Picture supply: Getty Photographs

Authorized & Normal (LSE: LGEN) shares have loved a pleasant little spell not too long ago. As I write, the FTSE 100 monetary inventory is up 7.6% in simply over a month.

Over 5 years although, L&G shares have fallen round 24.3%. That’s clearly not nice.

However the earnings…

The silver lining to that subdued share price is that the dividend yield now stands at a scrumptious 8.9%. That’s among the many highest round within the UK market (or anyplace else).

Higher nonetheless, analysts anticipate the insurance coverage and asset administration agency to pay out 21.8p per share in dividends in 2025. With the present share price at 231p, that places the forward-looking yield at 9.4%!

It means £10,640 invested within the shares would generate me £1,000 a yr in annual passive earnings.

Naturally, dividends aren’t assured, and the share price might proceed underperforming (lowering the whole return). However as a shareholder myself, I do just like the look of the earnings potential right here.

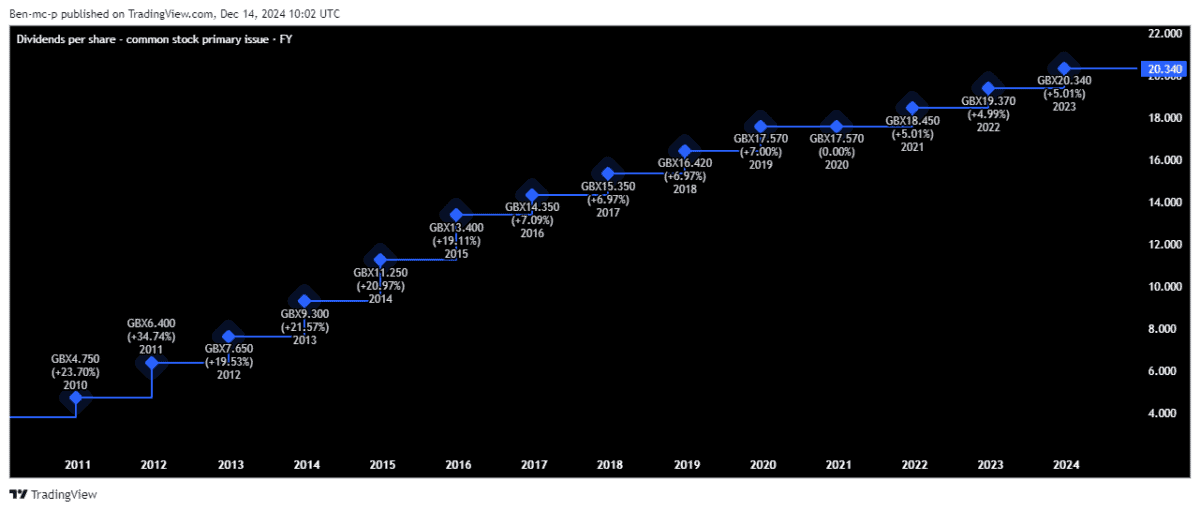

Moreover, I really like its great long-term dividend progress report.

However ought to I purchase extra shares?

I’ve some reservations

Admittedly, if it wasn’t for the clockwork-like dividends and monster yield, there wouldn’t be a lot to get enthusiastic about. Authorized & Normal’s progress has been sluggish, with the agency working in regular however mature markets.

Plus, whereas boasting a robust model and huge expertise, the agency additionally faces fairly a little bit of competitors within the UK. That is one thing to think about.

In the meantime, it additionally operates in a closely regulated business. This partly explains why worldwide buyers haven’t been eager to snap up UK monetary shares for the reason that 2007/08 monetary disaster.

With Donald Trump again within the White Home aiming to decontrol and unleash animal spirits, it’s potential that the inventory continues to meander within the wilderness for the subsequent 5 years. Or maybe the other is perhaps true.

Rate of interest cuts might assist, doubtlessly resulting in a re-rating of the inventory. Nevertheless, inflation crept again up in October, to 2.3%, above the Financial institution of England’s 2% goal and the sharpest rise shortly. So price cuts aren’t now a shoo-in over the approaching months.

Regular away

Trying on the enterprise, it seems to be strong, with buying and selling at the moment according to expectations.

Between 2024 and 2027, L&G anticipates core working earnings per share growing at a compound annual progress price (CAGR) of between 6% and 9%.

In early December, administration additionally advised that shareholder returns may very well be increased than beforehand outlined. As a reminder, it had dedicated to a modest £200m share buyback and a 2% rise within the annual dividend, following a 5% hike this yr.

This information is what perked up the share price not too long ago.

I’ll maintain reinvesting

On steadiness, I nonetheless price this as the most effective high-yield dividend shares round. I’d prefer to see a bit higher share price efficiency, however the 9%+ yield makes up for this.

I’ll make investments extra money within the inventory throughout 2025, although not £10,640 as that will be a giant chunk of my ISA allowance used up on a single share.

What I’ll do nonetheless is reinvest any dividends I get to gas the compounding course of. Even when the annual yield stays regular at 9.4%, merely reinvesting these payouts might develop £3k to £10k inside 14 years.