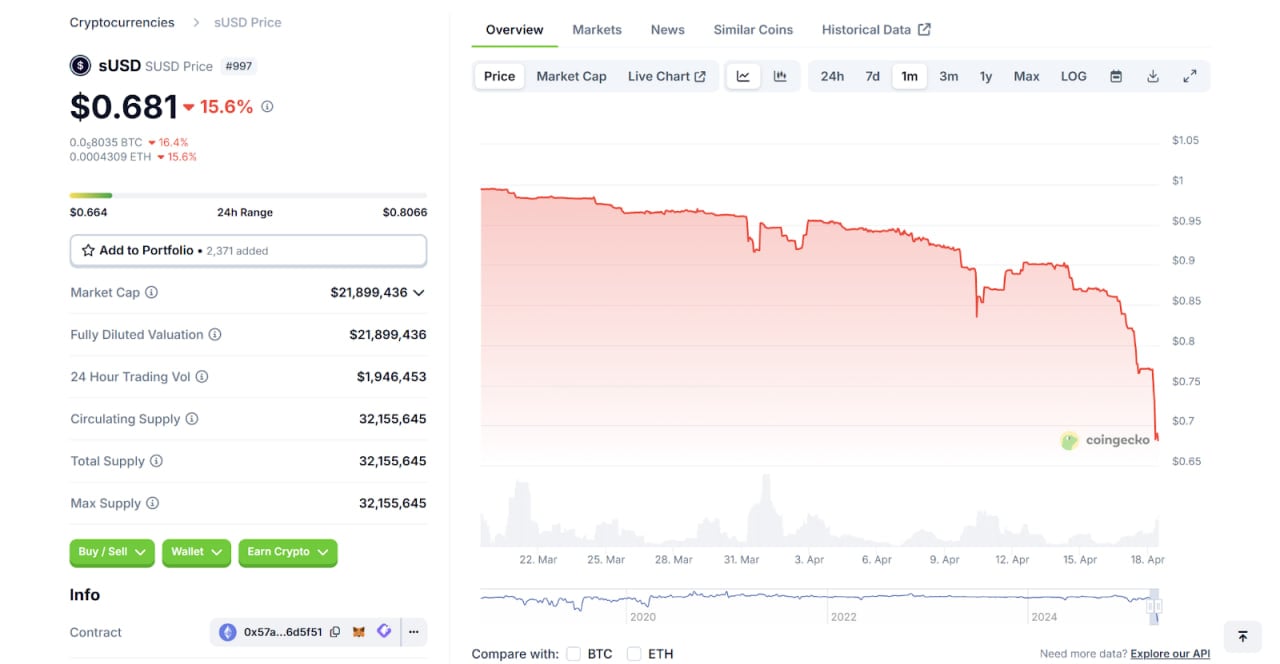

The sUSD stablecoin, integral to the Synthetix protocol and designed to carry a $1 peg, has crashed to $0.68 as of April 18, 2025. This dramatic depegging occasion has shaken the DeFi group, elevating questions in regards to the stability of decentralized stablecoins.

sUSD Worth Collapses to $0.68

In contrast to fiat-backed stablecoins, sUSD depends on $SNX staking and debt swimming pools, making it weak to protocol adjustments. The current price drop, which started round March 20, 2025, marks some of the extreme disruptions in sUSD’s historical past. The stablecoin’s worth fell to $0.83 by April 10 and continued its vital lower, hitting $0.68 at present.

Supply: CoinGecko

Why Did sUSD Depeg?

The depegging stems primarily from the SIP-420 protocol replace, which modified the Synthetix ecosystem’s debt administration and sUSD issuance processes. Earlier than SIP-420, $SNX stakers minted sUSD individually and managed their debt, incentivizing them to purchase sUSD at a reduction to repay obligations and preserve the peg.

The replace launched a protocol-owned staking pool – “420 Pool”, the place stakers deposit funds collectively, eliminating the stabilization mechanism wherein the person has an incentive to buy discounted sUSD. This shift weakened the mechanism that traditionally restored the peg throughout price deviations.

The replace additionally led to a surge in sUSD provide. The collateralization ratio for minting sUSD by $SNX has come down to the present 200%, making it simpler to mint sUSD. In the meantime, in response to Parsec Analysis, over 80 million USD price of $SNX has flowed into the “420 Pool.” Mixed with Infinex campaign-driven holdings, there was an growth in sUSD provide, leading to oversupply and inadequate shopping for incentives which have pushed the price down.

Moreover, if the worth of $SNX drops sufficiently, sUSD is now not totally backed. Fears of under-collateralization would possibly immediate customers to alternate sUSD for $SNX and promote it. Such an motion would result in further downward stress on $SNX, triggering a deleveraging cycle. Declines in $SNX’s price since March have probably contributed to the sUSD depeg occasion lately. Nonetheless, regardless of the dramatic price lower of sUSD, $SNX nonetheless has optimistic progress at present, reflecting combined market sentiment.

Supply: CoinGecko

Responding to the depegging occasion, there was a 30% drop in Synthetix’s Whole Worth Locked (TVL) from $100 million to $70 million between March 29 and April 17, 2025.

The lower coincided with a 70% discount in Perps Lively Accounts and Perp Quantity since April 9, reflecting diminished engagement on account of sUSD’s instability, as reported on Synthetix Stats.

Supply: DeFiLlama

Supply: Synthetix

Synthetix’s Response Plan

The Synthetix crew has acknowledged the depegging on account of “mechanism transition pains” and is actively addressing the problem. The crew is enhancing liquidity incentives, notably inside Curve swimming pools, to draw consumers and restore market steadiness.

Extra collaborations are additionally underway to create new demand channels for sUSD, probably integrating it into lending markets or different DeFi purposes.

Furthermore, the Synthetix founder revealed by way of a put up on X that he now holds 35 million $SNX and is the biggest holder. He defined that he funded the purchases by promoting as a lot as 90% of his $ETH holdings since 2020 to assist Synthetix operations.

For the DeFi ecosystem, this disaster underscores the significance of strong fallback mechanisms throughout protocol upgrades. As Synthetix works to revive sUSD’s peg, the success of its efforts will form confidence in algorithmic stablecoins and affect future DeFi designs. Stakeholders ought to intently monitor developments, as the end result will decide whether or not sUSD can regain its stability or face ongoing challenges in a aggressive DeFi market.