Picture supply: Getty Photographs

It has been a wonderful couple of months for traders in Lloyds (LSE: LLOY). The Lloyds share price has surged 24% because the flip of the 12 months and twice that a lot over the previous 12 months.

An investor who put £1,000 into the black horse financial institution at its September 2020 nadir would now be sitting on a holding price £2,763.

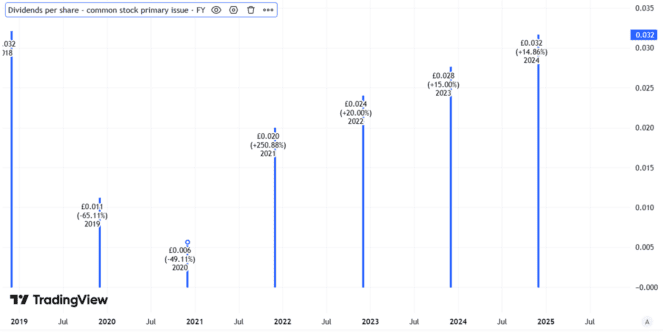

Quick-term dividend progress, however nonetheless 88% under 2007 ranges

They might even be incomes a dividend yield of 12.8%. For consumers immediately the yield could be 4.7%.

The potential yield is even larger as Lloyds has been rising its dividend handily.

Final week it introduced a full-year dividend per share enhance of 15%. What is called a progressive dividend coverage signifies that the FTSE 100 financial institution goals to continue to grow its dividend, though in observe no dividend is ever assured to final.

Created utilizing TradingView

Lengthy-term Lloyds shareholders know that solely too properly.

Even after final week’s enhance, the dividend per share just isn’t but again to the place it stood in 2018. It’s 88% under the place it stood in 2007, earlier than Lloyds bumped into bother within the monetary disaster.

The shares might nonetheless transfer up from right here

On the subject of the Lloyds share price, I see room for it to maintain transferring upwards from right here.

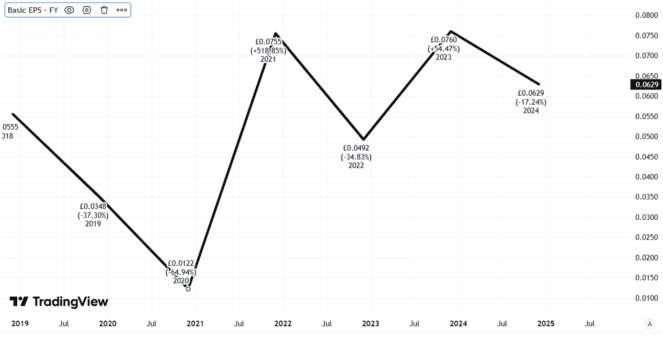

In the meanwhile, the financial institution’s shares commerce on a price-to-earnings (P/E) ratio of 11.

Shifting up to a £1 share price would suggest a potential P/E ratio of 16. That’s excessive in comparison with its peer group of main UK banks, though smaller lenders like Metro Financial institution have a a lot larger P/E ratio (64 in its case).

But when Lloyds’ earnings develop, the share price might hit £1 even when the P/E ratio stays broadly unchanged. They must develop by near 50%. Is that seemingly provided that final 12 months, earnings per share fell 17%?

Created utilizing TradingView

With its sturdy manufacturers, £312bn mortgage guide and large buyer base, Lloyds has the potential to carry out properly. Nevertheless, I don’t see any purpose to count on earnings per share to leap dramatically. The latest pattern has been downwards.

The financial institution faces ongoing pressures, resembling mounting prices for historic automotive finance practices (it put aside a £700m provision for that in its most up-to-date earnings).

In the meantime, a medium-term danger that issues me is larger mortgage defaults consuming into income. The financial institution stated in its outcomes that asset high quality stays sturdy and final 12 months noticed decrease default charges although, which helps partly clarify why the Lloyds share price has been transferring up.

Given the reassurance on asset high quality and comparatively cheap-looking valuation, I feel that momentum might proceed. Nevertheless, I don’t assume the possible enterprise efficiency is powerful sufficient to justify a transfer up to £1.

I’m steering clear

The final time the Lloyds share price was that top was again in 2008.

For now, enterprise stays sturdy. The financial institution’s upbeat word about default charges in its outcomes was music to my ears as an investor.

However it’s not sufficient for me to need to make investments.

Lloyds has been a long-term catastrophe over the previous 20 years. I’m not assured sufficient within the financial outlook to need to purchase financial institution shares proper now – together with this one.