Picture supply: Getty Pictures

One of the best time to purchase shares is when no person else needs to. That’s when costs are lowest and traders get probably the most for his or her cash, which ends up in the best long-term returns.

Whereas share costs have been coming down, there’s completely nothing to say they will’t fall additional. Regardless of this, I feel proper now does appear like a very good time to begin investing.

Inventory market momentum

The inventory market makes traders do uncommon issues. Usually, individuals gravitate in the direction of shopping for when costs are low – that’s why occasions like Black Friday are so well-liked.

The alternative’s true with shares. When issues begin turning down, traders usually start promoting the shares they have been beforehand shopping for, although the costs are actually decrease than they have been.

It’s straightforward to see why this occurs – share costs change extra usually and extra dramatically than the price of shopper electronics. And traders naturally fear about downward momentum. If a inventory’s going to be cheaper tomorrow, promoting it at immediately’s costs can appear like it is sensible. However the very best traders are those who’re in a position to purchase when shares are falling.

The place are we now?

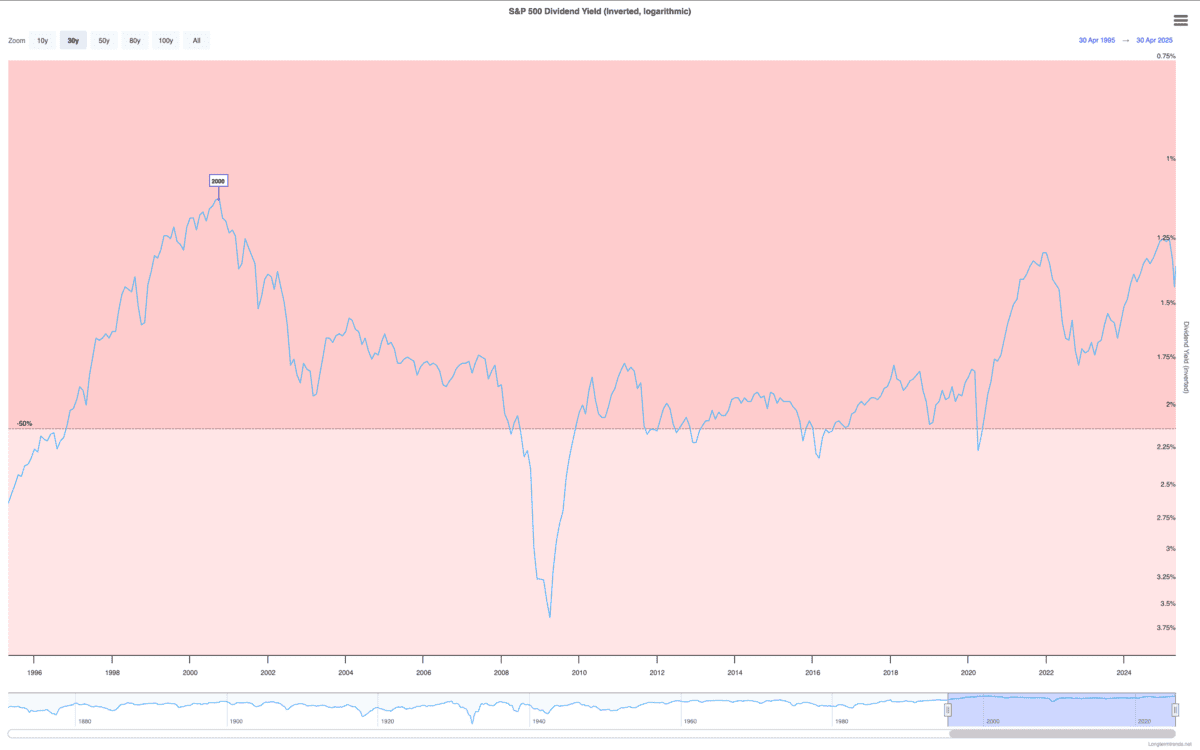

Share costs as a bunch have been risky over the past couple of weeks. However whereas the FTSE 100 has recovered from its losses, the S&P 500 continues to maintain working its means decrease. Traders nevertheless, shouldn’t be too hasty on the subject of shopping for US shares. Regardless of the current downturn, the S&P 500’s dividend yield remains to be traditionally low.

The present 1.2% dividend yield’s additionally round a 3rd of what traders may get from the FTSE 100. So there’s nonetheless lots to be mentioned for UK shares from a price perspective.

On each side of the Atlantic, I feel the very best technique is to search for particular person alternatives. In every index, there are shares the market could be underestimating.

Discovering worth

Diageo‘s (LSE:DGE) a good example. The stock’s been falling steadily for the final three years, pushed by short-term uncertainty and decrease alcohol consumption amongst Millennials.

These are real points, however there are additionally optimistic tendencies that shouldn’t be ignored. Regardless of declining alcohol consumption, spirits have been taking market share from beer and wine.

Moreover, the inventory seems unusually good worth at immediately’s costs. The dividend yield’s round 4% and the price-to-earnings (P/E) ratio’s round 16.

Traders haven’t had the possibility to purchase the inventory at these ranges in a very long time. And I feel Diageo’s scale ought to give it an enormous benefit on the subject of adapting to shifting preferences.

Getting began

Might Diageo shares fall farther from their present ranges? Completely – traditionally low metrics aren’t any assure the inventory’s going to go up any time quickly. Proper now although, traders get lots for his or her cash. The power of its manufacturers is a singular asset that ought to give it an enormous benefit over rivals.

Discovering the proper time to begin investing is almost inconceivable. However for anybody fascinated about it, I don’t consider there’s been a greater time to think about shopping for Diageo shares within the final decade.