Picture supply: Getty Pictures

The historic chart for BAE Programs (LSE: BA.) shares exhibits they went nowhere for over 20 years (between late 1998 and early 2022). But the FTSE 100 defence inventory did reliably pay out dividends throughout that point.

In February 2022 although, the chart began rising nearly vertically following Russia’s surprising invasion of Ukraine. This marked the biggest army battle in Europe since World Conflict II, sparking intensive army help for Ukraine from Western nations.

BAE’s share price is now up 140% in 5 years, beating the FTSE 100 by round 125% within the course of.

However ought to I ought to scoop up just a few extra shares as issues stand? Let’s have a look.

Robust progress

Within the first six months of 2024, the agency’s gross sales grew 13% 12 months on 12 months to £13.4bn, whereas underlying earnings earlier than curiosity and tax (EBIT) rose 13% to £1.4bn. Underlying earnings per share (EPS) grew 7% to 31.4p.

Alongside this sturdy operational efficiency, BAE made progress in a variety of key areas.

- Below the AUKUS safety pact between Australia, the UK and US, it was chosen to assist construct Australia’s new fleet of nuclear-powered submarines

- It signed a £4.6bn contract for the supply of the primary three Hunter Class frigates in Australia

- The £4.4bn acquisition of US-based Ball Aerospace was accomplished to type a brand new Area & Mission Programs enterprise

- It completed a £1.5bn share buyback programme and began one other one value £1.5bn

Trying forward, BAE raised its full-year gross sales steerage to £25.3bn, or progress of 12%-14%, up from its earlier estimate of 10%-12%. Underlying EPS is projected to extend by 7%-9% to 63.2p.

Conflicts

One danger right here could be an sudden drop in Western defence spending. BAE’s authorities clients proceed to supply a major quantity of its tools to Ukraine. So a sudden halt to the struggle there would seemingly trigger volatility within the share price.

Sadly, a ceasefire seems to be unlikely, with Russia having simply launched an enormous air strike throughout Ukraine. Moscow stated all ceasefire talks have now “misplaced relevance“.

In the meantime, Israel and Iran-backed Hezbollah have exchanged heavy fireplace in a significant escalation. And we might even see extra sabre-rattling from the US and China through the upcoming US presidential election.

Given all this, it’s no shock that NATO members have dedicated to extend their defence spend to 2%+ of gross home product (GDP) yearly. The UK authorities is aiming for two.5% of GDP.

My transfer

However is all this already priced into the inventory in the present day? It’s buying and selling at nearly 22 occasions earnings, which is a premium to its a number of over the past 5 years.

Then once more, that’s equal to European peer Thales (22) and much cheaper than US rival Northrop Grumman (33). I don’t assume the inventory is overvalued contemplating the earnings progress potential.

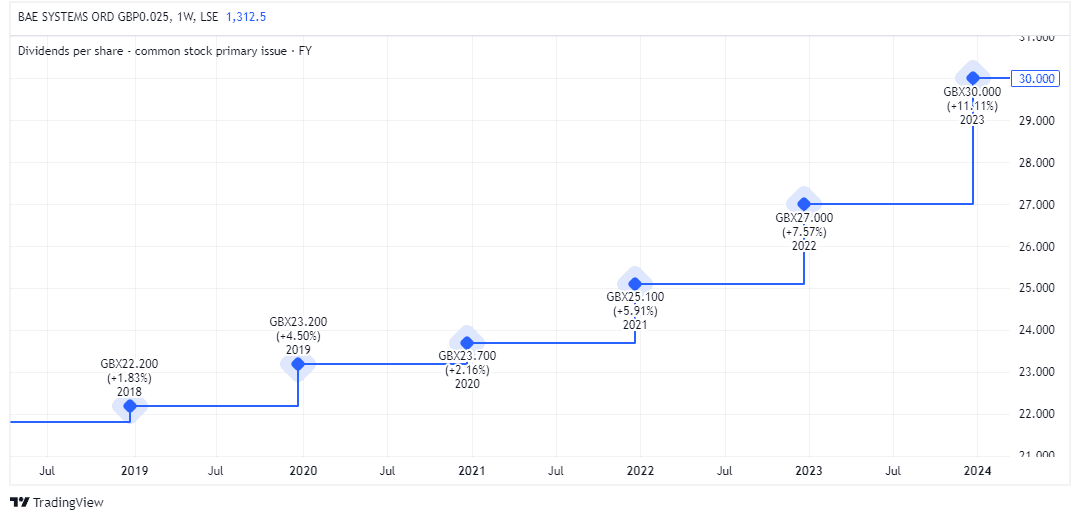

The two.3% dividend yield is decrease than earlier years. But the payout has been rising properly.

I reckon the BAE share price is about for additional positive aspects within the years forward as nations sadly really feel the necessity to bolster their defences. The corporate’s order backlog stood at a document £74.1bn in June.

I’m not shopping for extra however am going to maintain holding my shares. And if I didn’t already personal them, I’d make investments in the present day and maintain for the subsequent few years.