YEREVAN (CoinChapter.com) — The U.S. Securities and Change Fee (SEC) has delayed its resolution on whether or not to approve Ether ETF choices on Cboe Change. In keeping with a Feb. 28 regulatory submitting, the company has set Could 2025 as the brand new deadline for a remaining ruling.

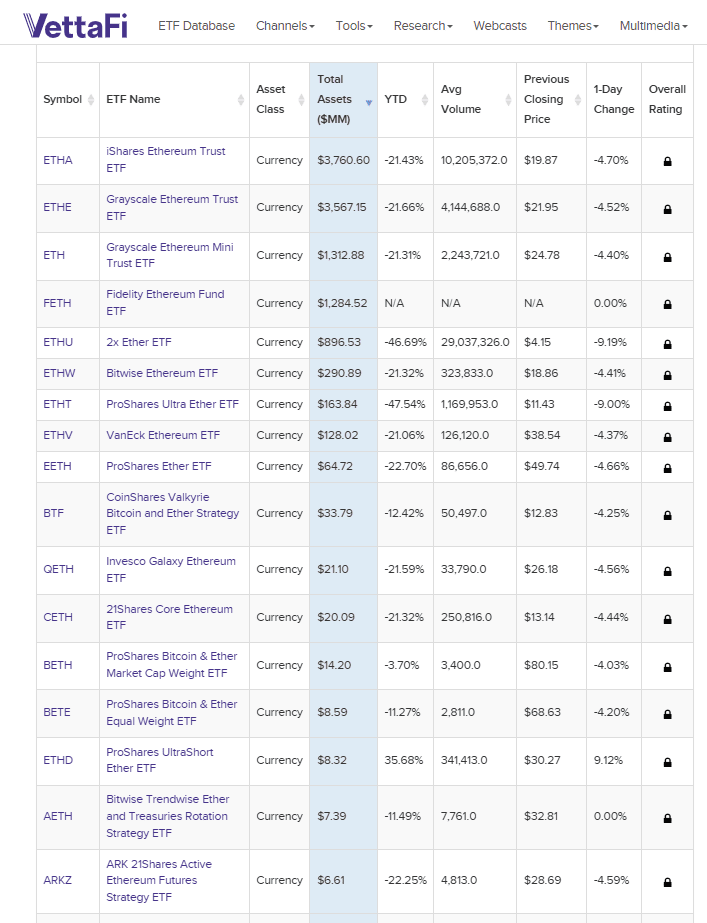

Cboe initially submitted its request in August 2024, searching for approval to checklist choices on the Constancy Ethereum Fund (FETH). The SEC prolonged its assessment interval in October 2024, stating it wanted further time. FETH is among the many largest Ether ETFs, managing roughly $1.3 billion in internet belongings, primarily based on information from VettaFi.

SEC Additionally Delays BlackRock’s Ether ETF Choices Approval

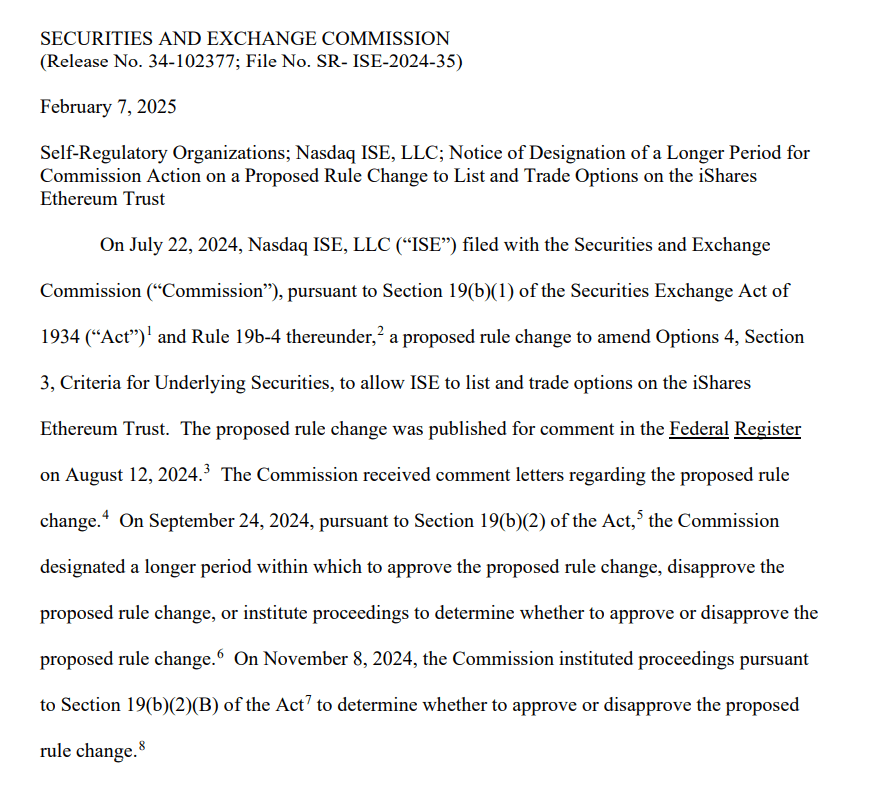

The SEC has additionally postponed its resolution on Nasdaq ISE’s request to checklist choices for BlackRock’s iShares Ethereum Belief (ETHA). The company plans to situation a ruling by April 2025.

BlackRock’s fund is the biggest Ether ETF, holding over $3.7 billion in internet belongings, in accordance with VettaFi information. The SEC’s method to Ether ETF choices contrasts with its dealing with of Bitcoin ETF choices, which started buying and selling in November 2024.

Spot Ether ETFs Proceed to Entice Investments

Though Ether ETF choices face regulatory delays, spot Ether ETFs have seen regular development. Since launching in July 2024, these funds have attracted $11 billion in internet belongings, primarily based on VettaFi figures.

Choices permit merchants to enter contracts granting the correct to purchase or promote an asset at a predetermined price. Many buyers use choices on Ether ETFs for danger administration and market publicity.

Crypto ETF Choices Market Expands

The demand for crypto ETF choices has elevated with the rise of institutional participation. On the primary day of buying and selling in November 2024, Bitcoin ETF choices for BlackRock’s iShares Bitcoin Belief ETF (IBIT) noticed $2 billion in publicity.

In the meantime, crypto futures markets proceed to develop. On Feb. 19, Coinbase launched Solana (SOL) futures. The Chicago Mercantile Change (CME) Group introduced plans to launch SOL futures contracts on March 17, pending regulatory approval.

Political Developments and Crypto Rules

Modifications in monetary regulation might have an effect on crypto ETF choices. Former U.S. President Donald Trump has said that he needs the nation to turn into a “crypto capital” and has appointed crypto-friendly leaders to monetary regulatory positions.

The SEC continues to evaluate purposes for Ether ETF choices, whereas establishments monitor developments in crypto derivatives markets.