Picture supply: Getty Photos

The chips that Nvidia (NASDAQ: NVDA) designs proceed to energy the continuing synthetic intelligence (AI) revolution. Remarkably, its inventory has surged by round 24,000% over the previous decade.

This implies a £5,000 funding made in September 2014 would now be value over £1m!

Whereas it’s unimaginable to foretell with certainty which inventory will turn out to be the following ‘millionaire-maker’ — I want it was that straightforward — there are particular traits that always accompany such investments.

Listed below are some primary ones:

- Secular traits: the corporations are in industries which might be experiencing fast development or disruption.

- Continuous innovation: excessive research and growth (R&D) spend displays a deal with innovation.

- Founder mode: founders usually suppose in years (or many years) fairly than quarters like some employed CEOs.

- ‘Overvalued’: huge winners virtually completely look overvalued by typical metrics.

A founder-led innovator

Unsurprisingly, Nvidia ticks all these containers. Its graphics processing items (GPUs) have powered high-growth industries like gaming, crypto mining and, extra not too long ago and most important of all, AI.

The chipmaker spends a tonne on R&D and product innovation. Final yr, it allotted $8.6bn to R&D, up from $1.8bn in FY18.

A decade in the past, the inventory was overvalued by most conventional metrics. Shock shock, it’s at the moment too. That’s why it’s extra essential, for my part, to deal with whether or not the agency’s development engines are nonetheless firing.

Lastly, Nvidia is led by visionary founder Jensen Huang. He had the ethical authority to danger pivoting the enterprise in the direction of AI computing just a few years in the past. In distinction to this, manager-led Intel has been sluggish to capitalise on the AI revolution.

In the present day nevertheless, Nvidia’s clients are extremely concentrated amongst giant tech corporations. If these pull again on AI spending, development may shortly stall.

Similarities

A inventory that I feel may also be a giant long-term winner is Shopify (NYSE: SHOP).

The corporate’s platform lets customers effortlessly create on-line shops in minutes. It affords built-in instruments for stock administration, fee processing, transport, and extra.

Whereas many e-commerce corporations have struggled post-Covid, Shopify continues to be rising. Final yr, income jumped 26% to $7.1bn. Within the first six months of 2024, it climbed 22%. The expansion engine continues to be purring.

Crucially for me, the administration crew may be very progressive and long-term oriented. Certainly, Shopify says it’s “constructing a 100-year firm“.

Final yr, CEO Tobias Lütke offered off the agency’s capital-intensive logistics division. Not solely is that this bettering margins, it’s permitting Shopify to totally consider creating AI-powered instruments.

Within the second quarter, manufacturers together with Toys ‘R’ Us, Mas+ by Lionel Messi, and Dios Mio Espresso by Sofia Vergara launched on the Shopify platform.

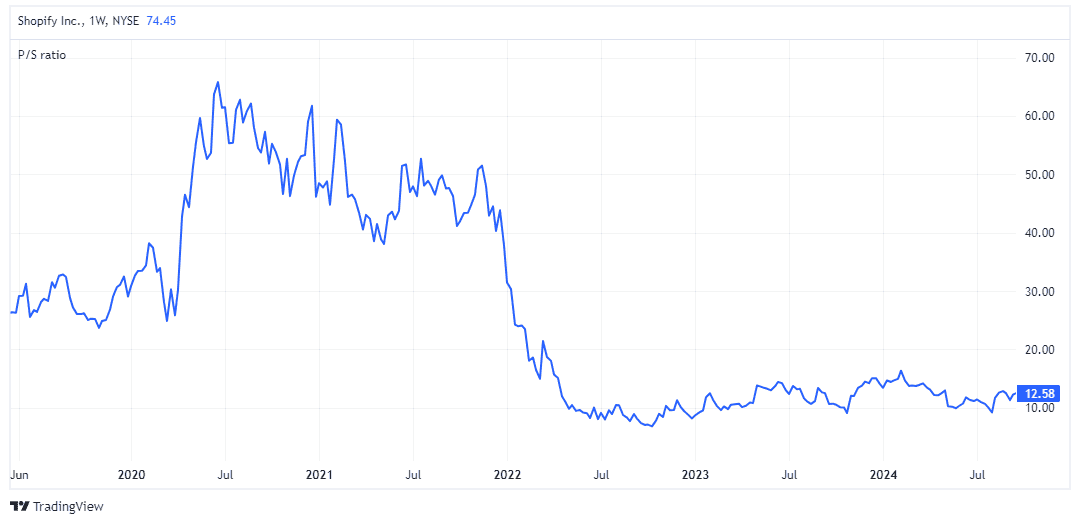

With a price-to-sales (P/S) ratio of 12.5, the inventory isn’t low cost. But it surely’s a sizeable low cost to earlier years.

One danger to Shopify’s development is weak client spending amid stubbornly excessive inflation. One other could be a recession within the US, its largest market.

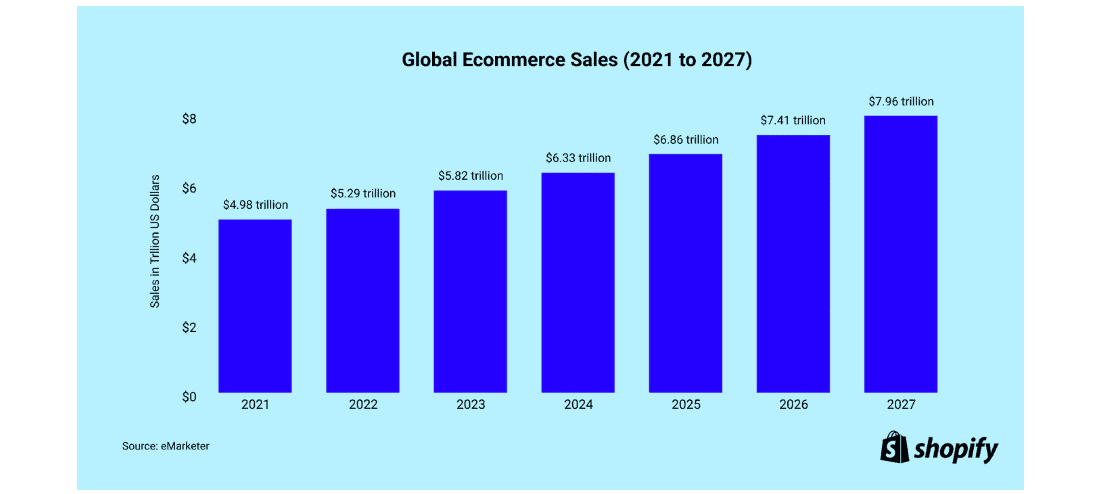

Nonetheless, world e-commerce gross sales are nonetheless projected to succeed in almost $8trn by 2027, up from $5.8trn in 2023. So the secular pattern of on-line buying continues apace.

Because the clear chief in e-commerce software program, the agency stands to learn straight.

Finally, we don’t know the place the following millionaire-makers are hiding. However to me, Shopify shares many related traits to Nvidia, which is why it’s my third-largest holding at the moment.