Key Takeaways

- Mt. Gox has commenced the distribution of Bitcoin and Bitcoin Money to its collectors.

- The initiation of repayments by Mt. Gox is exerting downward strain on Bitcoin market costs.

Share this text

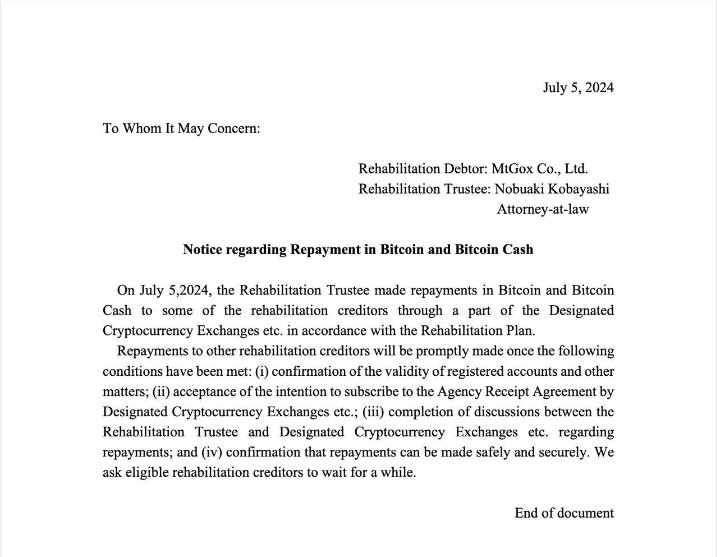

Mt. Gox, as soon as the dominant drive within the crypto trade world, has commenced the distribution of Bitcoin and Bitcoin Money to its collectors, marking the tip of an almost decade-long wait.

The method started this July, following final month’s announcement of the compensation plan.

Mt. Gox and its place in crypto historical past

Programmer Jed McCaleb based Mt. Gox in July 2010, later promoting it to French developer Mark Karpelès in March 2011. Below Karpelès’ management, the trade expanded its operations in Tokyo and by 2013 was dealing with over 70% of all world Bitcoin transactions.

Regardless of its market dominance, Mt. Gox struggled with persistent safety and operational points. Between 2011 and 2013, the trade fell sufferer to a number of hacks and transaction malleability assaults, resulting in frequent buying and selling and withdrawal suspensions. These recurring issues step by step eroded person belief and resulted in important liquidity challenges.

The trade’s troubles culminated in early 2014 when it suspended all bitcoin withdrawals, citing technical difficulties. This transfer fueled hypothesis in regards to the firm’s solvency. On February 24, 2014, Mt. Gox ceased operations completely, shutting down its web site and halting all buying and selling actions.

The latest transfer to launch funds to former customers has induced extra promoting strain within the Bitcoin market, reflecting the continued affect of the trade’s historic significance. On the time of writing, Bitcoin is buying and selling on the $54,200 degree.

Share this text

![]()