Picture supply: Getty Photographs

Shares have been unstable not too long ago. This 12 months, many shares are down 10%+. Is there the potential of a serious inventory market crash from right here? Nicely, I don’t suppose we will rule one out, as a result of proper now, there’s a brand new threat rising.

A significant threat?

In the meanwhile, most buyers are specializing in two fundamental points – tariffs and the potential of a US/international recession. These are each legit issues and so they justify the current market weak point.

I’m rising more and more involved about one other – much less talked-about – threat, nevertheless. And that’s the fast flight of capital out of the US.

You see, for a very long time, the US has been seen as a pillar of security within the monetary markets. The US greenback, for instance, is the world’s ‘reserve currency’ and the foreign money that buyers sometimes flock to when there’s uncertainty.

US Treasuries, in the meantime, are typically seen as safe-haven investments. In periods of uncertainty, international buyers have a tendency to maneuver into these bonds, pushing costs up and yields down.

Nonetheless, right this moment the panorama appears to be altering. As a result of unpredictable and unstable nature of insurance policies and rhetoric (tariffs, tweets, discuss of eradicating the Fed Chair) popping out of Washington, international buyers are shifting cash out of the US at an alarming pace.

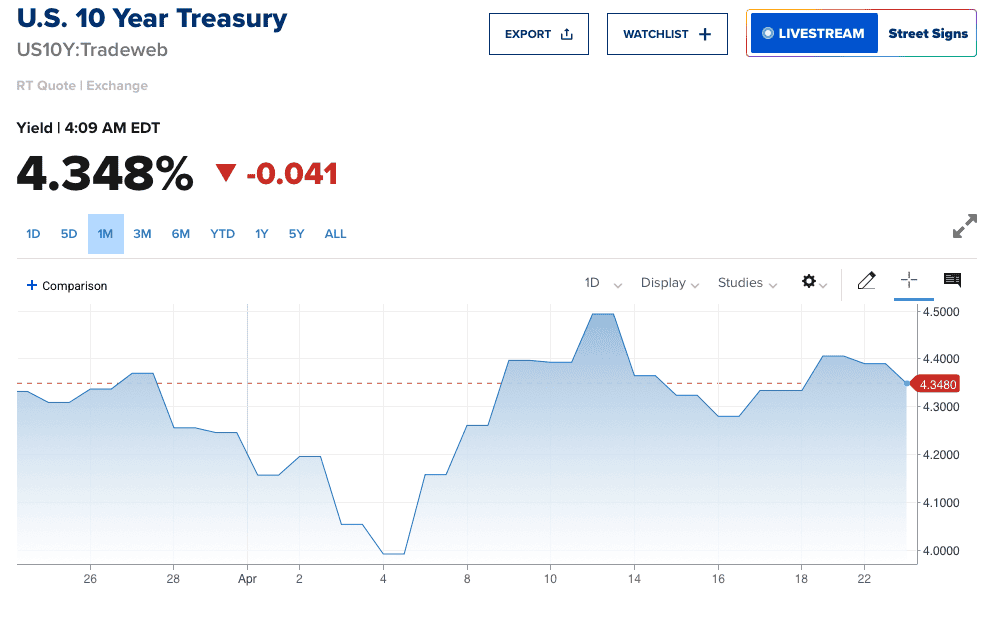

We will see this in bond yields. Since ‘Liberation Day’, 10-year US Treasury yields have risen sharply as China and Japan have offloaded US debt.

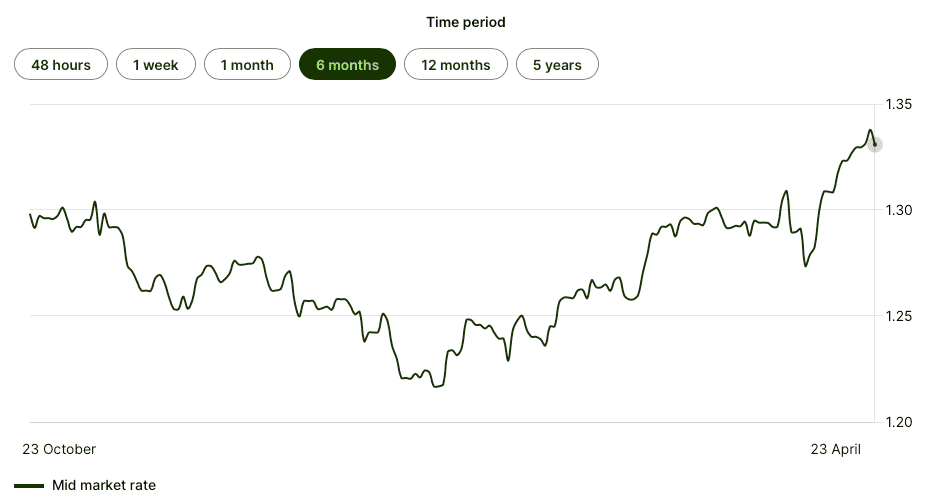

We will additionally see it within the US greenback. Simply have a look at how a lot the pound has strengthened in opposition to the buck in current weeks.

I’m getting involved that this pattern may escalate if the political backdrop doesn’t settle down. If it was to escalate, it wouldn’t be good for international markets.

One implication might be excessive borrowing prices for US corporations and customers. This might damage the world’s largest economic system considerably.

One other implication might be the downgrading of US debt by a scores company comparable to S&P. This might doubtlessly ship shares down sharply.

Total, the backdrop is somewhat regarding. So, we will’t rule out a inventory market crash.

Ought to the market’s belief points with the US administration deteriorate additional, then this might be the catalyst for the sell-off to tackle its subsequent leg.

TD Securities’ Prashant Newnaha

What I’m doing

Now, I’m not going to dump all my shares due to this threat. That wouldn’t make sense as a long-term investor.

However I’m specializing in threat administration. Extra particularly, I’m boosting my ‘defensive’ positions.

One inventory I’ll prime up is Unilever (LSE: ULVR). It produces on a regular basis gadgets comparable to soaps, deodorants, and detergents – stuff individuals have a tendency to purchase it doesn’t matter what’s taking place within the economic system.

Up to now, this inventory has offered some safety in opposition to financial/market weak point. And it seems to be doing the identical factor now – 12 months to this point it’s up about 7%.

One different factor to love is that it’s a really dependable dividend payer. The yield is about 3.3% at present, and this might appeal to buyers if UK rates of interest fall.

After all, as a worldwide operator, this firm may face some tariff points. It may additionally come underneath strain if customers downgrade to cheaper manufacturers.

But when there’s a serious market meltdown, I’d count on the inventory to outperform. So, I feel it’s price contemplating right this moment.