Picture supply: Getty Pictures

If I had £500,000 in my Shares and Shares ISA, I imagine I may comfortably earn £25,000 yearly as a second earnings. That may be achieved by investing in bonds and dividend-focused shares that give me a mean yield of 5%. That’s concerning the equal of a £30,000 wage after tax. It’s not dangerous, however it may not be sufficient for some individuals.

How’s it achieved?

The utmost annual contribution to a Shares and Shares ISA is £20,000. As such, it could take some time to construct up to £500,000 via contributions alone. In fact, that excludes the primary motive individuals make investments… to make their cash work and develop.

In brief, there are many methods to show an empty portfolio into £500,000. A method can be to speculate £500 a month for 22.5 years — this assumes 10% annualised development. The difficulty right here is {that a} £25,000 second earnings wouldn’t go as far in 22 years, plus the return price may finish up being decrease.

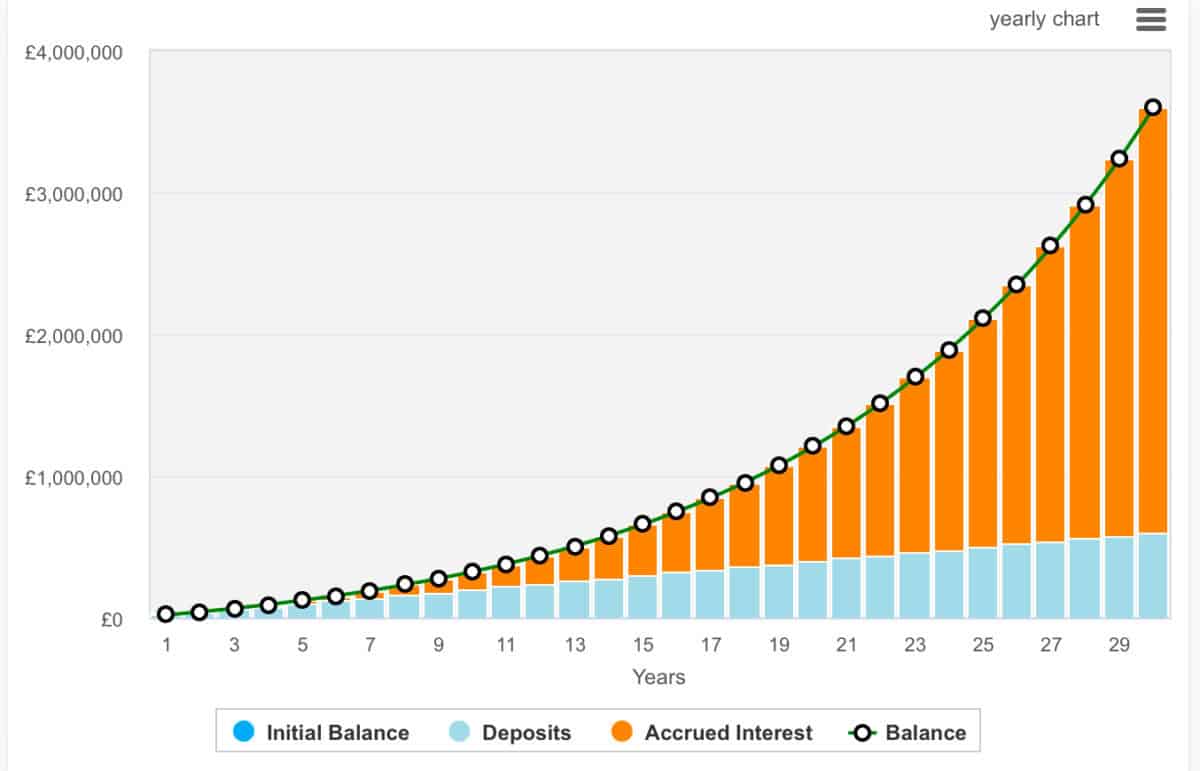

Nevertheless, greater contributions may imply this £500,000 determine is achieved sooner. The beneath chart reveals what could possibly be achieved when an investor maxes out their ISA allowance. In such a case, and assuming a powerful 10% annualised development price, this £500,000 can be achieved in simply 13 years. However try that compounding impression within the later years!

A actuality examine

There may be, nonetheless, a difficulty. And that concern is that many novice traders lose cash. They go chasing mega returns on dangerous investments and, most of the time, incur sizeable losses.

And this is the reason many advisors merely suggest investing in index-tracking funds. These are funds that goal to trace the efficiency of an index just like the FTSE 100. This additionally gives instantaneous diversification.

Different choices to think about

Along with such funds, traders could wish to contemplate trusts like Scottish Mortgage Funding Belief (LSE:SMT) to ship diversification and publicity to growth-oriented shares in tech.

Managed by Baillie Gifford, Scottish Mortgage focuses on high-growth firms, together with each private and non-private companies. It has vital holdings in tech giants like SpaceX, Nvidia, Amazon, and Meta.

Many traders may even level to the belief’s glorious observe report. From its first investments in Amazon in 2004, Scottish Mortgage usually picks the subsequent huge winner earlier than they’ve change into family names.

Nevertheless, it’s price noting that the belief employs gearing (borrowing to speculate), which might amplify features but additionally improve losses, making it a higher-risk technique. As of April 2024, gearing stood at 13%, down from 17% the earlier 12 months.

Regardless of this threat, I’ve just lately topped up on Scottish Mortgage because the shares dipped. Personally, I imagine its long-term development potential, significantly with tailor-made investments in synthetic intelligence (AI) and disruptive applied sciences, outweigh the short-term volatility.

Furthermore, it does have investments within the luxurious sector that present a level of shelter from the volatility of tech.