Picture supply: Getty Photos

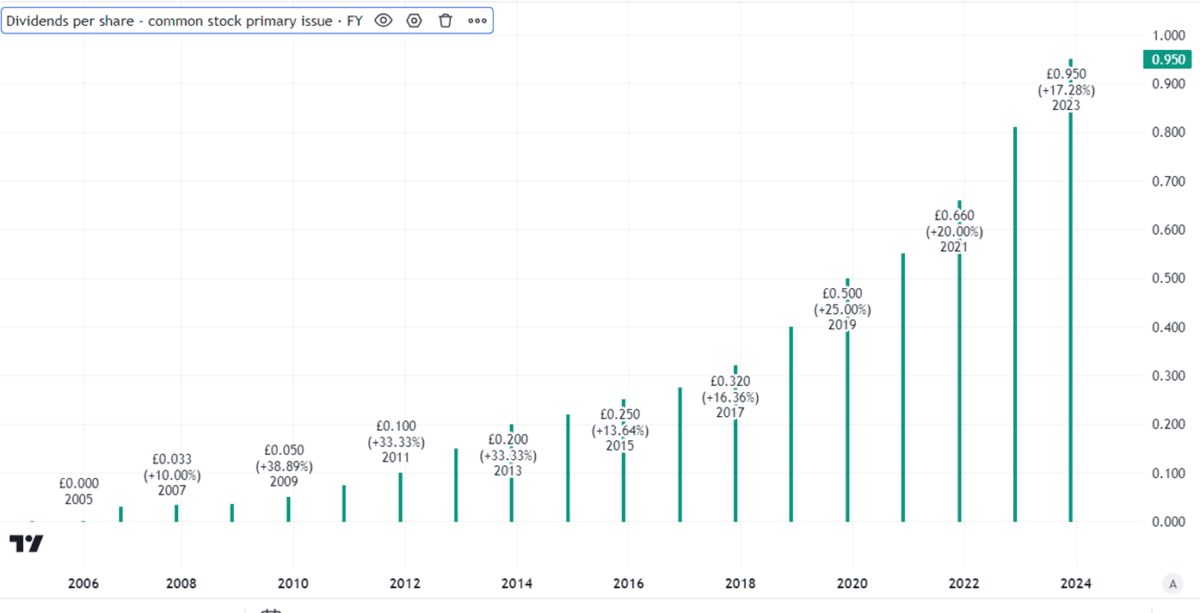

The enterprise mannequin of Judges Scientific (LSE: JDG) is easy but profitable. It buys up small and medium-sized specialist instrument makers, provides them the advantages of centralised help and largely lets them get on with what they do finest. In some methods, it’s paying homage to the enterprise mannequin Warren Buffett makes use of at Berkshire Hathaway. However whereas Berkshire doesn’t pay something out to shareholders, the Judges Scientific dividend has been rising rapidly.

Final 12 months, it elevated by 25%. That’s solely the newest in a sequence of double-digit proportion will increase.

Created utilizing TradingView

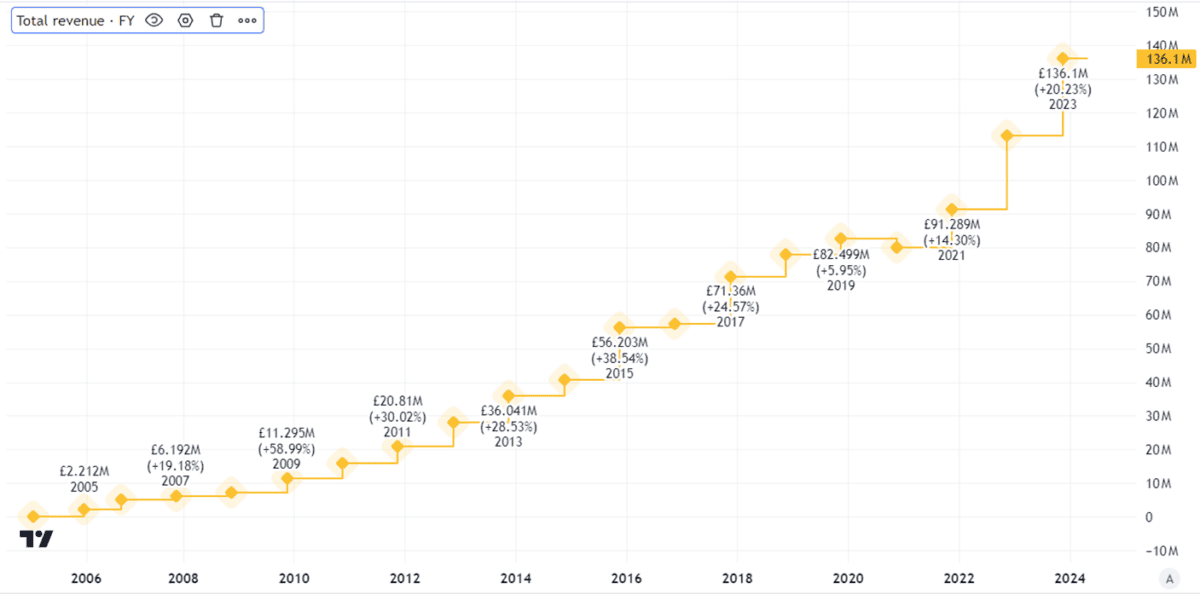

The long run appears to be like shiny

I believe Judges would possibly solely simply be getting going. It has confirmed its enterprise mannequin and is now scaling it up. Its fast-growing revenues pay testomony to this.

Created utilizing TradingView

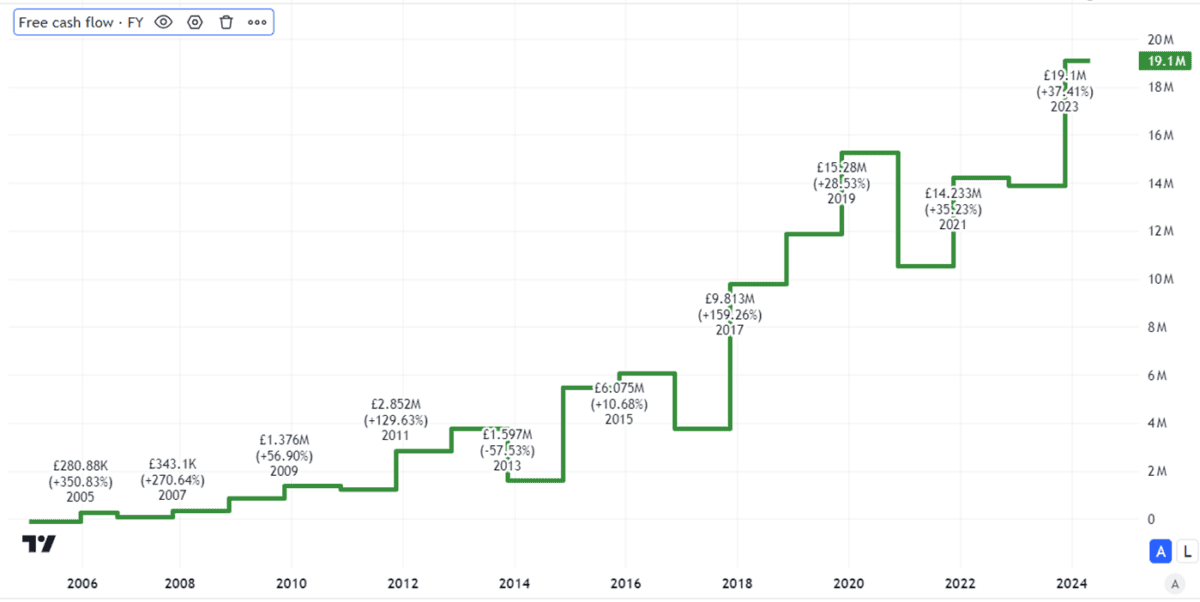

The corporate has additionally confirmed that it might develop income, not simply revenues.

That’s essential from an earnings perspective as a result of finally to pay dividends, an organization must be being profitable. Not solely is Judges worthwhile, additionally it is money generative. Free money flows have been rising healthily.

Created utilizing TradingView

Dividend may preserve rising

I believe that’s excellent news in relation to the Judges Scientific dividend. Already, it’s well-covered. Certainly, final 12 months the dividend was lined greater than 4 occasions by earnings. That signifies that Judges has substantial scope to maintain growing the dividend at clip even when earnings are flat.

In actual fact, although, I count on earnings to develop over the long run. Judges will help acquired corporations enhance their gross sales organically, due to its large buyer base and advertising prowess. The corporate additionally continues to develop by acquisition. Final 12 months noticed natural income progress of 15% and the corporate acquired a number of corporations.

The speed of improve might sluggish over time because the baseline will get larger (though that is still to be seen). However I see no motive to count on the corporate to cease rising dividends.

It has the money to take action and I believe dividend progress has been a key a part of the funding case for the corporate so far. Altering that all of the sudden may harm the share price.

Why I’m not shopping for

There are dangers. They may forestall progress, or result in the dividend falling.

One could be if the agency overstretches itself attempting to fund bigger acquisitions that don’t end up effectively. One other is the emergence of opponents aping Judges’ profitable enterprise mannequin, making it tougher for the enterprise to search out attractively priced acquisitions.

Nonetheless, I like the corporate and would fortunately personal the shares. However I don’t just like the valuation in any respect.

The price-to-earnings ratio of 80 is approach too excessive for my tastes. That prime valuation has additionally served to depress the dividend yield. Regardless of a rising payout, the yield is simply 0.8%.

So except the valuation turns into extra enticing, I cannot be shopping for.