Bet_Noire

Marathon Digital (NASDAQ:MARA), the well-known Bitcoin (BTC-USD) miner, reached a peak price over the past Bitcoin bull market, at round $76 per share in November 2021. The inventory presently trades at round $19. Shares excellent on the November 2021 excessive had been 102.63 million shares, whereas shares excellent immediately are 282.79 million shares. There was a 175% dilution since November 2021. Reaching the earlier all-time price on the present variety of shares would imply a market cap of round $21.5 billion. That is across the mixed market cap of all U.S.-listed Bitcoin miners. That is value noting earlier than shifting into the remainder of this text.

The final Bitcoin bull run adopted the third halving occasion in 2020, and plenty of traders and analysts contemplate the halving occasion a powerful catalyst for a Bitcoin price rally. The fourth Bitcoin halving occasion befell two months in the past, and this sentiment of a price rally forward is strongly shared amongst Bitcoin traders. A Bitcoin price rally sometimes extends to Bitcoin-linked shares. Throughout a Bitcoin bull market, Bitcoin firms which have proven effectivity in operations, good monetary efficiency, or launched revolutionary services simply choose up on the Bitcoin-driven momentum.

|

BTDR |

CLSK |

CORZ |

BITF |

MARA |

|

|

Jan. – Apr. common BTC mined |

~292 |

~687 |

~907 |

~303 |

~915 |

|

Might (post-halving) BTC manufacturing |

184 |

417 |

448 |

156 |

616 |

|

Publish-halving share -/+ |

-37% |

-39% |

-50% |

-48% |

-32% |

Following the latest halving occasion, miners have seen their month-to-month BTC manufacturing diminished (the halving occasion slashed block rewards in half). Marathon Digital’s post-halving effectivity is value noting; the corporate was the least impacted by the halving by way of month-to-month BTC manufacturing, following the operations updates launched by miners in Might. MARA’s manufacturing declined by ~32% in comparison with the typical BTC produced between January and April – the bottom discount in manufacturing amongst publicly traded Bitcoin miners.

I’ve lined Marathon Digital two occasions previously, the primary protection was in August final yr and the second was in January. I used to be bearish on MARA in my August article as a result of over 300% YTD non-catalyst-driven price surge the inventory recorded at the moment; nevertheless, in January, I noticed the potential within the surge in transaction charges on the Bitcoin community as Bitcoin Ordinals had been recording heightened actions, and I highlighted how Marathon Digital stood to achieve from the heightened Ordinals exercise (contemplating Marathon Digital runs its personal mining pool), not additionally forgetting the momentum that was constructing across the spot Bitcoin ETF approval. Based mostly on these components, I gave MARA a score improve to “hold” in January.

After the halving occasion, Marathon has confirmed a excessive stage of effectivity and continues to work in the direction of all-round vertical integration. Marathon Digital’s method to mining operations effectivity is considerably distinctive. The miner makes use of proprietary know-how throughout software program, firmware, and {hardware}, thus controlling a number of important enterprise variables for favorable operations. The most recent addition to Marathon’s proprietary tech stack is its next-gen immersion cooling answer.

Most analyses of BTC miners focus primarily on hashrate development and electrical energy capability, overlaying metrics like mining rigs output and the miner’s vitality capability (Th/s and MW). The results and significance of environment friendly cooling programs for efficient mining operations usually take a again seat. I, nevertheless, contemplate cooling as a darkish horse in Bitcoin miners’ operational effectiveness.

Marathon Digital Spearheads Two-phase Immersion Cooling in Bitcoin Mining

Marathon Digital is an organization that has all the time been large on optimization in each {hardware} and software program, and this has set the corporate aside amongst Bitcoin miners. The corporate unveiled a two-phase immersion cooling (2PIC) system – the 2PIC700 tank on the Empower Convention in late March, in Houston – as an addition to its proprietary tech stack. There’s a rising market demand for enhanced cooling options (like immersive cooling) pushed by the rising want for larger processing speeds and overclocking capabilities in high-performance computing (HPC) clusters used primarily for AI processing.

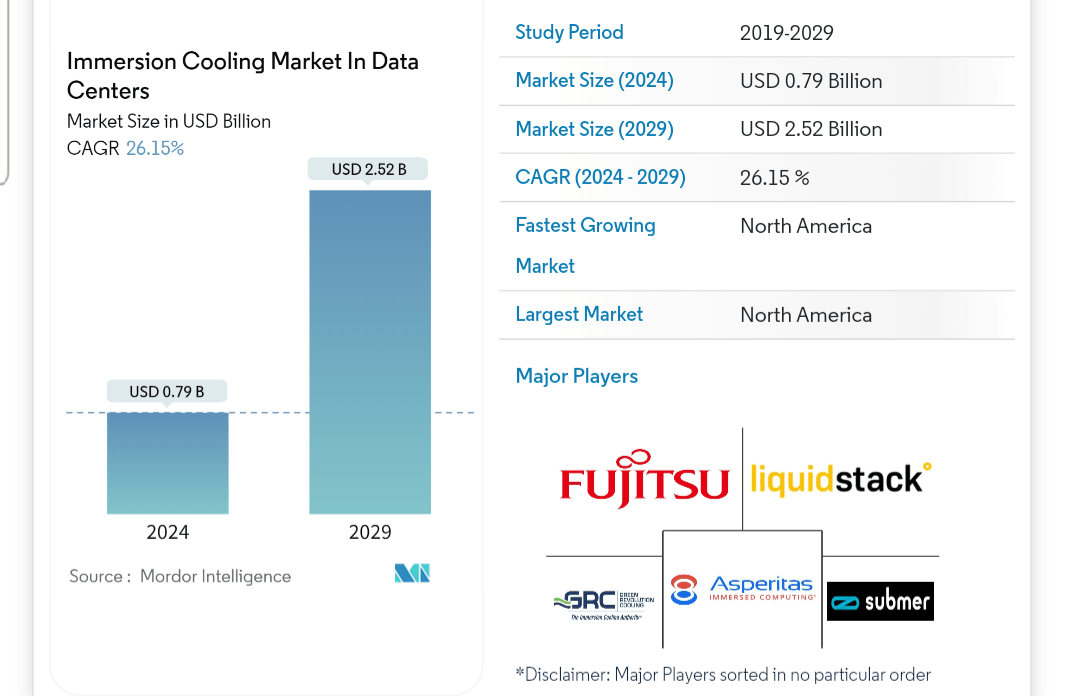

Modor Intelligence

Experiences by market researchers recommend that the immersion cooling market in knowledge facilities will develop by ~26% CAGR between 2024 and 2029, reaching a $2.9 billion market measurement from the present ~$790 million market measurement. Be aware that this development projection particularly focuses on immersion cooling adoption inside HPC knowledge facilities.

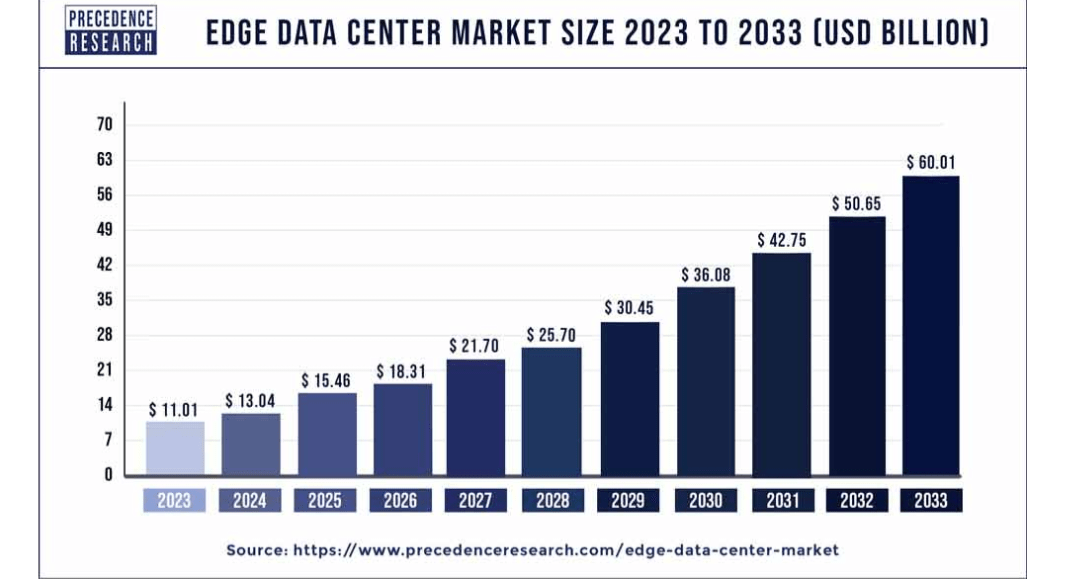

Edge knowledge heart market development (Priority Analysis)

Different rising tech sectors, like edge AI and IoT programs, may additionally very a lot see two-phase immersion cooling adoption on the edge; therefore, the potential market measurement is far bigger. The sting knowledge heart market measurement is projected to develop at round 18% CAGR, to achieve a $60 billion market measurement by 2033, in line with Priority Analysis. Edge computing entails processing knowledge in real-time close to the information supply; therefore, the necessity for very quick processors in a constrained area. 2PIC provides the flexibility for computing energy to be packed right into a a lot smaller area whereas sustaining optimum chip temperature.

The immersion cooling approach has been round for some time and has already witnessed some adoption in cloud knowledge facilities in addition to within the Bitcoin mining sector. Alibaba (BABA) adopted immersion cooling for its knowledge facilities some years in the past and has reportedly achieved higher effectivity, recording a decrease Energy Utilization Effectivity (PUE) at a few of its knowledge facilities which have applied immersion cooling.

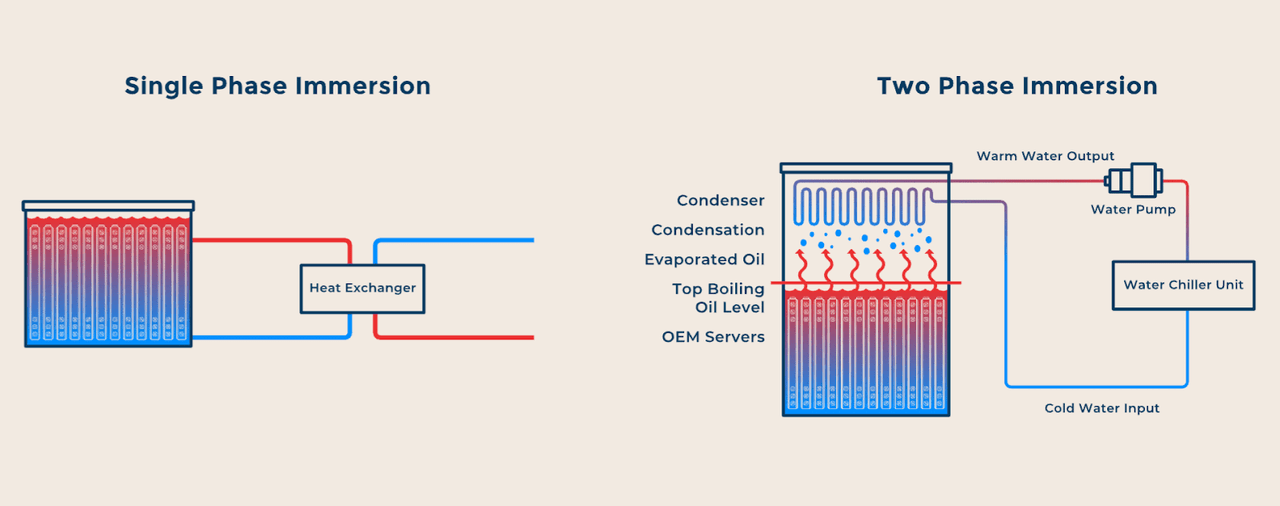

At present, the well-known and widely-used immersion cooling approach is the single-phase immersion cooling (SPIC). In SPIC, laptop parts or ASIC miners (within the context of Bitcoin mining) are submerged right into a single-phase hydrocarbon dielectric liquid coolant. The method is named single-phase as a result of the liquid coolant would not change its state within the cooling course of. The first benefit of SPIC is its a lot larger energy density in comparison with non-immersive cooling methods.

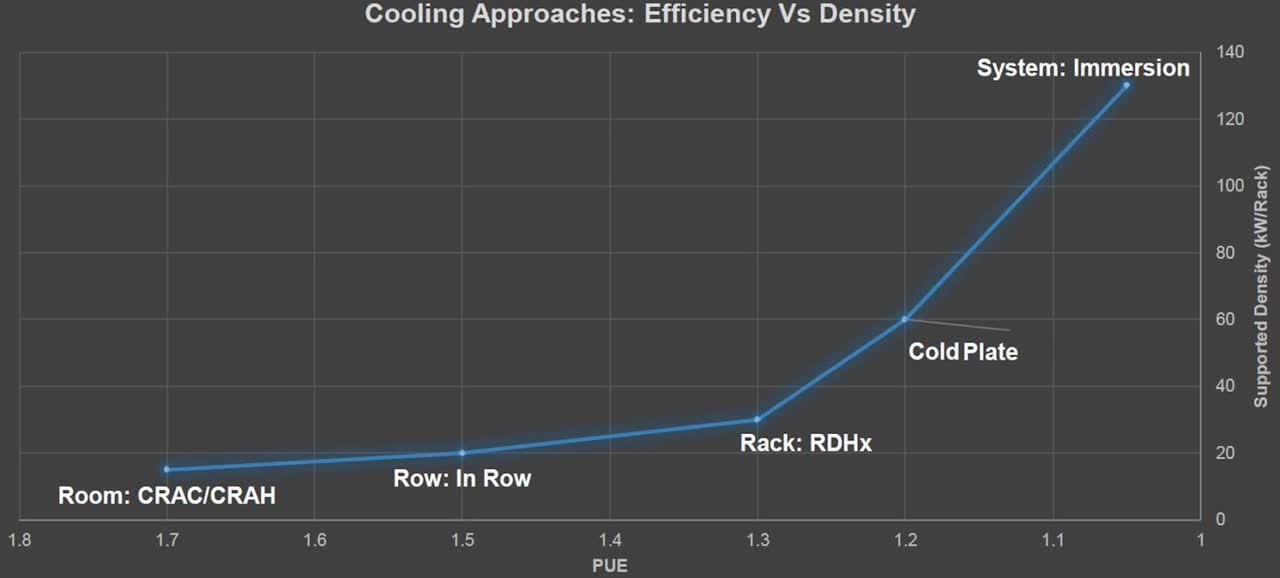

Cooling models effectivity and energy density curve supply (Open Compute Undertaking)

The graph above is from a presentation on the Open Compute Summit in 2018, evaluating effectivity and energy density amongst completely different cooling models. Right here we see immersion cooling has the bottom PUE (finest effectivity) and the best energy density (highest capability).

Single-phase and two-phase immersion cooling illustration (Marathon Digital)

The most recent iteration of immersion cooling is 2PIC. Similar to SPIC, the 2PIC approach entails submerging laptop parts or ASIC miners (within the context of Bitcoin mining) into fluorinated dielectric fluid or coolant. The fluoride liquid cools the ASIC miners in a purpose-built tank. As warmth is generated by the miners, the coolant absorbs latent vitality, inflicting a few of the fluoride liquid to transition right into a gaseous state. Water-cooled coils appearing as condensers on the prime of the purpose-built tank condense the gaseous fluorinated fluid again into its liquid kind, permitting it to return to the underside of the tank for the cooling cycle to proceed. This methodology, involving the change of state of the coolant, creates a extra environment friendly cooling answer over SPIC. Fluorinated fluids in a gaseous state require much less vitality to chill again to liquid kind in comparison with the cooling of hydrocarbon oils or coolants within the SPIC approach. In Bitcoin mining, improved cooling instantly interprets to larger realized hashrate as mining rigs will carry out at their optimum if adequately cooled.

Additionally, the adoption of immersion cooling in mining amenities considerably reduces overhead energy consumption by minimizing the necessity for added parts that draw additional vitality, comparable to giant followers, exterior pumps, or warmth exchangers, that are core parts in air-cooled and hydro-cooled setups, giving the power a greater PUE and probably translating into improved operational value effectivity within the long-term.

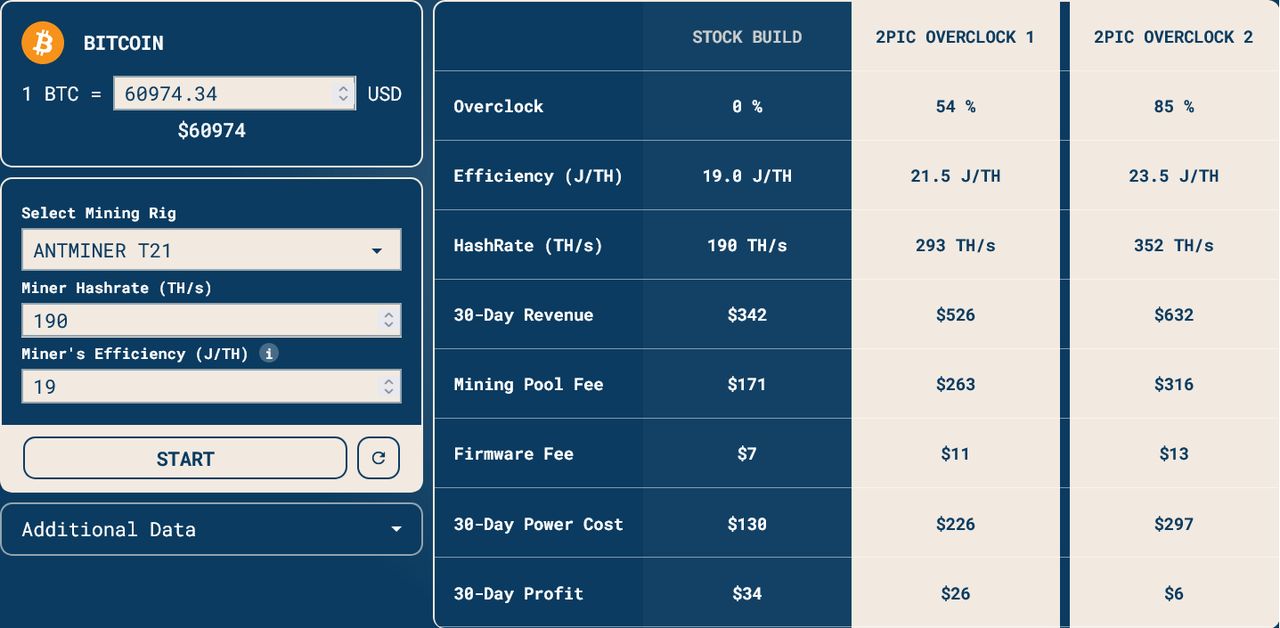

2PIC700 overclocking calculation (Marathon Digital)

The above picture, displaying knowledge from the 2PIC700 calculator software on Marathon Digital’s web site, reveals materials adjustments within the output capability of BITMAIN’s Antminer T21 when it’s cooled by the MARA 2PIC700 tank. On the “2PIC Overclock 1” column, the miner is overclocked (clarify overclocking) by 56%. This resulted in a ~54% hashrate enhance from the unique 190 TH/s output. Although the mining effectivity dropped by round 13% from 19 J/Th to 21.5 J/Th, the hashrate elevated by round 54% to 293 Th/s. A better overclocking at 85% ends in mining effectivity dropping from 19.0 J/th to 23.5 J/th (a ~23% lower in effectivity) whereas hashrate will increase by a powerful 85% to 352 Th/s. This can be a very favorable trade-off between mining effectivity and hashrate.

I imagine that in searching for alpha in tech shares, understanding a comparatively lesser-known know-how, its potential functions, and its disruptive impression permits traders to face out early and keep forward of the pack. I imagine that the revealing of Marathon Digital’s 2PIC tank has not but been totally priced into MARA, because the market seems to underestimate its potential as a catalyst for each the inventory and the corporate’s development. Whereas analysts at JPMorgan nonetheless preserve their underweight score for MARA, I take a bullish view. As I discussed earlier, cooling metrics are sometimes thought-about ancillary by traders and analysts in analyzing Bitcoin miners.

Different Noteworthy Newest Highlights on Marathon Digital

…because the BRC-20 ecosystem continues to develop, it’s going to probably carry larger charges to miners. As acknowledged earlier, transaction charges turn into a comparatively necessary a part of a miner’s earnings when block rewards get minimize in half throughout halving. MARA is well-positioned to benefit from transaction charges post-halving as a result of it owns and operates a self-mining pool. MaraPool represented greater than 22% or about 380 BTC of MARA’s complete Bitcoin manufacturing in December. This bodes nicely for MARA.

Excerpt from my final MARA protection.

Because the fourth halving occasion in April and the following slashing of block rewards in half, transaction charges have turn into an necessary a part of miners’ income, along with block rewards. Miners’ income from transaction charges has grown immensely because the introduction of the aptitude so as to add uncooked binary knowledge known as inscriptions on the Bitcoin community. These inscription transactions (which embrace multimedia and software program information) have giant byte knowledge in order that they sometimes command larger charges. Inscriptions are like “NFTs” on the Bitcoin community.

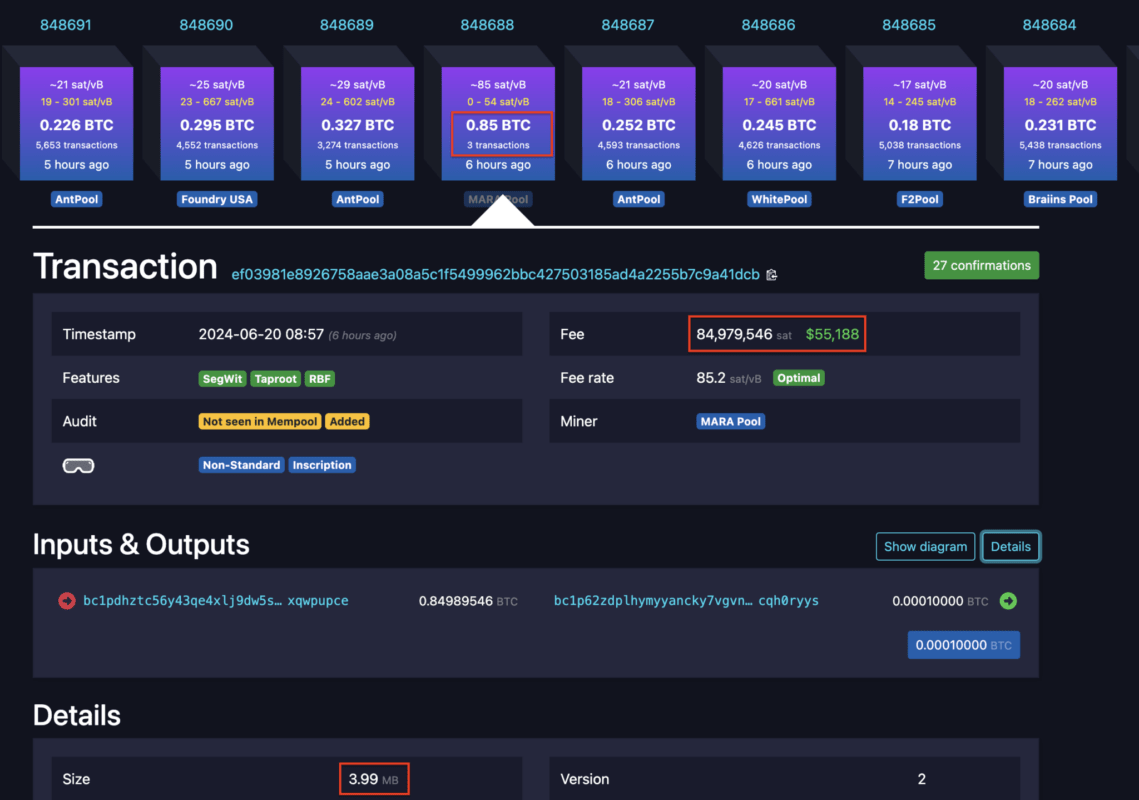

MARA Pool 0.85 inscription charge (TheMinerMag – Bitcoin Mining Information, Information, Analysis and Evaluation)

Marathon Digital got here in ready for the halving, rightly anticipating the surge in transaction charges that might comply with the halving’s discount in block rewards. Marathon launched Slipstream in February – a Bitcoin Layer-2 service that enables direct and seamless submission of arbitrary knowledge on the Bitcoin community, permitting customers to ship such transactions on to Marathon Digital’s mining pool. I imagine this is without doubt one of the components that made Marathon Digital emerge because the least impacted miner by month-to-month BTC manufacturing after the halving occasion. That is spectacular administration prudence and foresight proper there, for my part. It’s value mentioning that Slipstream service has attracted some criticism from a faction of the Bitcoin group who cited the opportunity of transaction censorship as this goes towards the Bitcoin community’s core ethos of complete decentralization.

Final week, Marathon Digital acquired a 0.85 BTC charge by its mining pool, MARA Pool, to inscribe a video on a Bitcoin transaction. MARA Pool included solely 3 transactions within the block the place this inscription was recorded and the 0.85 BTC inscription charge was a lot larger than the typical 0.22 BTC charge recorded by different swimming pools regardless of their processing a mean of 4,500 P2PKH transactions (common transactions) per block. Within the warmth of a full-blown crypto bull market (possible imminent) the place NFTs regain their misplaced hype, I count on extra of some of these charges.

Marathon controls its personal mining pool MARA Pool, runs its personal firmware (MARAFW for optimized mining), is actively concerned within the research and design of extra environment friendly mining {hardware} (just like the UCB 2100 alternative management board for BITMAIN Antminers), and is spearheading a next-gen cooling system. This stage of involvement in each aspect of its operation makes Marathon Digital an all-round vertically built-in Bitcoin miner.

From a capability and monetary standpoint, Marathon Digital has recorded enlargement and development. Within the Q1 CY24 monetary reported a 184% enhance in internet revenue at $337 million or $1.26 per diluted share. The MARA administration has proven some divergence from their earlier technique of leasing electrical energy to run mining operations. The corporate added 516 MW of electrical energy and now has a complete of 1.1 GW capability, of which it now controls 54% in comparison with simply 3% of electrical energy management on the finish of This fall final yr. This enlargement makes the near-term goal of fifty exahash by the top of this yr a lot achievable. I imagine that the timing of this capability enlargement could be accretive for the corporate.

Dangers

There stays the chance that 2PIC is probably not adopted because the go-to knowledge heart cooling tech in the long term. New iterations of different current cooling strategies, like hydro-cooling, may emerge and show equally environment friendly or cost-effective to set up.

As reiterated by analysts overlaying Bitcoin-linked shares on Looking for Alpha, these shares exhibit excessive volatility as a result of they’re instantly linked to a extremely speculative and unstable asset. Investing in Bitcoin shares comes with an inherent volatility threat.

Takeaway

Management your personal future or another person will. – Jack Welch

I imagine that Marathon Digital has the potential to realize an unparalleled stage of effectivity in comparison with friends with this stage of all-round vertical integration. Bitcoin has turn into mainstream and Bitcoin mining is not the fledgling business that it was as soon as thought-about to be. Miners that management their very own enterprise variables by vertical integration have a excessive aggressive benefit over friends at this stage of the market lifecycle.

MARA is down about 27% since my final article in January with a “hold” score. The present inventory price is a pretty entry. The post-halving momentum and rally are constructing up for Bitcoin and this momentum will almost definitely unfold to environment friendly miners with wholesome monetary standing like MARA.