Ahoy! Dose of DeFi is in search of a part-time paid researcher. This individual would contribute to analysis and hyperlink gathering in addition to authoring and publishing their very own deep dives. Extra data right here. Ship resume & one analysis pattern to careers@caneyfork.co.

Beneath, Denis returns to take inventory on the state of the modular blockchain house. He first appeared on the market alternative in November 2022, after which how rollups had been advancing in Might 2023. Since then, the pendulum positively swung in the direction of Solana and the monolithic design, however already so early on in 2024, the modular narrative is oscillating again.

This concern of Dose of DeFi is dropped at you by:

There’s a greater technique to deploy and handle Uniswap v3 positions. Attempt Oku.commerce out at this time for a greater liquidity provision expertise. Observe Oku on X.

Solana is all the trend as of late, and rightfully so. It’s gone from the darkish days of the Alameda disaster, to robust price motion, and from frequent halts to efficiently dealing with one of many busiest airdrop claims in historical past – all whereas sustaining extremely low charges. From the angle of onboarding new customers, Solana is a sensible choice: Ethereum L2s nonetheless cost up to USD1 per transaction (and we actually don’t suppose ranging from BSC or Tron is a good suggestion).

One other of Solana’s strengths is its single international state that immediately displays all market alerts, with out the arbitrage and bridging hops between rollups or shards. It’s as if buying and selling on all international exchanges was seamless 24 hours a day, with occasions immediately mirrored in price modifications on all exchanges, irrespective of the geography or time zone.

These are the advantages of a monolithic chain at its greatest, however there stay downsides to this design alternative. Most notably, that the Solana validator set traits in the direction of centralization attributable to very excessive {hardware} necessities. This occurs as a result of Solana monolithically handles all three layers of blockchain: execution, consensus, and information availability.

On the opposite finish of the design spectrum, modular structure – and particularly the outsourced information availability layer – is rising in reputation. This method lowers transaction prices whereas sustaining low {hardware} necessities (though MEV threatens this). A modular design additionally permits for extra specialised chains and {hardware} for particular purposes, with dYdX being one of the best instance.

On the forefront of the modular motion is Celestia, a sequence optimized for rollup information effectivity. Ethereum, alternatively, has arrived at a modular method in a extra piecemeal method, constructing the airplane while already flying. We consider rollups are the important thing to scaling and cheaper transactions, with the battle for information availability layers (and the remainder of the modular stack) now on.

The information availability downside was first recognized within the early race to scale blockchains. The main target was on minimizing the quantity of information to retailer with a purpose to maximize the variety of nodes in a community. The identical dynamics underpinned Bitcoin’s block dimension wars. Knowledge availability refers to a blockchain’s skill to make its information accessible to all community individuals. The important thing breakthrough in fixing this downside was the introduction of information availability sampling (DAS), as Bridget Harris explains:

“With DAS, light nodes can confirm that the data is available by participating in rounds of random sampling of block data rather than having to download each entire block. Once multiple rounds of sampling are completed – and a certain confidence threshold is reached that the data is available – the rest of the transaction process is safe to occur. This way, a chain can scale its block size yet maintain easy data availability verification. And considerable cost savings are also achieved: these emerging layers can reduce DA costs by up to 99%.”

Celestia, Avail, NearDA, and EigenDA are a very powerful DA initiatives. They need not confirm transactions, however merely verify that every block was added by consensus and that new blocks can be found to the community. They depend on third-party sequencers to execute and confirm transactions. Celestia was launched in October 2023, Avail and EigenDA have their mainnet in coming months, and Close to has most just lately introduced its DA answer. Let’s evaluation the distinctive options of every:

-

Celestia selected the quickest street to market with fraud proofs (that are additionally utilized by optimistic rollups). The tradeoff is that within the present configuration, Celestia gained’t have the ability to assist ZK rollups. Celestia’s staff claims that round 70% of all new Arbitrum Orbit chains are utilizing Celestia for information availability.

-

Avail (ex Polygon Avail) as a standalone blockchain offers a quick and safe information and consensus layer that offers builders what they should launch a rollup (whether or not a ZK or optimistic).

-

EigenDA might be probably the most Ethereum-aligned, as a result of it’s a DA module, not a blockchain. Additionally, the restaked ETH in EigenLayer will likely be out there to safe rollups utilizing EigenDA. Its weak spot is that it’s not utilizing information sampling or information availability proofs.

-

NearDA allows saving on a rollups’ information availability charges, by storing information on Close to’s sharded blockchain. NearDA leverages an essential a part of Close to’s consensus mechanism, which parallelizes the community into a number of shards.

After which we have now the rollups themselves. Of the rollups that construct on these DA suppliers, there are a variety of instruments to make it simpler to launch a rollup:

-

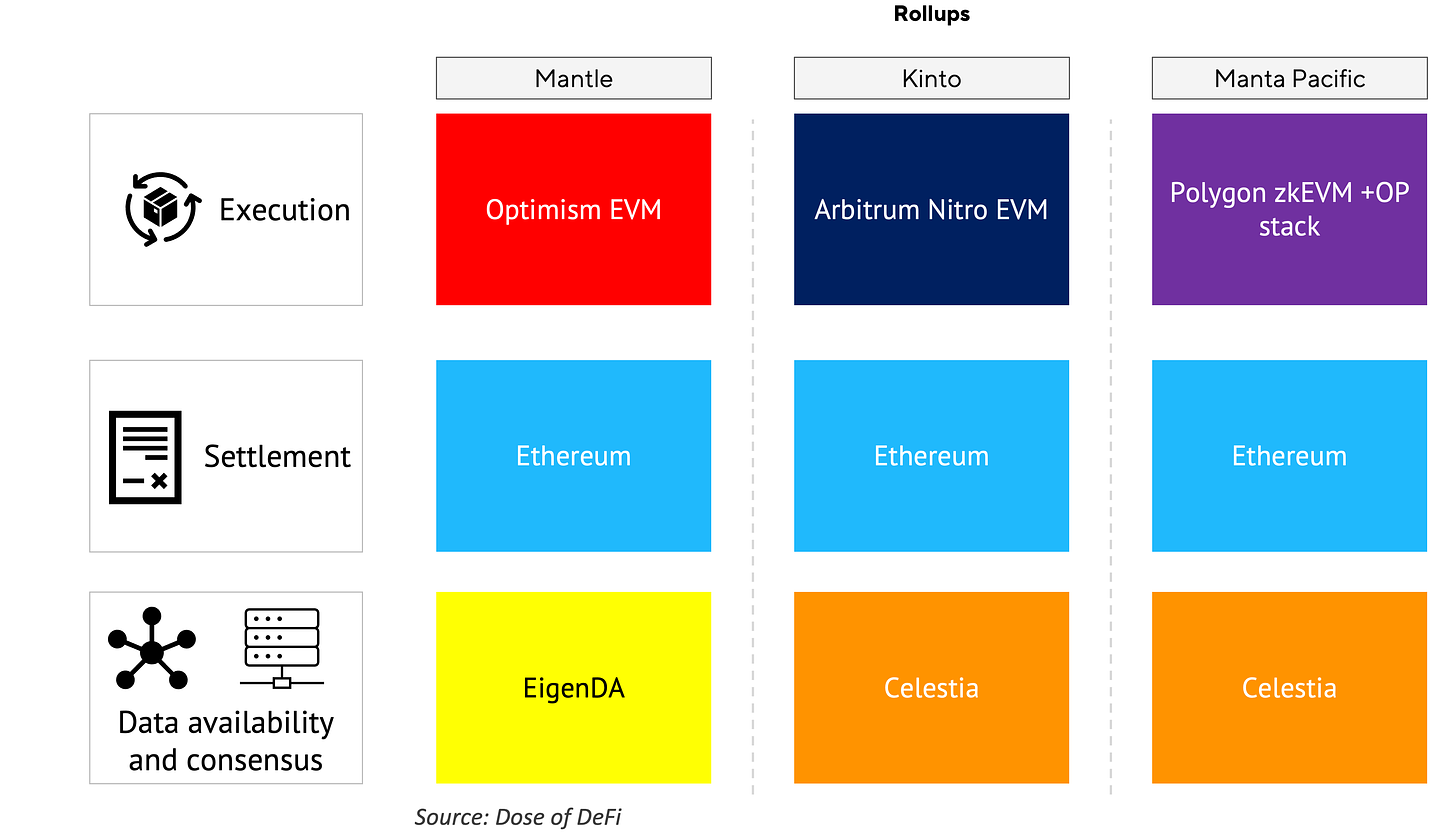

By harnessing Celestia’s modular information availability, Manta Pacific offers considerably decrease prices in comparison with monolithic L2 options, and has already saved $1million in Ethereum fuel charges. Manta additionally makes use of customized opcodes for verifying ZK expertise, which makes it actually low cost for them to have privateness and native randomness within the protocol.

-

The Mantle Community is constructed upon a modular structure that merges an optimistic rollup protocol with the info availability answer from EigenDA. This integration allows the Mantle Community to inherit Ethereum’s safety whereas additionally offering extra inexpensive and readily accessible information availability.

-

Kinto is a KYC’d chain the place each consumer and developer should full a passport KYC course of earlier than transacting on the community. It makes use of Celestia to drive down prices.

In a really modular means, modules of every layer are chosen primarily based on particular wants. The number of mixture choices could be seen right here:

Rollup-as-a-service initiatives like Eclipse make it even simpler to launch a rollup, the place the developer chooses which expertise to make use of for every of the three modules.

Equally, Conduit permits you to deploy a rollup in quarter-hour, with Optimism, Arbitrum Orbit, and Celestia because the supported stacks. A month-to-month internet hosting infrastructure payment is paid to Conduit, and there is a separate information availability payment paid to the supplier.

The wealth of potential mixtures that modularity creates is actually a significant step ahead. Is it akin to the issue of constructing an early web site in comparison with the benefit and customization of Squarespace at this time?

Regardless of the expansion in DA initiatives, many have reservations about outsourcing DA. Vitalik made his clear: “Your data layer must be your security layer.” Dankrad Feist, one other member of Ethereum Basis, concurs: “If it doesn’t use Ethereum for data availability, it’s not an (Ethereum rollup) and therefore not an Ethereum L2.”

We agree. Rollups with outsourced information availability will likely be much less safe than these utilizing the identical chain for information and consensus (and actually ought to be referenced as “validiums”), though safe sufficient for sure purposes. Brief-term initiatives utilizing such rollups will emerge and fade rapidly, making it a great experimentation and testing floor. Nevertheless, for long-term holding of economic belongings, L1s similar to Ethereum or rollups utilizing them each for information and consensus will stay the networks with the bottom danger profile.

Whereas skeptical about outsourced information availability, Ethereum is massive on modular structure. The early imaginative and prescient of scaling by way of sharding was deserted in favor of modular.

The three foremost updates wanted to implement the imaginative and prescient are rollups (we talked about these earlier than), proposer-builder separation (“instead of a block proposer generating a ‘revenue-maximizing’ block by itself, it delegates the task to a market of outside actors (builders)”), and information sampling. The latter is a means for gentle nodes to confirm {that a} block was revealed by solely downloading a couple of randomly chosen items of information. That is technically more difficult than the opposite two and would require two to a few years to ship.

Vital observe: EIP-4844 was step one in bettering Ethereum’s information availability layer earlier than information sampling goes dwell. As mentioned earlier, enhancing Ethereum is just like constructing the airplane while flying; as soon as the Ethereum Basis acknowledged the necessity for rollups (aka when Vitalik dropped the well-known rollup-centric future), the staff opted to increase blocks with blobs (a devoted house tailor-made particularly for rollup information). Blobs are anticipated to scale back the price of rollup transactions up to 10 fold. EIP-4844 is scheduled to go dwell with the Dencun improve in March/April. Whereas it is a non permanent answer to maintain Ethereum aggressive for 2 to a few years, the long-term answer will likely be supporting validity proofs on mainnet itself, which is able to make rollups orders of magnitude cheaper.

Whereas Solana is likely to be strongly defending its philosophy of monolithic structure (and so they would possibly show proper for a lot of use circumstances), the business appears to be converging on modularity. Within the case of Ethereum, solely modular structure will allow a future the place:

1. Transactions are low cost for thousands and thousands of customers because of rollups (scalability);

2. The community is protected against censorship and threats like 51% assaults (safety); and

3. A median PC or perhaps a cell can run a node to confirm transactions (decentralization).

One would possibly ask if Ethereum’s modular structure solves the blockchain trilemma that was imagined to be unsolvable? Technically it doesn’t, as a result of Ethereum just isn’t a monolithic community anymore, however as a modular community, it does.

Of those three, we expect decentralization is a very powerful a part of the trilemma to unravel. Innovation will ultimately drive down transaction prices; prioritizing decentralization (particularly geographic) is the one means to make sure long-term safety for the community. Ethereum is main in decentralization by having probably the most distributed validator set, with greater than 800,000 validators. On the similar time, with the modular method, it may adapt to new design improvements by personalized rollups that launch on prime. Celestia and others actually share this imaginative and prescient. The query remaining is whether or not Ethereum can transfer on this modular path quick sufficient to maintain up with the competitors, which is constructing from scratch, and never fixing the airplane while flying.

-

Uniswap Basis proposes payment swap for token holders in governance Hyperlink

-

Superstate launches on-chain, regulated fund monitoring TBills Hyperlink

-

DEX aggregator Jupiter airdrops $700m to Solana customers Hyperlink

-

Synthetix 2024 roadmap Hyperlink

-

Filth Roads author launchs M^0, “money middlware for the digital age” Hyperlink

-

CoW DAO releases MEV-capturing AMM Hyperlink

-

Lending protocol Morpho sees big development Hyperlink

-

a16z invests $100m in EigenLayer Hyperlink

That’s it! Suggestions appreciated. Simply hit reply. I’m in Denver subsequent week, get in contact when you’re round.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Monetary Content material Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content material is for informational functions and isn’t supposed as funding recommendation.