Picture supply: Getty Pictures

There aren’t that many FTSE 100 firms that may declare to have posted £1bn in annual revenue. However that’s precisely what this well-liked excessive avenue trend retailer did when it posted its full-year outcomes this morning.

Subsequent

Subsequent (LSE: NXT) is a well-loved and recognisable excessive avenue trend model, specialising in clothes, footwear and residential merchandise. Established in 1982, the corporate has grown to turn out to be a staple on the UK excessive avenue, working over 500 shops nationwide.

Past its bodily presence, it’s developed a profitable on-line platform catering to clients each domestically and internationally. The retailer provides a variety of merchandise, together with males’s, ladies’s, and kids’s trend, in addition to house furnishings and equipment.

For the fiscal yr ending January 2025, Subsequent simply managed to cross the £1bn revenue milestone, posting pre-tax revenue of £1.011bn. This equates to a ten.1% improve in annual income.

In the meantime, group gross sales rose by 8.2% to £6.32 bn, pushed by expectations-beating gross sales within the preliminary eight weeks of the fiscal yr. Because of this, the corporate has revised its gross sales progress forecast for the primary half of the yr from 3.5% to six.5%, resulting in an anticipated annual progress fee of 5%.

Moreover, the retailer elevated its pre-tax revenue steerage by 5.4% to £1.066bn.

Tariff chaos continues

In different information this morning, President Donald Trump plans to impose a 25% tariff on all imported cars to the US. The announcement despatched ripples via world monetary markets, with the FTSE 100 taking a minor hit. The UK helps a number of main automotive producers and associated industries, all of which might endure as markets tackle the impression of declining automotive exports to the US.

After all automotive tariffs aren’t a problem for the agency, however whereas upcoming adjustments to de-minimis customs thresholds are, they’re anticipated to have little impression on the corporate’s total gross sales and income. Within the EU, a lot of the firm’s enterprise already runs via a neighborhood subsidiary, that means it received’t be affected by the rule change. The rest, offered by way of a UK entity and imported by customers, will face further duties from 2028. Nonetheless, the monetary impression is predicted to be minimal, with an estimated internet price of below £1m.

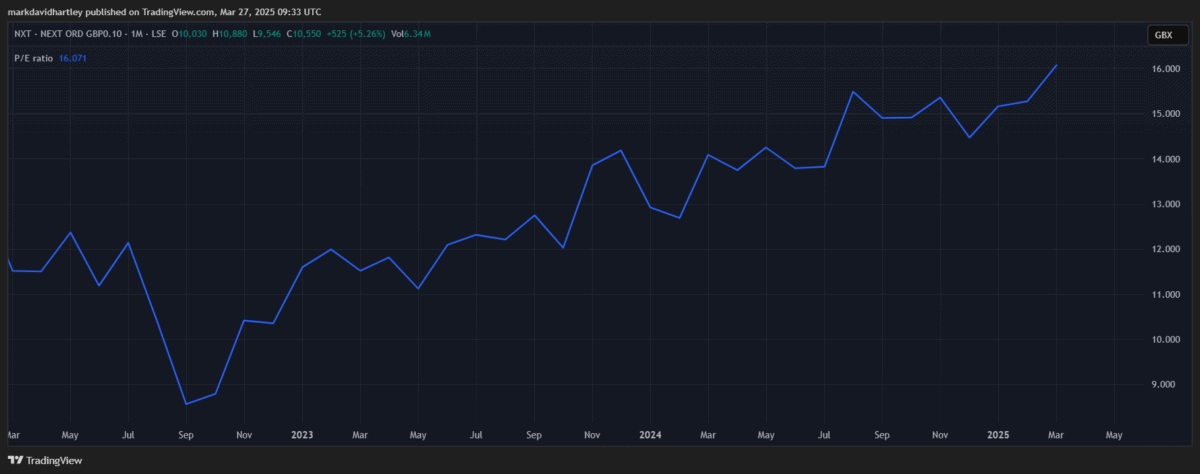

Nonetheless, the chance of losses from a broader financial downturn stays a risk. It’s additionally shifting in direction of overvalued territory, with a price-to-earnings (P/E) ratio rising from 8.5 to 16. Add to this shifting client behaviour and growing competitors from the likes of Marks & Spencer, ASOS and Debenhams Group.

Whereas these particular commerce insurance policies might indirectly impression the retailer, rising geopolitical tensions and market fluctuations stay a trigger for concern. All these elements might affect the corporate’s total operations and enterprise circumstances.

Heading in the right direction

Taking a look at as we speak’s numbers and monetary efficiency, there are notable indicators of sturdy administration and a resilient enterprise mannequin. The corporate’s profitable integration of on-line and bodily retail channels positions it properly within the evolving retail panorama.

It’s doing properly to reaffirm its place as a pacesetter inside the British trend retail sector. At this time’s outcomes reveal its capacity to spice up gross sales via market adaptability. Regardless of the financial challenges, I feel this strategic strategy, mixed with a powerful market presence, might equate to a promising future for the agency.

General, I feel it’s a great inventory to think about as a part of a portfolio aimed toward leveraging UK progress and sidestepping the impression of US commerce tariffs.