Solana (SOL) appears bullish as whales have renewed accumulation of the token, probably suggesting an imminent rally. Immediately, April 14, CoinRank shared knowledge disclosing that US-based SaaS agency Janover INC has purchased 44,158 SOL tokens value $5 million Solana for staking.

Whale provides over 44,158 SOL

That is the second buy, making the true property financing firm now maintain a complete of 83,084 SOL valued at $9.6 million. Primarily based on the corporate’s crypto-driven treasury coverage, Janover will begin staking the SOL tokens to assist safe and assist Solana community’s operations, consequently, generate rewards.

This transfer comes after Janover’s board not too long ago built-in cryptocurrency into the corporate’s company treasury technique. With its long-term crypto treasury technique, the agency began SOL accumulation and staking, hinting that the agency is ready to amass different favorite crypto property quickly.

Solana price updates

Whereas the whale’s token switch has despatched waves by means of the crypto market, it raises questions on SOL’s price motion. The whale’s exercise has already triggered a 1.9% rise in SOL’s market price, highlighting how large token transfers can stimulate the market.

A big motion of funds can immensely influence market stability and liquidity. Every time a major amount of property is withdrawn or dumped on-chain, it triggers an abrupt shock, leading to price volatility.

Strategic staking typically helps construct stability within the crypto market, particularly throughout turbulent instances. By staking, traders lock up property for a selected interval, lowering provide on exchanges and creating price assist ranges. This method lessens price fluctuations by suppressing panic promoting throughout downturns.

Such an enormous withdrawal means that whales are accumulating SOL tokens, driving SOL price positive factors. The asset price is presently standing at $132.34, up 2.3% from yesterday. Its worth has been up 30.1% and 5.1% over the previous week and two weeks in the past, respectively, a sign of token accumulation by traders and long-term consumers.

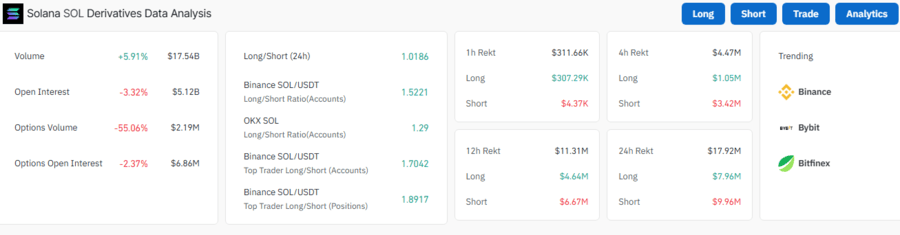

As per metrics from Coinglass, Solana’s transaction quantity rose by $5.91% from yesterday to $17.54 billion. This improve reveals a major outflow of SOL tokens from exchanges, suggesting substantial token acquisition that might set off shopping for stress and potential upward motion. Whale and long-term consumers seem like capitalizing on a current market dip to buy a big amount of SOL tokens.