Picture supply: Getty Photos

It has been a rocky few days within the inventory market. Thus far, although, we’re nowhere close to a inventory market crash within the UK. That’s generally outlined as which means the market has misplaced 20% or extra of its worth in a brief time frame.

Nonetheless, a crash may occur sooner or later. The truth is, it will occur sooner or later – we simply have no idea when. It may come this week, or it might take many years.

Crashes might be sudden and generally short-lived, so it pays to be ready.

Relatively than specializing in when it’d come, subsequently, I’m spending time on the point of try to revenue from it.

Might I double my cash?

I reckon I would even be capable to double my cash.

That depends on two equally vital components. The primary is {that a} inventory market crash can usually throw up a mismatch between the worth of a share and its present price. The second is that I’m a long-term investor.

My strategy

So my plan is to construct a watchlist now of earnings shares I might like to personal if I may purchase them on the proper price. I might then be able to pounce if a crash pushes them down sufficient.

I particularly wish to purchase shares in nice companies at a markedly decrease price than I believe they’re price.

Hopefully over time that might reward me in two methods: share price development and in addition the next dividend yield than shopping for the identical shares at the next price.

Placing the idea into observe

For instance, think about a share I personal: Authorized & Basic (LSE: LGEN).

I like its sturdy model, massive buyer base, and confirmed enterprise mannequin. Because the interim outcomes launched in the present day (7 August) present, the enterprise stays in fine condition.

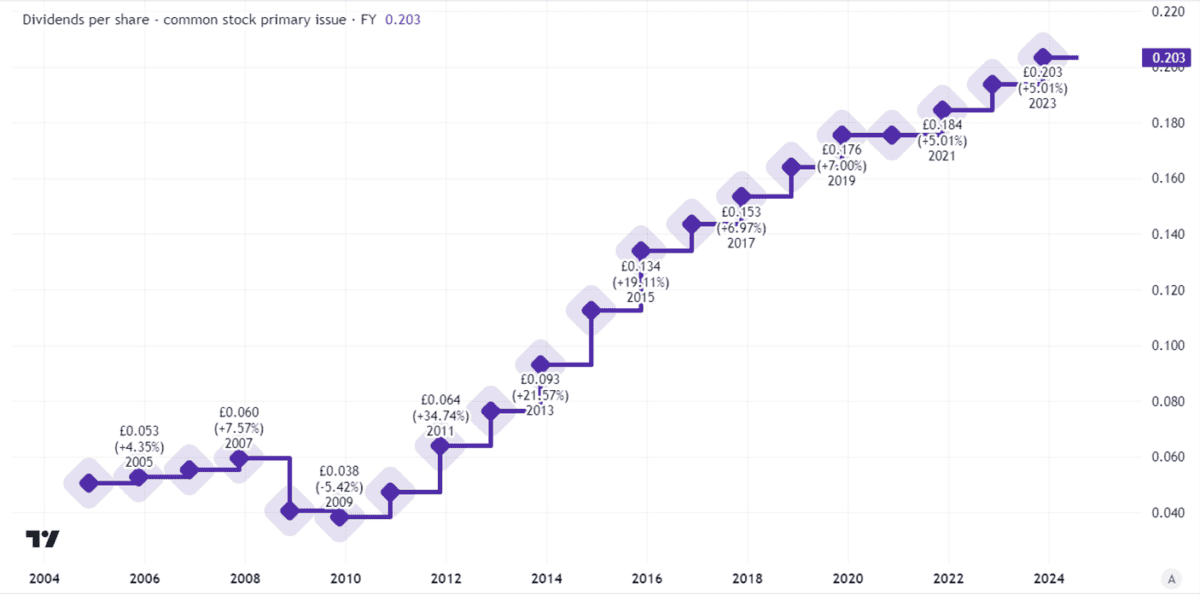

Certainly, the interim dividend was elevated 5%, though smaller rises are anticipated from subsequent 12 months onwards. Authorized & Basic’s dividend historical past over the previous couple of many years has been spectacular.

Created utilizing TradingView

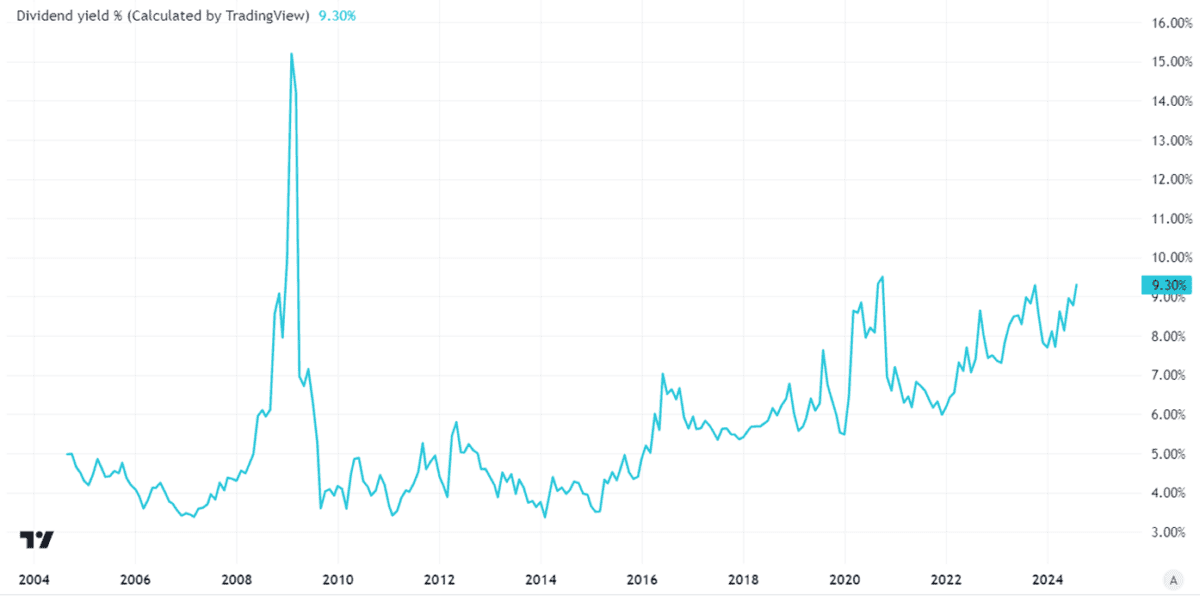

Nonetheless, the share already yields 9.3%. If I merely compounded my portfolio worth at 9.3% yearly by reinvesting dividends, I might have already got doubled its worth in eight years. That presumes that the share price is flat and dividends maintained on the present degree.

That’s by no means assured: because the chart above exhibits, the payout per share was lower following the monetary disaster in 2008. If there one other inventory market crash leads shoppers to drag out funds, we may see one other lower.

However what if I had purchased the shares in the course of the 2020 crash?

My buy price would have been decrease than it had been earlier than the crash. Over 5 years, the Authorized & Basic share price is down 8% — however it’s up 39% from its March 2020 low.

Not solely that, however shopping for at a decrease price would have meant I subsequently earned the next dividend yield.

Discover within the chart beneath how the dividend yield jumped because the price crashed in March 2020 (and in 2009).

Created utilizing TradingView

By shopping for fastidiously chosen nice shares cheaply in the course of the subsequent inventory market crash, I imagine I may realistically purpose to double my cash over the long run!