YEREVAN (CoinChapter.com) —Kernel DAO Airdrop Stay. The $KERNEL token launched on April 14, 2025, and instantly grew to become accessible on main exchanges similar to Binance, KuCoin, Kraken, Gate, MEXC, and Bitvavo. Declare entry is open at kerneldao.com/claim-airdrop.

About KernelDAO Airdrop

Kernel DAO Airdrop introduces a restaking infrastructure tailor-made for proof-of-stake networks. At the moment, the protocol secures over $2 billion in complete worth locked throughout three core merchandise: Kernel, Kelp, and Acquire. Every product addresses a definite operate within the restaking mannequin — providing pooled safety, enabling liquidity entry, and offering automated yield methods.

To start with, Kernel helps decentralized purposes on BNB Chain by pooling validator collateral, thereby lowering the price of securing on-chain protocols. In the meantime, Kelp operates on Ethereum and points rsETH — a liquid token that permits customers to stake property whereas sustaining full compatibility with DeFi protocols. As well as, Acquire simplifies entry to complicated yield methods by providing vaults optimized for airdrop accumulation and risk-managed returns.

Collectively, these elements are unified by means of the $KERNEL token. By staking it, customers can take part in governance, earn Kernel Factors, and supply slashing insurance coverage — all of which strengthen alignment throughout the KernelDAO ecosystem.

Kernel DAO Airdrop Entry and Participation

The airdrop opened at 11:00 AM UTC on April 14. Chain distribution will depend on utilization patterns: individuals utilizing solely Kernel obtain their airdrop on BNB Chain, whereas customers of Kelp, Acquire, or any product mixture obtain allocations on Ethereum. The preliminary circulating provide was set at 16.23% of the whole 1 billion tokens.

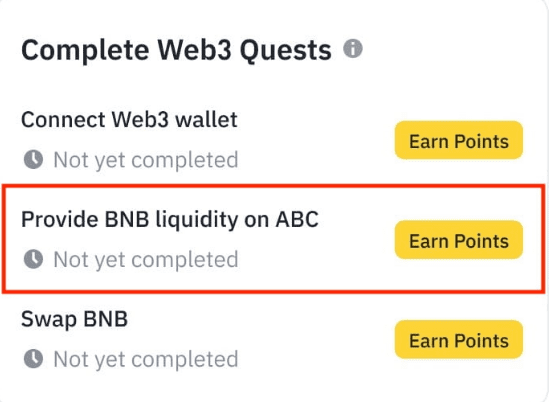

Customers also can earn $KERNEL by means of Binance Megadrop. Participation requires BNB fixed-term deposits and completion of KernelDAO-specific Web3 duties by means of a Binance Web3 Pockets. Last scores are calculated utilizing the method:

Last Rating = (BNB Mounted-Time period Factors × Quest Multiplier) + Bonus Factors

As soon as the occasion concludes, rewards are distributed to Binance spot wallets proportionally to customers’ scores.

Construction of KernelDAO Airdrop Merchandise

Every product in KernelDAO targets a definite problem within the restaking ecosystem and integrates right into a broader capital coordination framework.

Kernel capabilities as a shared safety infrastructure on BNB Chain. It aggregates staked property to create pooled validator protection, permitting decentralized purposes to entry financial safety with out setting up unbiased validator networks. This design considerably reduces entry prices for initiatives needing slashing ensures or consensus-level integrity. By leveraging Kernel, initiatives can bootstrap belief whereas stakers earn protocol rewards for underwriting that belief.

Kelp offers a liquid illustration of restaked Ethereum property by means of its ETH token. This token permits customers to entry staking rewards whereas sustaining liquidity — which means they don’t must lock funds long-term. It’s broadly built-in with DeFi platforms, enabling customers to maneuver rsETH between protocols like Aave and Compound for added yield. Kelp’s construction additionally helps composability, permitting restaked property for use throughout a number of purposes with out compromising validator alignment.

Acquire automates participation in complicated yield-generating alternatives throughout DeFi, CeDeFi, and real-world asset platforms. Its vaults are non-custodial and optimize for various risk-return profiles. For instance, agETH focuses on airdrop eligibility by monitoring and interacting with ecosystems prone to reward early customers. hgETH, alternatively, balances DeFi publicity with structured danger mitigation, providing institution-grade methods in a single click on. These merchandise simplify entry to classy methods whereas sustaining person management over property.

Kernel DAO Airdrop Governance and Token Allocation Mannequin

Protocol governance makes use of staked $KERNEL to find out validator insurance policies, reward settings, and AVS integrations. Solely lively stakers can vote. This mechanism hyperlinks governance on to financial participation.

Staked tokens additionally act as slashing insurance coverage. Validators backed by $KERNEL share protocol rewards with stakers, aligning danger with potential earnings. This provides an financial security layer throughout the ecosystem.

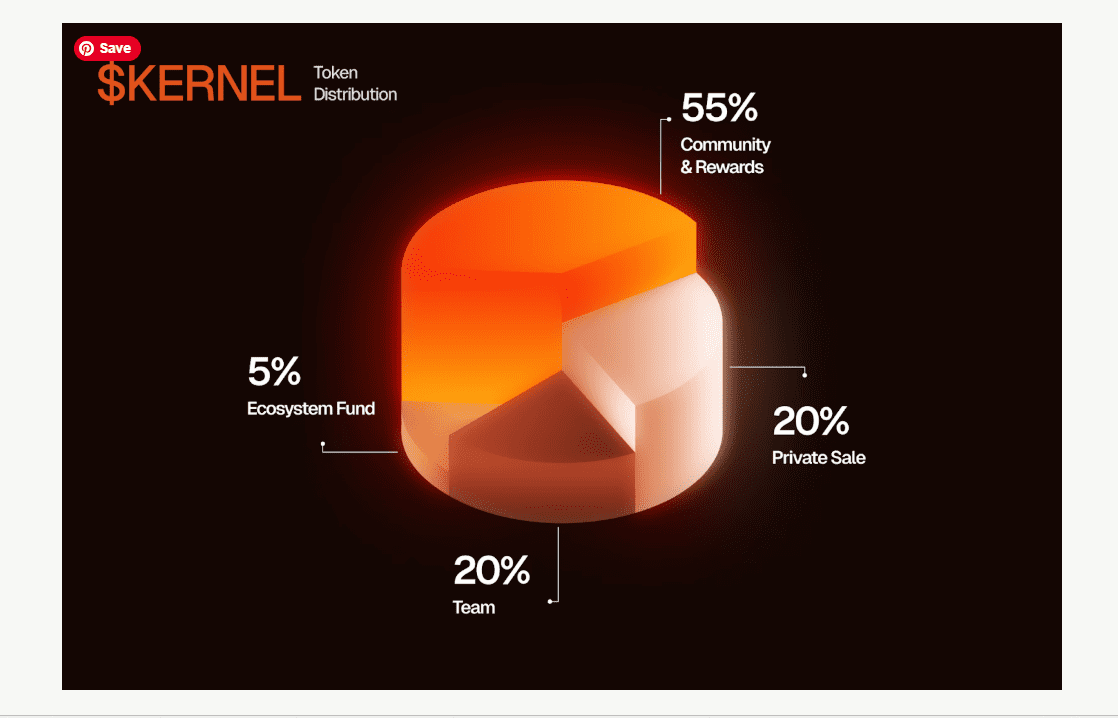

55% of the token provide is allotted to neighborhood use — together with airdrops, staking incentives, and lively participation rewards. Non-public sale and crew allocations every account for 20%, whereas 5% helps future partnerships and integrations. All allocations comply with structured unlock schedules with gradual vesting to forestall speedy inflation.

Ahead Outlook

KernelDAO is positioned to broaden past its present presence on Ethereum and BNB Chain. The subsequent part focuses on cross-chain deployment, aiming to function a common financial safety layer for Layer 1 and Layer 2 ecosystems. This contains onboarding extra validator units and enabling shared safety frameworks throughout new networks.

The roadmap outlines integration with extra DeFi protocols, in addition to partnerships involving tokenized real-world property (RWAs). These collaborations will lengthen the utility of KernelDAO’s merchandise, permitting restaked property to entry a broader vary of yield alternatives and safety purposes.

One other key focus is refining the slashing safety mechanism. KernelDAO intends to reinforce its insurance coverage buildings to reduce losses for stakers and guarantee excessive reliability for protocols relying on its safety layer. These upgrades are important because the restaking stack begins to service extra purposes with various safety wants.

With the Kernel DAO Airdrop Stay and the unified $KERNEL token circulating on main exchanges, infrastructure growth is about to speed up by means of 2025. All customers can confirm their eligibility or declare tokens straight at kerneldao.com/

Kernel DAO Airdrop — FAQs

1. What’s the Kernel DAO Airdrop?

The Kernel DAO Airdrop is a token distribution occasion for $KERNEL, the governance and utility token of the KernelDAO ecosystem.

2. When did the airdrop begin?

It began on April 14, 2025, at 11:00 AM UTC.

3. The place can I declare my $KERNEL tokens?

Eligible customers can declare at kerneldao.com

4. Which chain will I obtain the airdrop on?

-

BNB Chain if you happen to solely used Kernel

-

Ethereum if you happen to used Kelp, Acquire, or a number of merchandise

5. What’s KernelDAO’s complete token provide?

1 billion $KERNEL tokens, with 16.23% in circulation at launch.

6. How is the token distributed?

-

55% to the neighborhood

-

20% non-public sale

-

20% crew

-

5% ecosystem development

7. What’s Binance Megadrop’s function?

Binance Megadrop lets customers earn $KERNEL by locking BNB and finishing Web3 duties.

8. What are KernelDAO’s merchandise?

-

Kernel: shared safety on BNB Chain

-

Kelp: liquid restaking on Ethereum

-

Acquire: automated vaults for yield and airdrops

9. What’s the utility of $KERNEL?

It allows staking, governance, slashing insurance coverage, and reward eligibility.

10. What’s subsequent for KernelDAO?

Enlargement to extra chains, deeper DeFi integrations, and enhanced validator insurance coverage techniques.