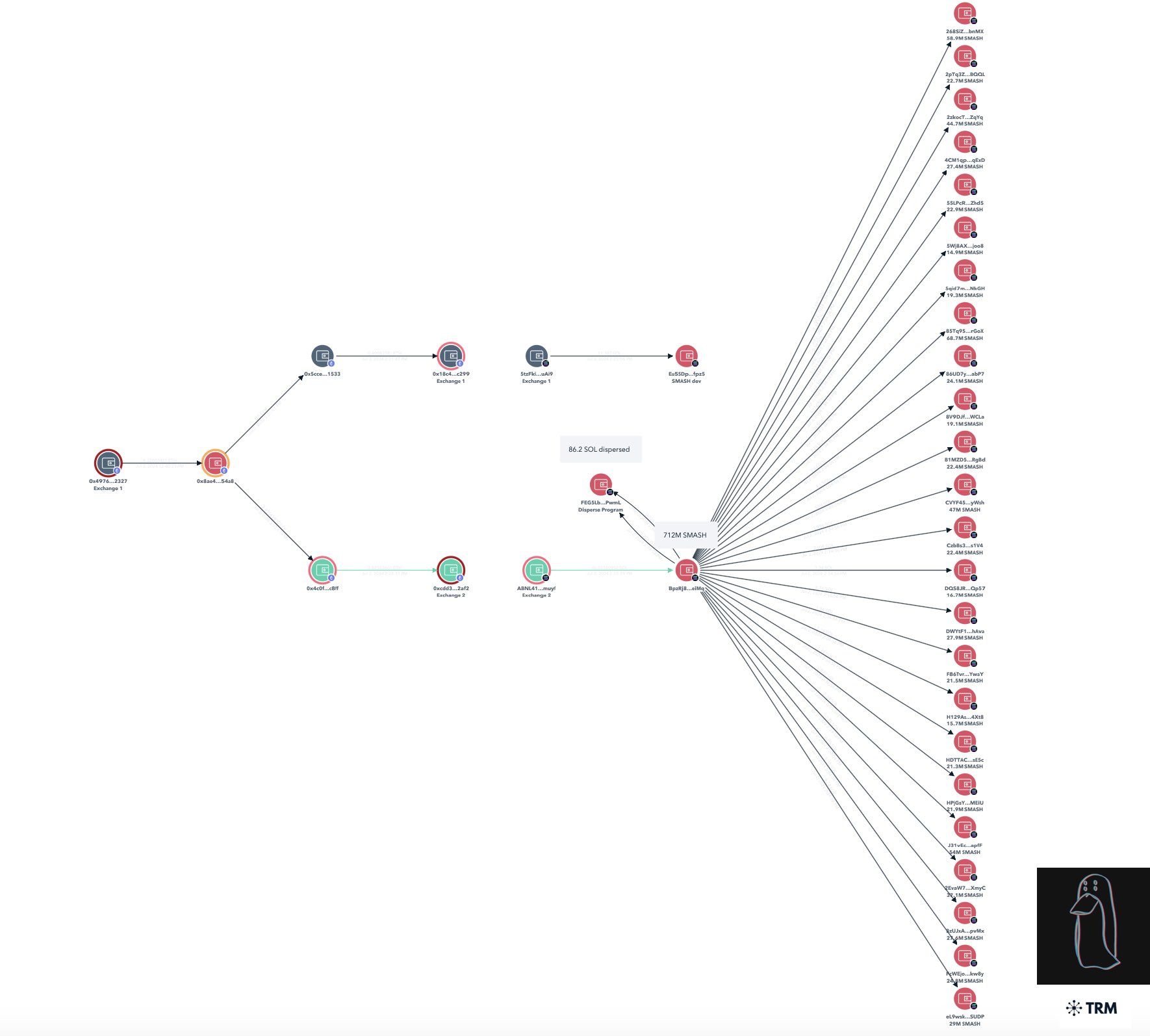

Outstanding on-chain sleuth ZachXBT uncovered proof suggesting insider buying and selling on SMASH. He identified that insiders and wallets linked to the builders bought up to 78% of the SMASH quantity.

“Why do all of you instantly nuke your reputation with meme coin scams?” ZachXBT known as out.

Moreover, ZachXBT’s findings point out that at the very least 71% of the coin’s provide has a direct reference to insider wallets funded from the identical Ethereum deal with because the developer’s pockets on Solana. A complete of 24 addresses collectively obtained 86.2 SOL, valued at round $11,500.

This quantity was subsequently utilized to accumulate 712 million SMASH tokens, representing 71.2% of the entire out there provide of SMASH tokens. These property have been dispersed amongst smaller addresses, additional complicating the traceability of the transactions.

The incident with Chimaev’s SMASH coin is just not an remoted case. The crypto market has witnessed a surge in meme cash launched by celebrities, usually resulting in comparable controversies.

As an example, former Olympic athlete and Kardashian-Jenner member of the family Caitlyn Jenner confronted accusations of fraud after launching her personal coin. Equally, confusion and deceit marred singer Iggy Azalea’s token launch, as an unauthorized asset appeared available on the market simply earlier than her official launch.

Learn extra: 15 Most Frequent Crypto Scams To Look Out For

Earlier in June, Ethereum co-founder Vitalik Buterin has criticized superstar meme cash. Buterin emphasised that digital property ought to serve significant functions fairly than merely enriching insiders.

Disclaimer

All the knowledge contained on our web site is revealed in good religion and for normal data functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own danger.