Picture supply: Getty Photographs

With the Persimmon (LSE:PSN) share price falling 25% since April 2020, the inventory’s now (4 April) yielding a formidable 4.9%. This places it comfortably within the prime quarter of FTSE 100 dividend payers.

And if the analysts are right, the payout ought to enhance over the following couple of years. For 2024, the housebuilder returned 60p a share. Wanting forward, these crunching the numbers are forecasting 60.84p (2025) and 66.12p (2026). This implies the ahead yield could possibly be as excessive as 5.4%.

Nevertheless, I’m hoping future payouts will likely be increased than this. From 2020 to 2024, Persimmon paid out 81.2% of earnings. If this ratio is maintained, primarily based on the common of the brokers’ earnings forecasts, the dividend could be 77.80p (2025) and 92.17p (2026). This could push the ahead yield up to 7.6%.

After all, dividends are by no means assured.

For the time being, the corporate’s returning much less of its revenue to shareholders than it did beforehand. For 2024, the ratio is 65%. And I perceive the corporate’s warning. The latest housing market downturn means the trade has been treading fastidiously. However the firm’s most up-to-date replace suggests issues could possibly be on the flip.

Inexperienced shoots?

In 2024, it constructed 10,664 houses. That’s a 7.5% enchancment on 2023. And its earnings per share (EPS) elevated by 11.8%.

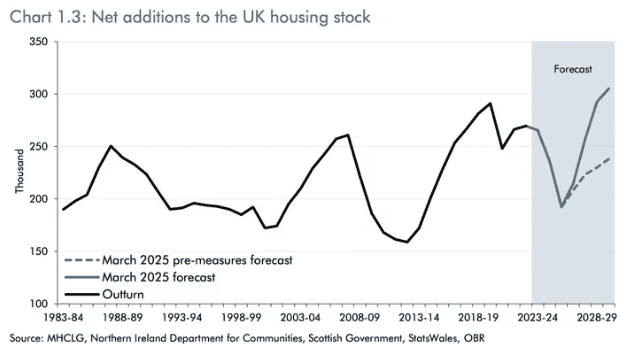

For 2025, it’s focusing on 11,000-11,500 completions. The trade has welcomed authorities need to spice up building, together with its main overhaul of the planning system. The Workplace for Finances Duty (OBR) is predicting a big improve within the variety of houses constructed throughout this Parliament.

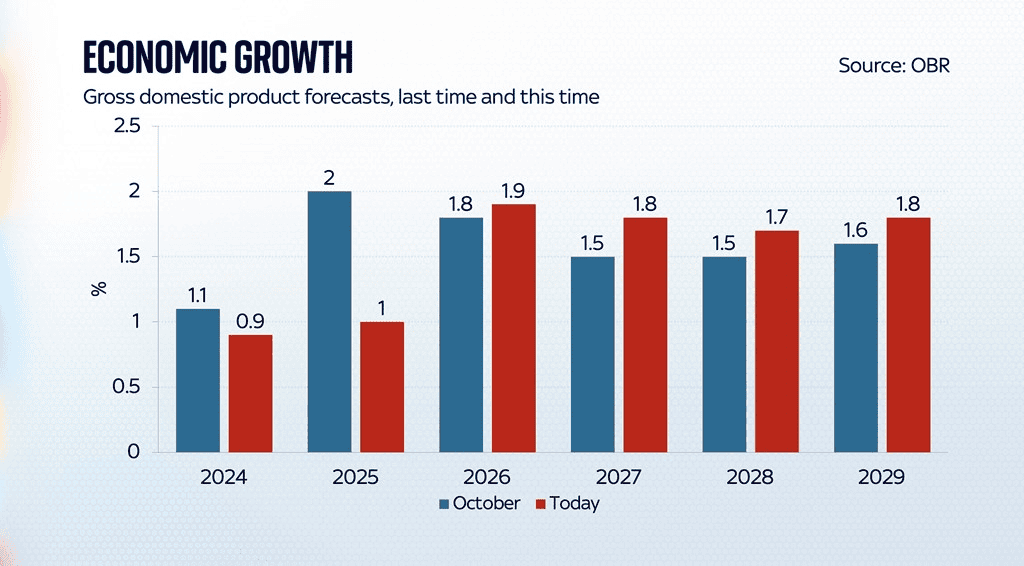

As introduced throughout the Chancellor’s spring assertion on 26 March, it’s additionally upgraded its UK progress forecast from 2026 by way of till 2029. If these estimates show to be correct, this could assist safe the anticipated restoration within the housing market that’s prone to profit from anticipated reductions in borrowing prices.

Nonetheless some challenges

However we’re not there but. Because of present international uncertainty, the OBR lately halved its progress forecast for 2025. And the ‘Trump tariffs’ may make issues worse.

Additionally, inflation has eroded revenue margins within the building sector. In 2022, Persimmon recorded a revenue earlier than tax per completion of £68,086. For 2024, this was 46% decrease at £37,050.

I doubt we’re going to see a return to pre-Covid margins any time quickly.

Dealer opinion

Nevertheless, with no debt on its stability sheet, a personal gross sales order e book of £1.15bn and a enterprise that’s prone to escape the worst of the tariffs, I believe the inventory has robust progress prospects.

And I’m not alone in considering the corporate has loads of potential. Of the 18 analysts overlaying the inventory, 13 say it’s a Purchase. Additionally they have a median one-year price goal of £15.41 a share – 27% increased than it’s at this time — with a spread of £12.60-£23.

I first purchased the corporate’s shares earlier than the pandemic. This implies I’m nursing a big loss. Nevertheless, since then to assist soften the blow, I’ve banked some wholesome dividends. And that’s why I invested. I noticed it as a superb dividend share.

However I believe the latest pullback within the share price means buyers in search of a progress share may take into account including Persimmon to their portfolios. And the dividend’s not unhealthy both.