Picture supply: Getty Pictures

The FTSE 100 main index of shares exhibits no indicators of slowing down after its blistering efficiency of 2024.

After hitting repeated document highs final 12 months, the Footsie continues to interrupt new floor at first of 2025. In current days it struck new all-time peaks round 8,767 factors. It’s up 5.4% since New Yr’s Day.

The FTSE 100’s positive factors are due to improved optimism over rate of interest cuts, strong company earnings information, and recent weak spot within the UK pound. Decrease sterling boosts abroad income for the index’s multinational firms.

But some particular person blue-chip shares have carried out much more strongly than the broader index. I’m assured a few of them will proceed outpacing the FTSE, too.

Authorized & Normal (LSE:LGEN) is one such firm I consider can hold climbing.

Buyback increase

Up 7.7% since 1 January, the share price has primarily been boosted by information of a significant upcoming divestment.

It introduced on Friday (7 February) the sale of its US safety enterprise to Japan’s Meiji Yasuda for a complete £1.8bn. Along with this, Authorized & Normal mentioned it’s going to cede a 20% stake in its pension danger switch (PRT) enterprise to the Japanese firm.

As for the proceeds, £400m will probably be shuttled into the brand new PRT association, whereas an extra £1bn will probably be made accessible for share buybacks following completion.

In consequence, the agency mentioned it “now expects to return the equivalent of [roughly] 40% of its market cap to shareholders over 2025-2027 through a combination of dividends and buybacks.”

Room for development?

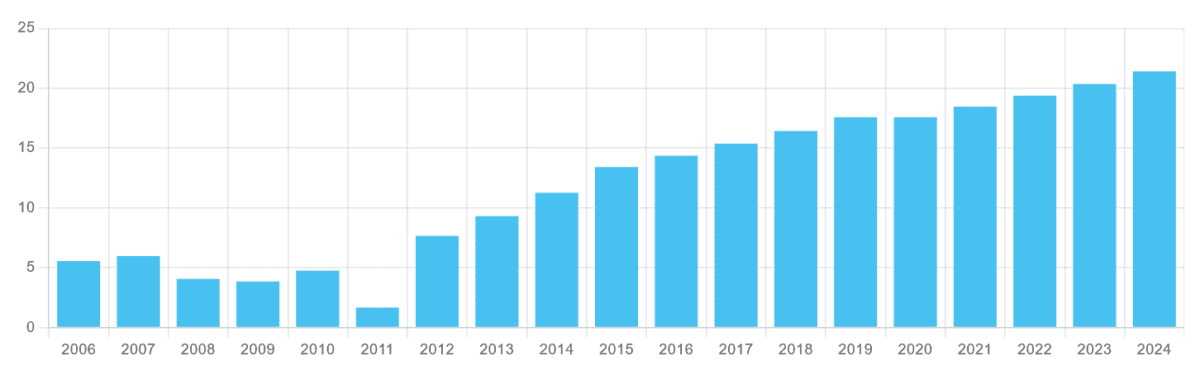

Because of its distinctive money era, Authorized & Normal is famed for its enormous dividends and impressive share repurchase plans. For 2025, analysts count on a 14th 12 months of dividend development out of the final 15, which in flip drives its yield to eight.8%. Friday’s buyback information places one other layer of icing on the cake.

Authorized & Normal’s share price has been beneath stress over the previous 12 months. However boosted by decrease rates of interest and rising structural demand for monetary planning companies, I’m optimistic it might proceed its current rebound this 12 months, offering a mix of wholesome capital positive factors and dividend revenue.

The corporate’s low cost valuation actually leaves loads of scope for recent positive factors, in my view.

For this 12 months, it trades on an undemanding price-to-earnings (P/E) ratio of 10.3 instances. What’s extra, its price-to-earnings development (PEG) for 2025 is a modest 0.3.

That’s a long way under the benchmark of 1 and under that signifies a share is undervalued.

Trying good

With the ability to precisely predict near-term share price actions is exceptionally robust. That is no completely different with Authorized & Normal, demand for whose shares might sink amid recent indicators of weak financial development and sticky inflation that impacts revenues.

However on steadiness, I believe issues are wanting fairly shiny for the monetary companies large. This view’s shared by Metropolis analysts, who count on sustained earnings development of 33% and 10% in 2025 and 2026 respectively.

No matter its share price, outlook for this 12 months, I believe Authorized & Normal shares are a prime FTSE 100 share to contemplate. I personal it in my very own portfolio and plan to carry it for the lengthy haul.