The crypto enterprise agency Pantera Capital says Ethereum’s dropping steam as Solana has grow to be a “major contender for the future of blockchain development.”

Pantera Capital, a crypto enterprise capital agency managing billions in property, reportedly eyeing a purchase order of hundreds of thousands price of SOL from the bankrupt FTX trade, seems to be more and more highlighting Solana’s potential over Ethereum to buyers.

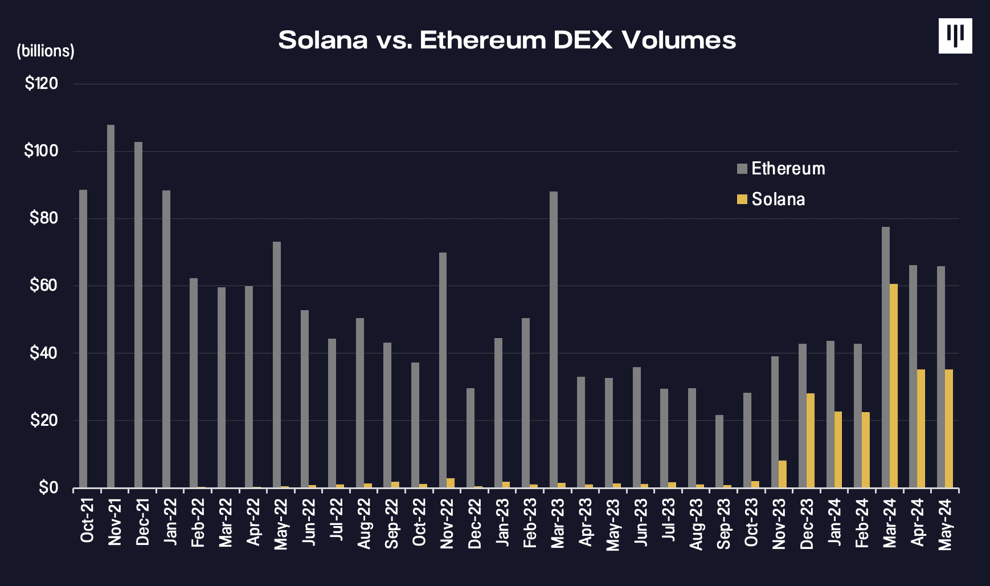

In a Jun. 18 publication, the Menlo Park-headquartered enterprise capital agency stated Ethereum’s dominance “appears to be yielding to the multi-polar model,” pointing to Solana as a brand new distinguished product that gained “significant share over the past year.”

“The shift is reminiscent of Microsoft’s dominance of the early desktop computer market, until Apple broke through with its vertically integrated approach. Solana is now a major contender for the future of blockchain development.”

Pantera Capital

Drawing parallels to Apple‘s breakthrough in the early days of personal computing, Pantera likened Solana’s built-in method to Apple’s vertically built-in technique with macOS, saying the community’s monolithic structure has a product roadmap “focused on optimizing every component of its own blockchain.”

The enterprise capital agency says Solana’s “architectural advantages” allow a spread of use instances and person experiences that “may be more challenging to implement on modular blockchains like Ethereum and Cosmos,” citing Solana’s “fast, low-cost transactions.”

“Solana’s architectural advantages are enabling it to capture an outsized share of the new demand coming into the blockchain space, accelerating its ascent as a rival to Ethereum.”

Pantera Capital

The agency’s endorsement of Solana follows stories saying that Pantera Capital was among the many bidders for SOL tokens auctioned by FTX throughout its chapter proceedings earlier this yr, shopping for a big stake within the tokens. Studies point out that Pantera Capital was taken with shopping for auctioned SOL tokens amounting to as a lot as $250 million, though the exact quantity acquired hasn’t been disclosed.