YEREVAN (CoinChapter.com) — The SEC stablecoin steerage, issued on April 4, confirms that some tokens usually are not securities. The USA Securities and Alternate Fee outlined these as lined stablecoins. These tokens are totally backed by US {dollars} or liquid, low-risk belongings. They have to additionally permit holders to redeem them 1:1 for {dollars}.

These US dollar-backed stablecoins are exempt from transaction reporting guidelines underneath securities legislation. However the SEC said that not all stablecoins qualify. Tokens backed by algorithms, software program fashions, or any kind of yield-bearing system are excluded.

The brand new stablecoin laws stop issuers from mixing consumer reserves with firm funds. Reserves should stay separate and can’t be used for market buying and selling or lending. The SEC additionally blocked issuers from paying curiosity, revenue, or yield to holders.

Coated stablecoins should observe strict reserve guidelines

Solely lined stablecoins that meet all of the SEC’s standards are acknowledged underneath this exemption. These tokens should be backed both by bodily fiat foreign money or short-term US Treasury Payments. They have to keep away from any monetary exercise involving consumer funds.

The SEC stablecoin steerage didn’t embrace algorithmic stablecoins or artificial {dollars}. These tokens proceed to face uncertainty within the US regulatory system. The company targeted solely on asset-backed fashions.

Issuers can’t promise any return to holders. In addition they can’t use reserve belongings to earn income. These guidelines apply to each current issuers and any new companies that plan to challenge US dollar-backed stablecoins sooner or later.

The SEC confirmed that no onchain curiosity or yield-bearing fiat tokens are permitted underneath the present pointers. Coated stablecoins are restricted to functioning as digital equivalents of fiat foreign money.

Stablecoin laws match GENIUS Act and Steady Act of 2025

The SEC stablecoin steerage matches efforts in Congress. Two proposals—GENIUS Act and Steady Act of 2025—assist comparable constructions. These payments purpose to safe the position of US dollar-backed stablecoins within the world monetary system.

The GENIUS Act, launched by Senator Invoice Hagerty, and the Steady Act of 2025, by Consultant French Hill, each require full backing and no profit-sharing. These legal guidelines align with the brand new SEC definitions for lined stablecoins.

Each payments encourage using regulated banks to retailer reserves. These should embrace US greenback deposits or short-term US authorities debt. The brand new SEC framework displays the identical priorities.

In accordance with the steerage, issuers should stay totally clear and keep away from any monetary operations with reserve funds. This contains buying and selling, lending, or investing actions.

US Treasury Secretary Scott Bessent spoke about stablecoin laws on the White Home Digital Asset Summit on March 7. He said that regulating stablecoins is a precedence for the present session. Bessent mentioned stablecoins are a part of the administration’s digital asset technique.

He additionally mentioned the US authorities will use stablecoins to assist the worldwide place of the US greenback. This contains utilizing US dollar-backed stablecoins to spice up demand for US Treasuries.

The Treasury sees these tokens as instruments to increase greenback use in digital markets. The SEC stablecoin steerage helps this place by making strict guidelines for reserve-backed tokens.

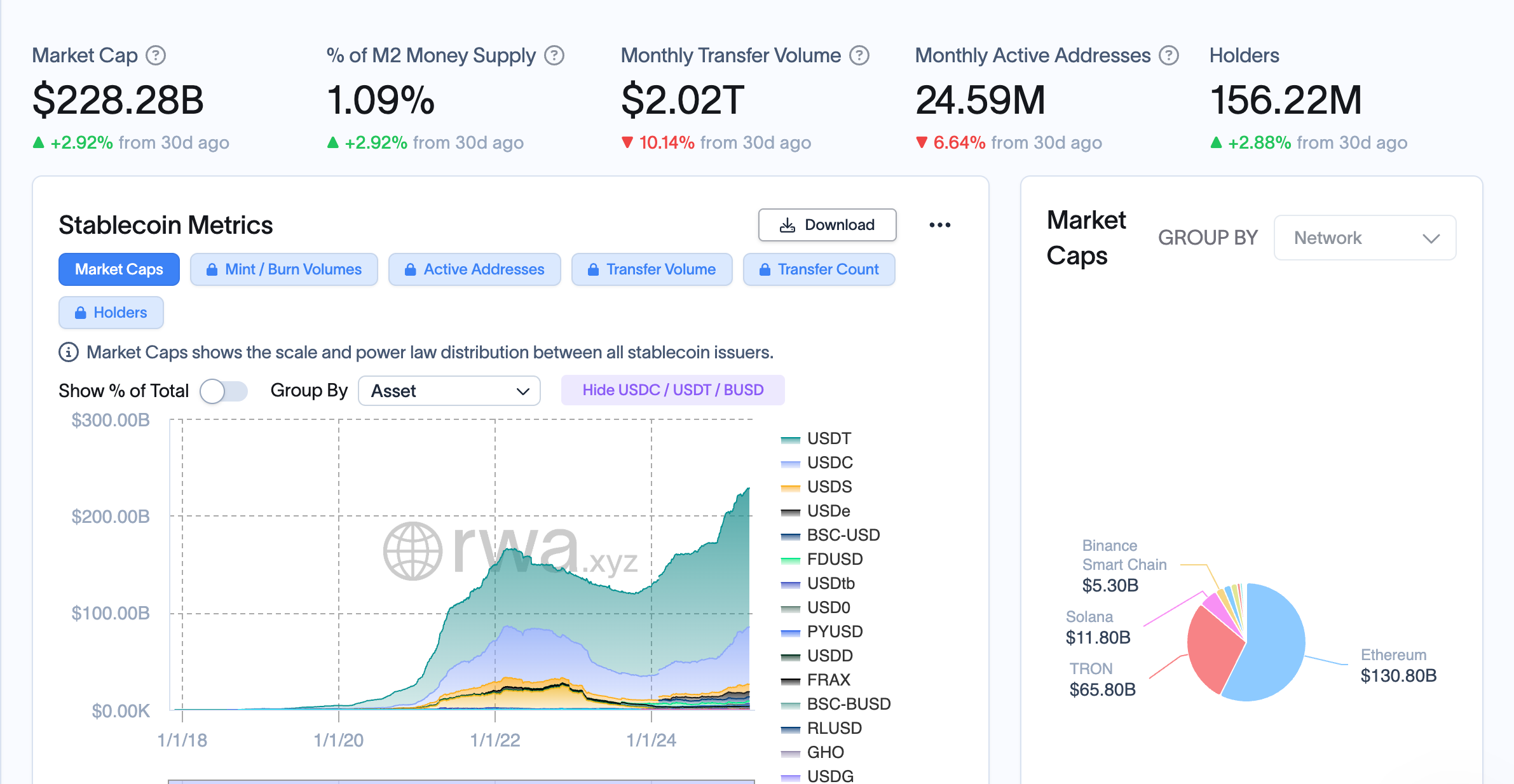

The information exhibits the size of adoption. Tether, the most important stablecoin issuer, holds extra US Treasuries than international locations like Canada, Germany, or South Korea. This connects the stablecoin ecosystem straight with US debt markets.