Picture supply: Getty Pictures

Measured over any time-frame, the Relx (LSE: REL) share price has lived up to its repute for being a development inventory. Driving the momentum over the previous couple of years has been its rising AI choices. However I’m beginning to see some potential chinks within the armour that might derail its rise.

Diversified enterprise mannequin

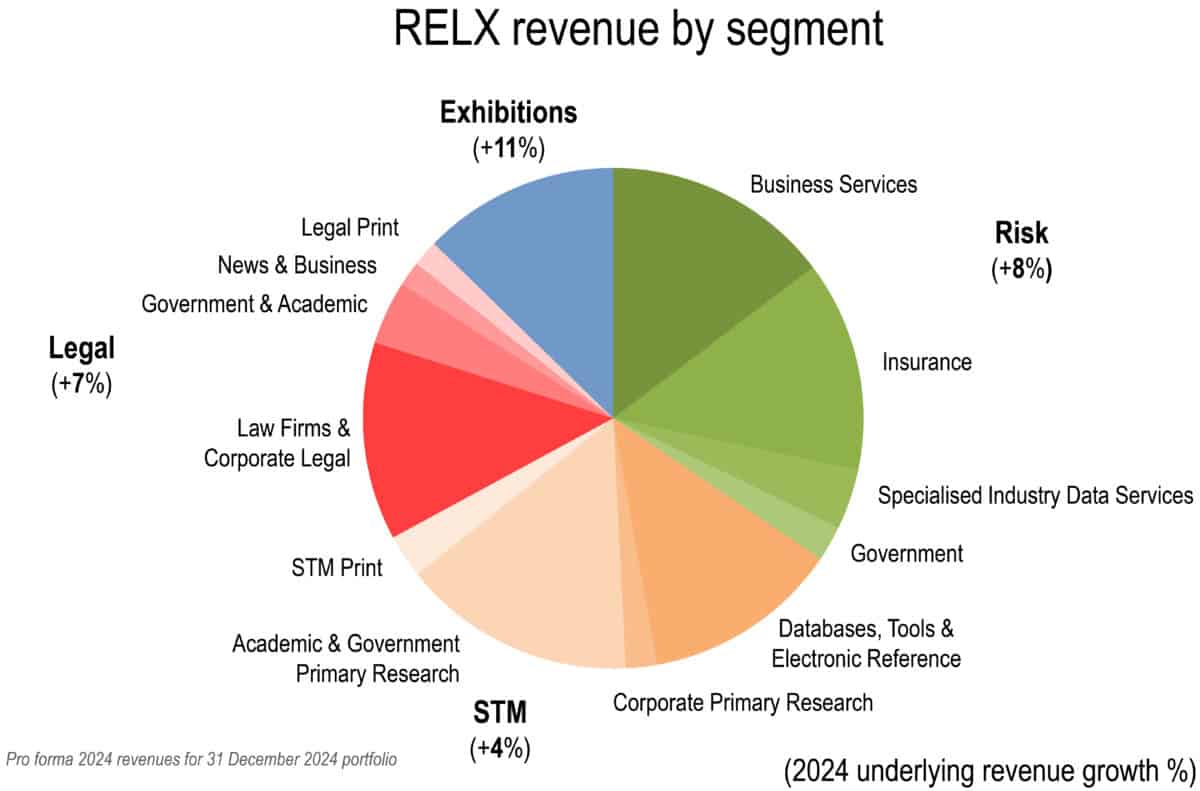

Relx is an info and information powerhouse. Nearly each information sector of the financial system depends on its analytics and decision-making instruments. This contains authorities, legislation, academia, science, and insurance coverage. The determine under highlights the sheer variety of its income streams is highlighted.

Supply: Relx presentation

One space that has seen super development is its authorized providing. Lexis+AI helps legal professionals automate their workflows.

The enterprise has a definite aggressive benefit right here. Its databases host over 161bn authorized paperwork and its AI mannequin is again checked in opposition to the authorized quotation service, Shephard’s. This ensures that its content material stays correct and up up to now, a given for any lawyer.

Scientific journals

One other space that’s seen explosive development is within the Scientific, Technical and Medical (STM) division. Main educational research and publications has seen unimaginable quantity development. In FY24, the variety of articles submitted throughout the portfolio grew by over 20%, and the variety of articles revealed was up 15%.

The sheer quantity of revealed article development since Covid has not gone unnoticed within the educational group, although. Many are starting to query whether or not quantity is extra vital than high quality. The problem of scientific or research fraud has shot up the agenda.

Scientific fraud

Final December practically each member of the editorial board of the pre-eminent Journal of Human Evolution resigned from Elseiver, the corporate’s publishing arm. They cited a dramatic downturn in high quality as the primary cause.

One thing is clearly afoot right here. In a latest open letter, a gaggle of scientists accused Springer Nature of failing to “protect…scientific literature from fraudulent and low quality” research.

So what?, you would possibly say. Why does this matter to an organization with a market cap of £70bn, one of many largest within the FTSE 100?

Evolving subscription mannequin

The normal cost mannequin for educational output entails establishments (resembling universities) paying a flat price for a bundle of journals. Nevertheless, this mannequin is being quickly supplanted by open entry fashions.

The outline ‘open access’ is one thing of a misnomer. What the business calls ‘processing charges’ have grow to be normal. A fast have a look at Open Entry Oxford quotes wherever as a lot as £10,000 per paper. Though Relx doesn’t report on such charges, estimates are that they have been $583m in 2023.

My concern is that your complete enterprise mannequin propping up an enormous slice of the corporate’s revenues is just not sustainable. A mannequin based mostly purely on article quantity will inevitably result in a dilution of high quality.

All this issues to an organization with some very wealthy valuation metrics. Its trailing price-to-earnings ratio at present stands at 37; price-to-book is 20. The inventory is priced for perfection. Its share price could possibly be clobbered if development slows.

For me, I see little margin of security right here, and subsequently I’m staying effectively clear for now.