Picture supply: Getty Pictures

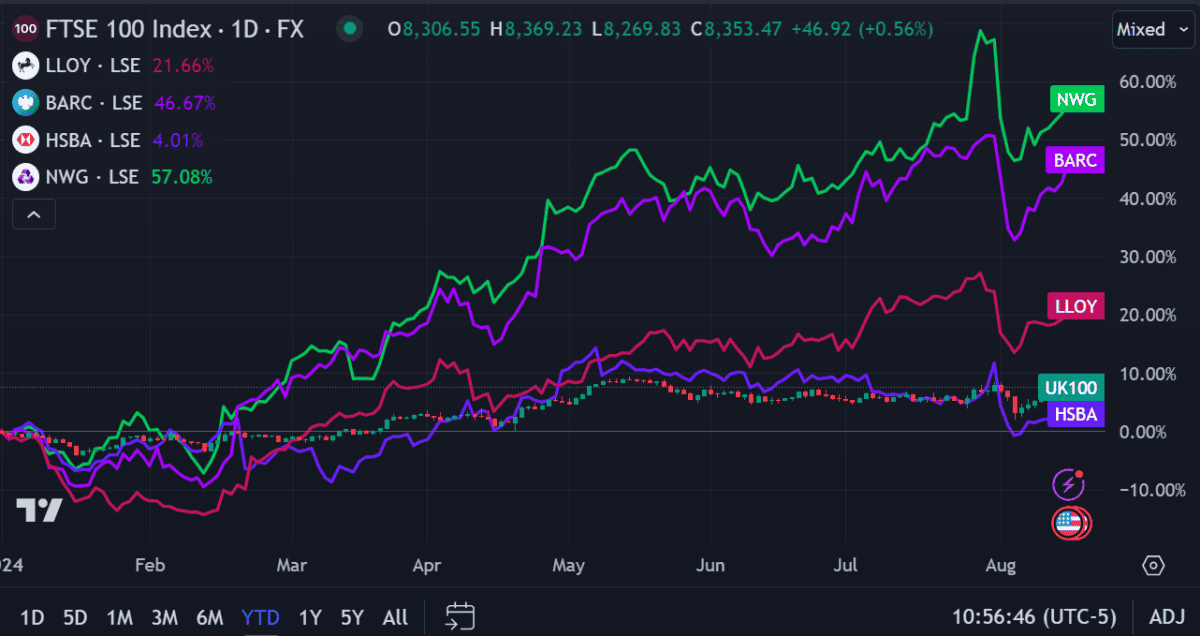

I’m not going to sugarcoat it — Barclays (LSE: BARC) is much outperforming the Lloyds (LSE: LLOY) by way of share price thus far this 12 months. And never by only a bit. 12 months-to-date (YTD), its progress is greater than double that of the black horse financial institution.

Nonetheless, at the very least Lloyds is doing higher than the FTSE 100, which is greater than I can say for at the very least one different financial institution.

Financial institution vs financial institution

As a buyer, I’ve lengthy been a fan of Barclays however I wouldn’t say my religion is unwavering. There are occasions when the financial institution actually checks my endurance. I’m not as conversant in Lloyds nevertheless it’s a horny inventory nonetheless.

So if I weren’t already invested in each, which might be the perfect decide right now?

Let’s examine their financials.

Lloyds

With the mortgage market turning into more and more aggressive, Lloyds is feeling the stress. That is its largest money-spinner, so it must be on high. And because the Financial institution of England (BoE) minimize rate of interest cuts final month, issues are even harder.

The cuts imply Lloyds’ internet curiosity margins decreased from 3.18% to 2.94% (the distinction between what it pays in curiosity and what it fees). Principally, it’s now incomes a bit much less from loans.

Plus, its 2024 first-half outcomes weren’t spectacular. Web earnings was down 9% and working bills rose, resulting in a 14% lower in earnings earlier than tax.

However nonetheless, the financial institution’s low share price appears to supply good worth. It has a horny ahead price-to-earnings (P/E) ratio of 8.9, buying and selling at 53% under truthful worth based mostly on future money circulate estimates.

Final however not least, its key worth proposition: an above-average dividend yield of 5.1%.

So how does Barclays measure up?

Barclays

The Barclays share price loved the largest increase from this week’s information that the US might keep away from a recession. It climbed 3.4% on Thursday whereas different banks closed up round 1.5%.

That brings its yearly beneficial properties up to an enormous 46%, making me surprise how far more it might probably develop. Surprisingly, it nonetheless hasn’t out-valued its earnings, with a ahead P/E ratio of solely 6.3. This locations it effectively under each Lloyds and the UK financial institution common of seven.3.

A number of key bulletins this month helped its fortunes. It elevated its dividend by 7.4% and initiated a $750m share buyback programme. It additionally expects to finish its acquisition of Tesco Financial institution by November this 12 months.

My key concern with Barclay is that the present share price could also be artificially inflated. The previous two years have been an financial mess, with excessive rates of interest skewing a number of metrics. Additional price cuts may tip the scales towards it, probably prompting shareholders to re-evaluate their positions.

Even after 16 years, the 2008 disaster lingers within the minds of many buyers. Till the present recession jitters have been absolutely quashed, I stay cautious of weighing an excessive amount of on Barclays.

The underside line

On the face of issues, Barclays seems to be like its progress prospects outmatch Lloyds. However those self same metrics give me pause for concern. It could promise a greater return — however at what threat?

As a well-established market chief, Lloyds feels extra steady to me, if considerably much less thrilling.

So perhaps holding a little bit of each is the perfect concept in any case?