Picture supply: Rolls-Royce plc

Rolls-Royce (LSE:RR.) shares stay considerably costlier than they had been in the beginning of 2024. The enginebuilder’s up 60%, actually. However price turbulence in latest weeks has seen surging curiosity from dip consumers.

In keeping with Hargreaves Lansdown, the FTSE 100 firm was the second-most bought inventory by its prospects within the final seven days. Solely US tech big Nvidia has attracted extra shopping for curiosity.

I can perceive why buyers are seizing this chance to open a place or construct on present holdings. The corporate is a gorgeous long-term play on the rising civil aviation market. It will possibly additionally look ahead to rising engine demand from defence prospects.

Nonetheless…

Nonetheless, I haven’t joined in and acquired the enterprise for my portfolio. With a ahead price-to-earnings (P/E) ratio of 27.8 instances, I believe the Rolls-Royce share price stays far too costly.

Big dangers to the corporate’s earnings embody ongoing provide chain issues and worsening financial situations within the US. We would see much less thrilling restructuring information forward, which might dampen among the enthusiasm across the Footsie inventory.

So which FTSE 100 shares would I purchase if not Rolls-Royce? Listed here are two I’d moderately snap up if I had money to speculate.

Glencore

Mining big Glencore (LSE:GLEN) was the fifth hottest inventory with Hargreaves Lansdown purchasers final week. It’s slumped in worth as worries over commodities demand have intensified.

Not solely are income at risk because the US economic system flirts with recession. Bother in China’s economic system — and specifically in its actual property sector — are additionally darkening the outlook for metals producers like this.

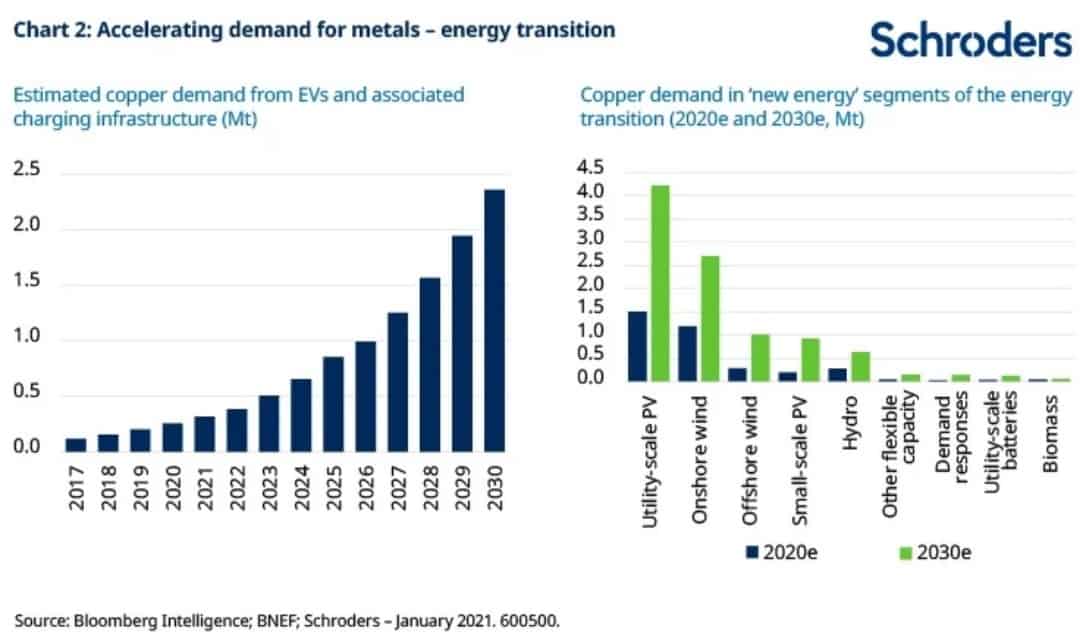

Nonetheless, the long-term image right here stays fairly thrilling, for my part. Glencore produces and markets a variety of uncooked supplies like copper, cobalt, nickel, zinc and lead. It’s subsequently nicely positioned to capitalise on rising sectors like renewable vitality and electrical autos.

Glencore shares now commerce on an undemanding ahead P/E ratio of 11.9 instances. I’d be very tempted to purchase the corporate at right now’s costs.

M&G

I’d additionally favor to spend money on M&G (LSE:MNG) than purchase Rolls-Royce shares right now. That is thanks mainly to its beautiful all-round worth for cash.

Okay, the monetary companies big could wrestle if the UK economic system fails to develop. However I believe that is greater than mirrored in its rock-bottom P/E ratio of seven.6 instances for 2024.

M&G shares additionally provide a 9.7% dividend yield for this yr, one of many largest on the FTSE 100. That is supported by the agency’s sturdy stability sheet (its Solvency II capital ratio rose to 210% as of June).

Like Glencore, it is a blue-chip inventory I’d purchase to carry for the lengthy haul. With Britain’s inhabitants quickly ageing, and peoples’ curiosity in monetary planning rising, I count on demand for its life insurance coverage merchandise and wealth administration companies to strongly enhance.

M&G was the twelfth most-purchased inventory with Hargreaves Lansdown prospects within the final week.