- PEPE price drops 15% amid rising buying and selling quantity and investor warning.

- Derivatives knowledge present diminished open curiosity and bearish stress on lengthy positions.

- Spot market outflows persist, limiting restoration regardless of RSI hinting at stabilization.

Pepe (PEPE), a meme-based cryptocurrency rooted in web tradition, recorded a drop in price on April 3, falling by 15.03% to $0.0006575. Regardless of its earlier beneficial properties in 2024, the token’s latest price motion displays rising warning amongst traders.

The decline was accompanied by a notable improve in buying and selling exercise, indicating a shift in short-term sentiment. As PEPE makes an attempt to regain its momentum, indicators present combined alerts amid rising volatility in each spot and derivatives markets.

PEPE’s price started the day at $0.0007719 however declined throughout afternoon buying and selling. The sell-off pushed its market capitalization down by 15.02%, now totaling $2.76 billion. Nevertheless, 24-hour buying and selling quantity surged by 44.31%, reaching $1.16 billion, reflecting intensified market engagement. The coin’s circulation stays at 420.68 trillion, practically similar to its most cap, with over 419,000 pockets holders.

The amount-to-market-cap ratio over 24 hours climbed to 42.31%, displaying sturdy buying and selling exercise.

Derivatives Information Reveals Blended Dealer Sentiment

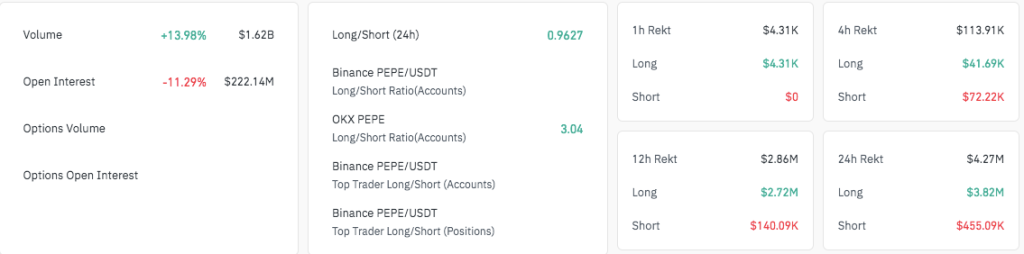

The 24-hour buying and selling quantity within the derivatives market was 13.98% larger, reaching $1.62 Billion. Nevertheless, open curiosity went down by 11.29 % to $222.14 million. This is because of decreased buying and selling operations as merchants withdrew trades as a result of fluctuation.

Platform-specific knowledge confirmed variation throughout exchanges. OKX merchants maintained a robust lengthy bias with a ratio of three.04, whereas Binance exercise remained extra balanced. Amongst high Binance merchants, quick positions outnumbered longs when measured by dimension, suggesting elevated cautious positioning.

Liquidations totaled $4.27 million prior to now 24 hours, with $3.82 million from lengthy positions and $455,090 from shorts. In shorter timeframes, similar to 12 hours, $2.72 million in longs had been liquidated, persevering with the stress on bullish merchants.

Spot Market Netflows Point out Persistent Outflows

Information obtained from the spot market utilizing netflow analysis reveals that outflows have been constantly noticed over months. This turned apparent between the center of November and the top of January and a drop within the price of PEPE. Whereas there was a build-up in exercise in mid-November, outflows had been noticed to start out quickly after persevering with up to early 2024.

Regardless, the netflows have been unfavourable since February, with little proof of a buildup in demand.

Momentum Indicators Counsel a Potential Quick-Time period Stabilization

Wanting on the hourly chart technical indicators concerning the quantity of shopping for and promoting stress, oscillators point out combined alerts. The Relative Power Index (RSI) is at 37.02, indicating rising from extra oversold charges early within the day. This rise means that promoting stress is diminishing.

In the meantime, the MACD stays beneath its sign line, with the MACD line at -0.00000022 and the sign line at -0.00000020, reflecting ongoing bearish momentum.

Continuously Requested Questions

Why did PEPE drop 15.03% on April 3?

The decline was triggered by elevated promoting stress and cautious investor sentiment. This was mirrored in a 15.02% drop in market cap and a spike in buying and selling quantity.

What does the derivatives knowledge reveal about dealer sentiment?

Open curiosity dropped by 11.29% whereas lengthy liquidations totaled $3.82 million, displaying bearish stress. The lengthy/quick ratio of 0.9627 signifies a slight quick bias amongst merchants.

Are there indicators of a possible restoration for PEPE?

The RSI climbed to 37.02 from earlier oversold ranges, hinting at weakening promoting stress. Nevertheless, the MACD stays bearish, displaying restoration could also be restricted within the quick time period.