Picture supply: Unilever plc

The Unilever (LSE:ULVR) share price has gone from £38.24 per share to £48.07. However analysts disagree on their outlook for the following 12 months with price targets extensively ranging £38.84 to £56.94.

I feel the corporate’s plans to restructure are extraordinarily fascinating. And I feel 2025 might yield a giant alternative that’s presently hidden beneath the floor.

A crossroads

Unilever shares are at a crossroads. There’s little question 2024 has been a powerful 12 months for the corporate, however the inventory’s buying and selling at an unusually excessive price-to-earnings (P/E) a number of.

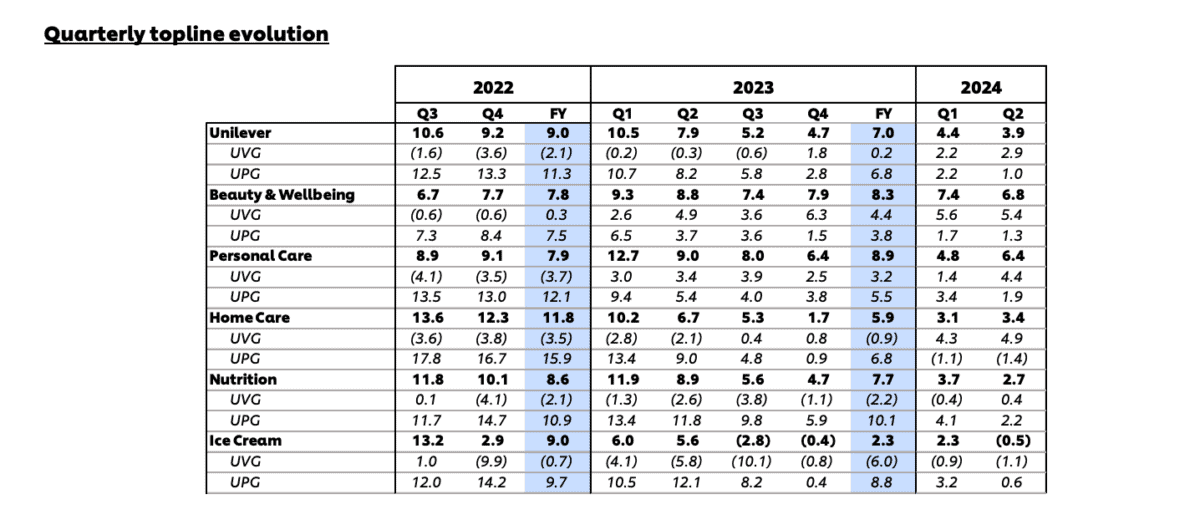

The spotlight has been Magnificence, the place gross sales have grown over 7% throughout the first half of the 12 months. Private Care, Residence Care, and Diet have additionally posted respectable outcomes.

Supply: Unilever pre-close aide-memoire Q3 2024

This isn’t what’s been pushing the inventory increased although. Again in January, Unilever shares had been buying and selling at a P/E ratio of 17 and that’s elevated to 21 in the present day – a 23% rise.

Which means the rising share price is essentially attributable to traders paying increased costs. And the massive query is whether or not the corporate’s gross sales can continue to grow to justify the expanded a number of.

If they will, then the shares might have additional to climb. But when income development stalls, the P/E ratio at which traders are prepared to purchase the inventory might fall, taking the share price with it.

A key catalyst

Which approach Unilever will go from right here is tough to forecast and I don’t assume there’s a lot margin of security for traders on the present share price. However I do see a possible alternative right here.

The corporate’s aiming to divest its ice cream enterprise earlier than the tip of 2025. There are good causes for this – its development’s been comparatively weak and it’s costly to run.

Unilever may promote the unit to a different enterprise. But when it demerges its ice cream operations as a separate firm – because it’s been suggesting – I feel this could possibly be very fascinating.

If the ice cream enterprise isn’t a part of the FTSE 100, I’d anticipate quite a lot of promoting when the inventory hits the open market. A very good quantity of this could come from index funds that may’t maintain it.

On this scenario, I’d anticipate the inventory to fall. And there could possibly be a possibility to purchase shares within the new firm at an unusually low price.

This has occurred earlier than

Final 12 months, the enterprise now often known as Kellanova divested WK Kellogg. The remaining operations stayed as a part of the S&P 500, however the cereal enterprise didn’t.

Because of this, the inventory instantly fell 30% to simply over $10 per share, implying a P/E ratio of 8. At that price, restricted development prospects develop into a lot much less of a difficulty.

Since then, the inventory’s up 70% and shareholders look set to gather a gradual dividend. And I feel one thing related may occur with Unilever’s ice cream division in 2025.

I’m not saying I’d look to purchase the divested ice cream firm at any price. However I shall be looking out for a possible cut price if establishments must throw the inventory out.

That is the place my curiosity in Unilever is. The inventory doesn’t soar out at me at in the present day’s costs, however I’m searching for a possibility within the ice cream enterprise as issues develop.