$USUAL: The place Yield and Governance Converge for a New Period of Tokenomics

USUAL introduces a refreshing tackle governance tokens, bridging the often-uneven stability between yield era and ecosystem progress. Backed by actual money stream and community-centric distribution, it provides customers a twin profit that many governance tokens fail to offer—regular returns and long-term worth.

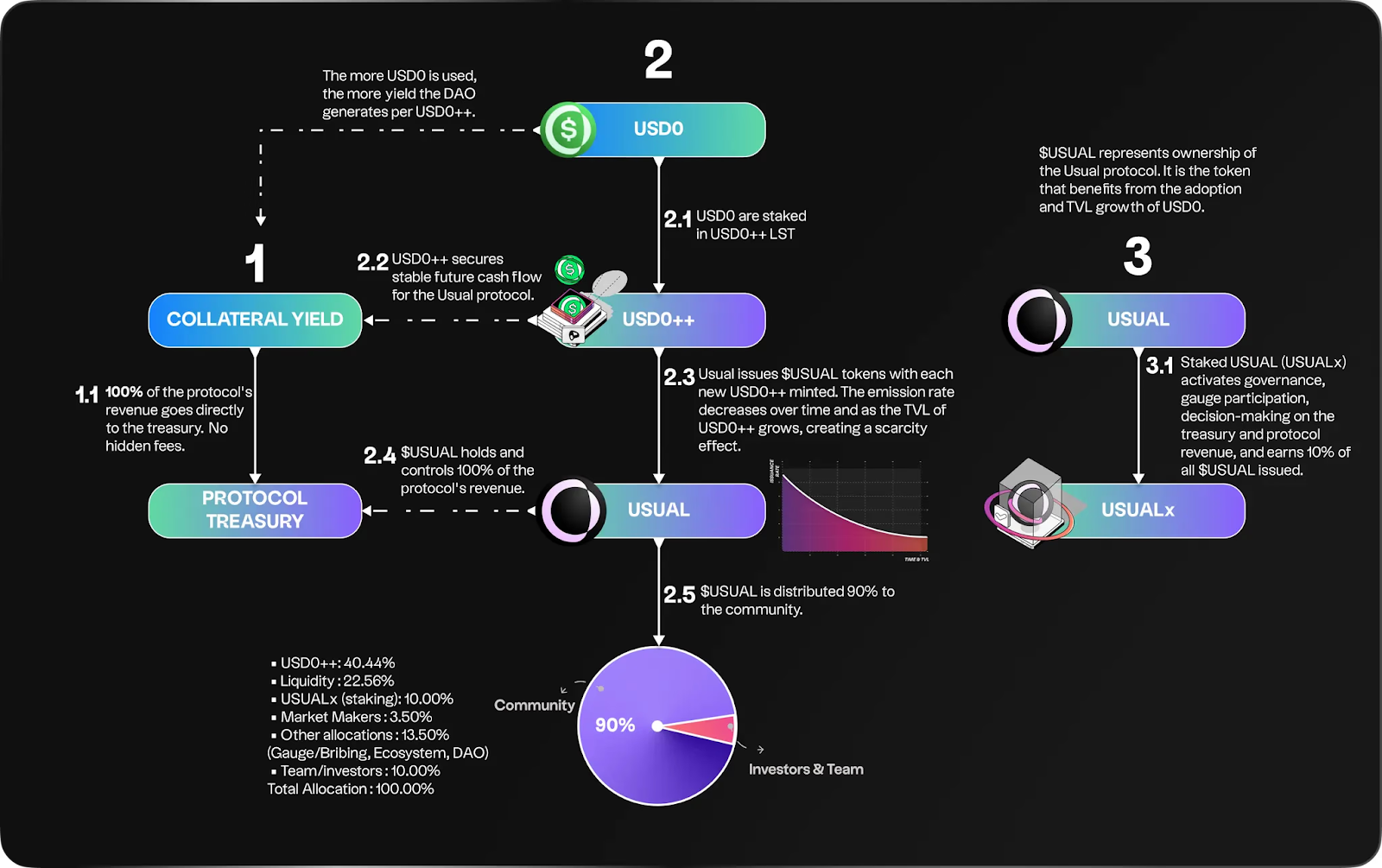

USUAL positions itself uniquely as each a governance and utility token with options designed to develop alongside the protocol. It’s not merely a governance token in title; USUAL grants holders entry to 100% of the protocol’s income, grounding it in actual money flows. Not like tokens that rely solely on hypothesis or short-term incentives, USUAL aligns its incentives with protocol income, making it a dynamic and useful long-term asset.

Supply: Standard

Shortage is a vital part of USUAL’s attraction. As deposits within the protocol enhance, USUAL’s emission fee decreases. This disinflationary issuance means the token provide doesn’t dilute over time, however relatively grows in tandem with Complete Worth Locked (TVL). In consequence, every token’s worth scales with protocol progress, making a secure basis for holders.

USUAL’s distribution mannequin ensures that the group stays the first beneficiary of the protocol’s success. Ninety % of USUAL tokens are allotted to the group, with simply 10% going to group members and early traders. This allocation protects customers from extreme insider affect, making a fairer, extra equitable construction that promotes sustained participation and ecosystem belief.

USUAL’s utility extends past governance by means of its staking characteristic, the place holders can activate governance rights and earn a portion of newly issued USUAL tokens. Staking incentives, together with a gauge mechanism that helps optimize liquidity distribution, encourage holders to have interaction actively with the protocol, bolstering long-term stability.

Supply: Standard

In Q1 2025, USUAL will allow a brand new characteristic, permitting customers to burn a portion of their tokens to unlock staked USD0 (USD0++), enhancing liquidity and adaptability for stakers. This selection expands USUAL’s utility whereas balancing provide and demand dynamics throughout the protocol.

USUAL’s design addresses the shortcomings widespread in most governance tokens. Not like many tokens that mimic current fashions, USUAL’s worth immediately correlates with protocol income progress. Its issuance mannequin is rigorously calibrated to keep up inflation charges beneath income progress, linking token worth to tangible money flows. This construction permits for significant, sustained worth for these invested within the protocol’s long-term imaginative and prescient.

The $USUAL emission mannequin is especially strategic, designed to manage token issuance primarily based on TVL progress and rates of interest of property backing USD0. This construction minimizes inflation, defending early adopters from dilution whereas preserving worth for long-term holders. By capping emissions and adjusting issuance charges primarily based on TVL progress, USUAL maintains intrinsic worth, guaranteeing that every token represents a rising portion of the protocol’s income.

This mannequin in the end advantages customers who contribute to protocol progress and underscores USUAL’s dedication to truthful worth distribution. Emission is saved considerably beneath treasury progress, stopping extreme inflation and aligning incentives throughout the ecosystem.

USUAL’s governance mannequin empowers holders with management over treasury and collateral administration, setting it other than many governance tokens that provide restricted utility past token holding. By way of staking, USUAL holders affect key monetary choices, guaranteeing that treasury administration aligns with the group’s imaginative and prescient. This stage of transparency and management fosters a way of possession and long-term dedication amongst customers.

The protocol’s roadmap consists of expanded utility, with future implementations providing holders higher entry to earnings per token. As TVL will increase, the token worth naturally scales upward, immediately correlating with the protocol’s monetary success. The USUAL mannequin is designed to draw long-term members, encouraging sustainable progress relatively than incentivizing short-term good points.

USUAL’s tokenomics mannequin displays a sustainable method, the place token provide progress is tied to ecosystem growth. This prevents extreme inflation and ensures a balanced distribution of rewards to these driving the protocol’s success. By aligning governance and utility options, USUAL’s framework helps a secure ecosystem for progress and collaboration.

With USUAL, holders achieve a possibility to take part in a governance mannequin that rewards dedication to protocol progress and supplies tangible, sustained worth. It’s a community-focused mannequin that prioritizes customers over insiders, setting a brand new normal for governance tokens.