No matter you concentrate on Tesla (NASDAQ: TSLA), this can be a inventory about which there appears to be no scarcity of opinions.

Simply wanting on the share price chart already provides a sign of the wild swings in sentiment we’ve got seen about Tesla within the inventory market at totally different factors.

It’s down 36% for the reason that begin of the yr. That could be a large fall for any firm, not to mention one which – even after the autumn – instructions a market capitalisation of over $800bn.

Regardless of that, the share continues to be up by over 50% up to now yr alone. Over 5 years, issues look even higher: shareholders over that interval are actually sitting on a 437% achieve.

Tesla appears to confuse many buyers

So, what’s going on right here?

A number of the motion displays Tesla’s virtually meme-like qualities for a corporation of its measurement, with a lot of buyers taking a robust view primarily based on elements like their opinion of its chief govt.

However most meme shares have a market capitalisation of some billion {dollars} at most. I feel there’s something very totally different occurring on the subject of Tesla inventory: even many subtle buyers are genuinely confused about how to worth it.

Is it a automobile maker with engaging revenue margins lately, now seeing gross sales volumes stage out?

In that case, even including in some additional worth for its fast-growing energy era enterprise, the present market capitalisation appears to be like crazy to me. It’s 20 instances the market cap of Ford, for instance.

Or, is Tesla actually an funding case a couple of confirmed capability to innovate and disrupt huge industries, because it has already executed with vehicles and will but do with taxis and robotics? In that case, I see an argument for Tesla doubtlessly being a long-term cut price on the present price.

Investing on information, not hope

Tesla has executed a really spectacular job on the subject of enterprise development. Income has soared lately. Damaged down right into a quarterly income quantity, although, and because the chart beneath reveals, there may be clear trigger for concern for Tesla buyers proper now.

Created utilizing TradingView

This week, the corporate introduced a woeful first quarter as the corporate fights fires on a number of fronts. Not solely has it seen falling gross sales, however earnings slumped too. The primary quarter noticed revenues fall by a fifth in comparison with the identical interval final yr.

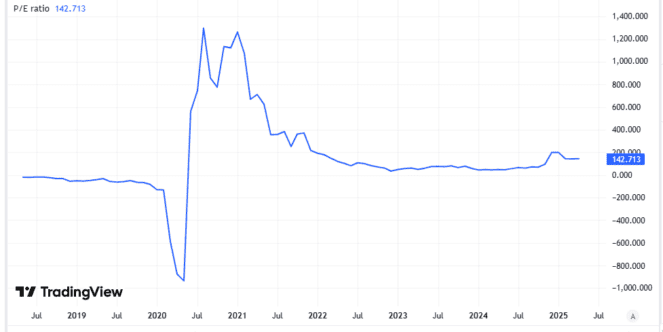

In the meantime, earnings per share (on a Usually Accepted Accounting Rules foundation) fell 71% in comparison with the identical quarter final yr. Already, Tesla’s price-to-earnings (P/E) ratio of 143 appears to be like far too excessive for me to think about investing. But when earnings fall, the valuation will look even much less engaging.

Created utilizing TradingView

I do see hope for the non-automotive enterprise. Vitality era and storage income surged 67% yr on yr within the first quarter. But it surely nonetheless represents solely round 15% of complete income.

For now, no less than, energy era and pipeline tasks like automated taxis look too unproven to justify the present Tesla valuation. With rising competitors, the car enterprise additionally appears to be like overvalued to me.

Taken collectively, primarily based on present information not future hopes, I see Tesla inventory as overvalued and won’t be investing.