Picture supply: Getty Photographs

I proceed to assume that there are some wonderful shares within the flagship FTSE 100 index which might be cheaper than they should be, based mostly on the long-term prospects of the enterprise.

Right here is one such share that I feel traders ought to take into account shopping for.

Low cost retailer, low cost price

The FTSE 100 enterprise in query is B&M (LSE: BME).

Presently, it trades on a price-to-earnings (P/E) ratio of underneath 11. That’s cheaper than has been the case for a lot of the previous few years.

Created utilizing TradingView

So, what’s going on? Partly the low P/E ratio displays a falling share price. B&M this week hit the bottom price it has traded for in a few years.

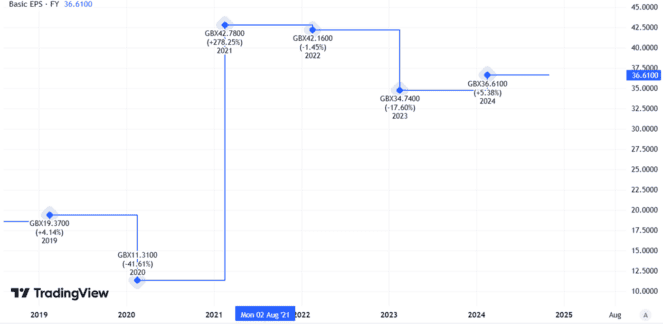

Put up-tax income final yr weren’t the very best ever, however they did beat the previous a number of years. Primary earnings per share additionally rose from the prior yr.

Created utilizing TradingView

The retailer’s most up-to-date buying and selling replace, in July, confirmed gross sales development within the first quarter in comparison with the identical interval final yr (at a relentless trade price).

Why has the share price fallen?

Given all of that, what’s going on?

B&M is well-established, it’s rising its footprint of retailers within the UK and France and its low cost providing signifies that weak financial efficiency might really enhance relatively than harm its attractiveness to consumers.

One attainable clue is within the detailed breakdown from the buying and selling assertion. Whereas the corporate noticed general gross sales development within the quarter underneath evaluation, the UK B&M-branded enterprise noticed a like-for-like gross sales decline of three.5%. If that may be a precursor of worse efficiency throughout the yr general, it might assist clarify why the Metropolis has taken fright.

With interim outcomes due this month, we’ll quickly learn how the FTSE 100 enterprise has been performing.

Nonetheless, even when the UK B&M enterprise exhibits a decline this yr, does that justify the 31% fall seen within the share price to date this yr?

This appears overdone to me

I don’t assume so.

The UK retail market is very aggressive and that’s an ever current threat for B&M. However it’s firmly worthwhile, has a confirmed enterprise mannequin, is increasing its store property so can seemingly develop economies of scale and in addition affords a dividend yield of three.8%.

The corporate made a mean of over £1m per day of revenue after tax final yr but instructions a market capitalisation of underneath £4bn in the intervening time.

With investor sentiment on the FTSE 100 share apparently lukewarm I feel it might fall even farther from right here.

However as a long-term investor, I feel it appears undervalued relative to how I count on the enterprise might carry out over the approaching 5 to 10 years.