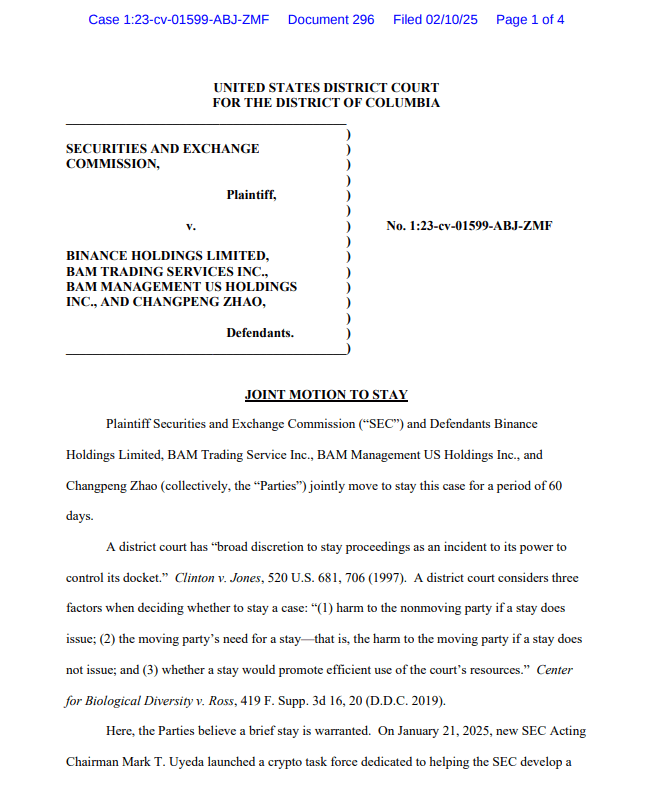

YEREVAN (CoinChapter.com) — The U.S. Securities and Trade Fee (SEC) and crypto alternate Binance requested a federal choose for a 60-day extension of their lawsuit. The joint request was submitted on April 11 to the U.S. District Courtroom for the District of Columbia.

The case started in June 2023 when the SEC sued Binance, Binance.US, and CEO Changpeng “CZ” Zhao. The SEC charged the alternate with 13 violations, together with unregistered affords of BNB and Binance USD, and points linked to Easy Earn, BNB Vault, and the staking program.

Within the April submitting, the SEC and Binance mentioned that they had “productive discussions.” These talks centered on how the newly created SEC Crypto Activity Pressure could have an effect on the claims. The request marks the second 60-day pause of 2025, following an earlier extension granted on Feb. 11.

SEC Crypto Activity Pressure Drives New Case Course

The SEC Crypto Activity Pressure launched on Jan. 21, simply in the future after Gary Gensler stepped down as SEC Chair. Mark Uyeda, now performing Chair, took over on Jan. 20. The Crypto Activity Pressure is now shaping the SEC’s method to digital property.

The April 11 court docket doc famous that the SEC continues to be reviewing how the duty drive could shift its authorized technique. The submitting acknowledged the company is looking for approval for “any resolution or changes to the scope of this litigation.”

Based on the report, Binance agreed that one other keep was within the curiosity of “judicial economy.” No listening to date was requested. As an alternative, each events will file one other standing replace after the 60-day interval ends.

The SEC just lately dropped a number of circumstances in opposition to different crypto companies. These embody Coinbase, Kraken, Gemini, Robinhood, and Consensys. The entire dismissals occurred after Gensler’s resignation.

The timing aligns with broader adjustments within the SEC’s regulatory strategies. The Crypto Activity Pressure now goals to make clear registration guidelines, draw regulatory strains, and give attention to disclosure. The Binance case might fall beneath these new processes.

CourtListener printed the April 11 standing report. Binance has not launched an official assertion on the most recent growth. The SEC has additionally not commented publicly past the submitting.

Second Pause Requested Since February Submitting

The primary request for a 60-day keep got here in February, simply weeks after Gensler stepped down. Either side used the time to evaluation the brand new regulatory panorama. They cited the Crypto Activity Pressure’s targets as one cause for the pause.

Now, the SEC and Binance are once more asking for extra time. The April 11 request doesn’t embody settlement phrases or adjustments within the 13 fees. The case stays open.

The following joint standing report is due on the finish of the 60-day pause.