Bitcoin’s post-halving consolidation has prompted cynical rhetoric from common crypto naysayer Peter Schiff.

Bitcoin (BTC) skeptic Peter Schiff advised that the worth proposition driving spot BTC ETF demand may shortly fade, contradicting professional predictions and market efficiency thus far. BTC has grown over 55% year-to-date (YTD), however Schiff famous that the token has traded sideways for over three months and posted minuscule features for spot Bitcoin ETF traders.

Spot exchange-traded funds observe the price of an underlying asset. On this case, the asset is BTC, and earnings are tied to increments within the cryptocurrency’s price.

Schiff’s assertion about BTC’s sideways price patterns could also be true, however the assertion maybe lacks context. Bitcoin has surged practically 70% for the reason that U.S. Securities and Change Fee (SEC) accredited spot BTC ETFs.

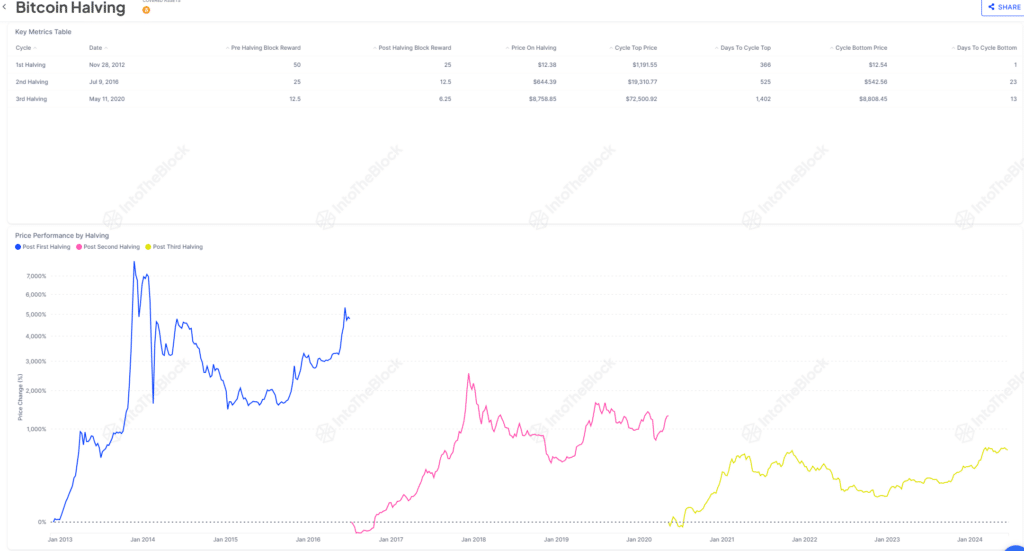

Moreover, BTC’s multi-week consolidation just isn’t new following a halving. The asset transitioned from an accumulation part right into a parabolic run over the past two cycles at the very least.

Rising institutional Bitcoin demand

BlackRock and Constancy’s respective spot BTC ETFs made one of the best debuts in over 30 years on Wall Road. Inside weeks, each funds amassed over $10 billion in property underneath administration (AUM). Regardless of billions in demand, Schiff scrutinized Bitcoin’s bullish thesis and price development. “ If ETF investors have been buying, who has been selling, and why?”

In the meantime, Bloomberg’s ETF professional Eric Balchunas has repeatedly spoken about capital flows from futures ETFs into spot BTC funds. The halving’s change in dynamics additionally noticed some sell-offs from crypto miners to keep up money reserves.

Nevertheless, on-chain knowledge confirmed that Bitcoin balances on centralized exchanges hit a four-year low, that means that spot holders aren’t promoting however somewhat holding on for pricey life, generally often called “hodling” within the digital asset business.

Schiff surmised that ETF patrons might grow to be uninterested in ready and begin liquidating shares because the asset continues in a consolidation vary. Whereas the state of affairs stays a risk, rising institutional demand suggests in any other case.

Entities just like the Wisconsin Funding Board have parked a whole lot of tens of millions into spot BTC ETFs, possible with a long-term view on the asset contemplating its development through the years.

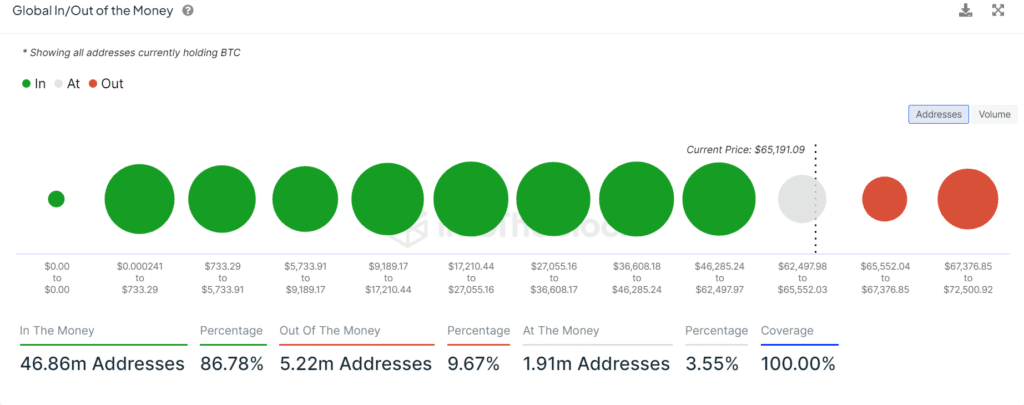

BTC jumped over 145% up to now yr. Compared, the S&P 500 has returned 85% within the final 5 years, bolstering the reward argument for investing within the high cryptocurrency by market cap. Moreover, IntoTheBlock knowledge confirmed that over 80% of BTC patrons are in earnings.

Balchunas and different consultants additionally opined that main establishments have but to enter the spot BTC ETF scene. But, the market is over $40 billion robust and rising. As crypto adoption quickly will increase and analysts count on the worldwide ETF market to just about triple by 2035 to a $35 trillion market, the bullish thesis behind Bitcoin’s ascent is arguably stronger than ever.