Fast Take

Let’s study the share price efficiency of publicly traded corporations which have adopted Bitcoin (BTC) as a treasury asset, excluding mining corporations.

Essentially the most notable instance is MicroStrategy, which adopted BTC in August 2020. At the moment, its share price was round $130. By March 2021, it soared to $1,300. Regardless of hitting a bear market backside of roughly $130 in January 2023, MicroStrategy’s share price is now buying and selling slightly below $1,500. MicroStrategy’s inventory has surged by over 900%, considerably outperforming Bitcoin, which has elevated by over 450% throughout the identical interval.

Subsequent, Metaplanet, a Japanese publicly traded firm, introduced its BTC adoption on April 8. Since then, its share price has surged by 326%, regardless of Bitcoin’s price declining by 6% in the identical interval. Metaplanet has continued to purchase extra Bitcoin since its preliminary announcement.

Semler Scientific introduced on Might 28 that it had bought 581 BTC as a treasury asset. Since then, its share price has elevated by over 60%, whereas Bitcoin’s price has fallen by 5%. Semler Scientific has additionally made further Bitcoin purchases.

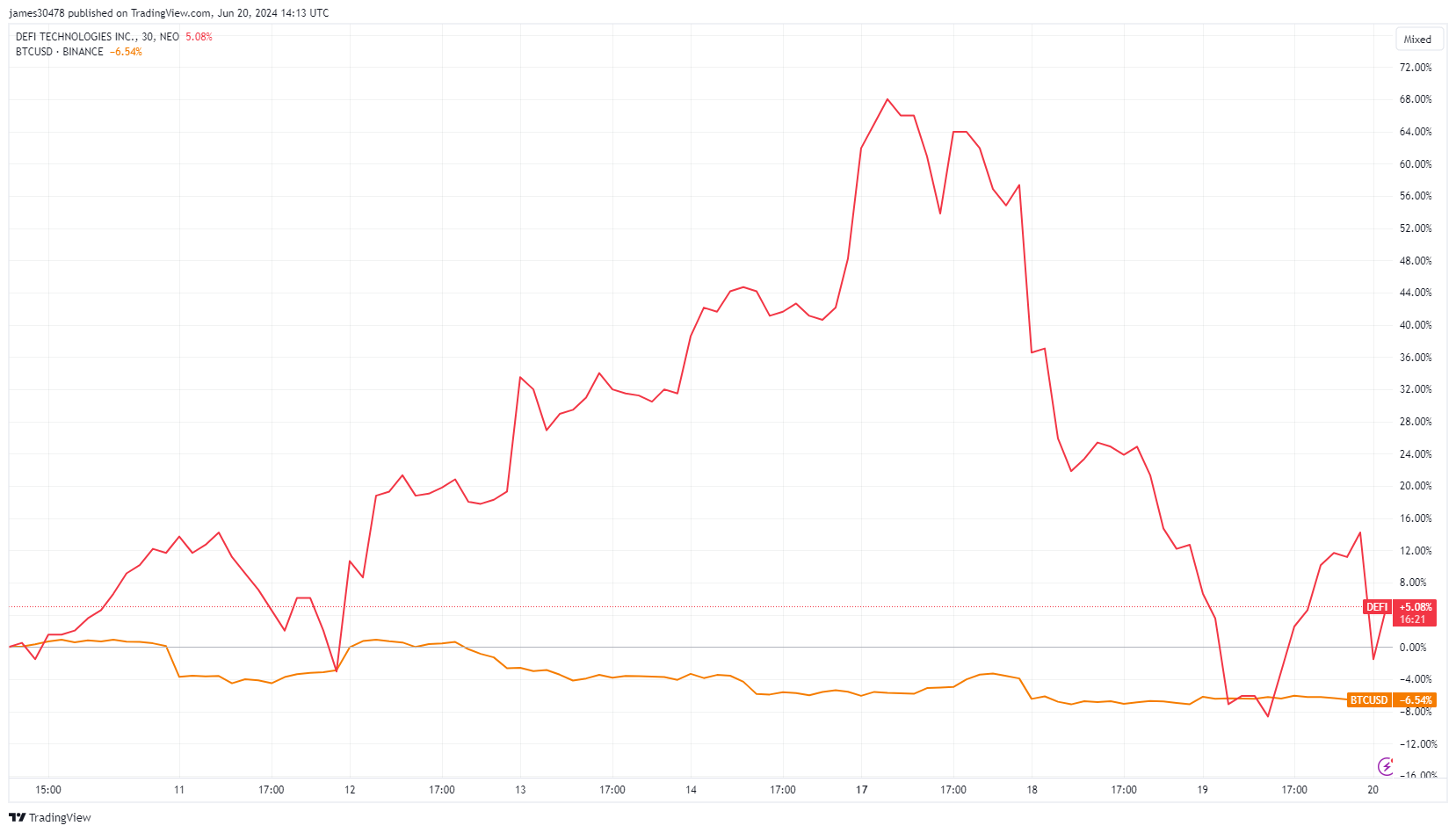

DeFi Applied sciences first introduced its buy of Bitcoin as a major treasury reserve asset on June 10, 2024. The corporate’s share price has elevated by over 6%, peaking at over 68% on June 17, regardless of Bitcoin’s price dropping by almost 7%.

Tesla is excluded from this analysis as Elon Musk has not said that it makes use of BTC as a treasury asset; the share price is at the moment down 30% from when Tesla first purchased Bitcoin again in 2021 and offered a minimum of 75% of it. Moreover, Coinbase is excluded as a result of it held cryptocurrencies on its stability sheet earlier than its IPO in 2021.