Picture supply: Getty Photographs

Selecting earnings shares has by no means been simple. And with a lot world uncertainty it’s laborious to know which sectors or corporations are more likely to keep their earnings and dividends.

On paper, corporations with a world footprint ought to do higher as they’re much less susceptible to a slowdown in a single explicit territory. However with President Trump’s erratic method to tariffs, it’s unclear who the short-term winners and losers will likely be within the world market.

Then there’s the specter of competitors. Attributable to intelligent applied sciences, conventional limitations of entry at the moment are simpler to beat than beforehand.

And if that’s not sufficient to deal with, the arrival of synthetic intelligence is threatening to disrupt conventional industries. Some corporations could also be left behind as they fail to embrace what has been described because the fourth industrial revolution.

For these causes, choosing dividend shares is usually a bewildering expertise.

Nonetheless, there’s one firm that I not too long ago got here throughout that doesn’t have to deal with any of those issues. And due to its wholesome dividend, I ponder whether Jersey Electrical energy (LSE:JEL) is an ideal earnings inventory.

A finger in lots of pies

In terms of electrical energy, there’s not a lot the corporate doesn’t do.

It oversees the import of electrical energy from France, generates energy utilizing its photo voltaic arrays, operates the transmission and distribution networks throughout the island, gives metering companies to home and business prospects, sells white items and gives consultancy companies. As a result of it has no opponents for the availability of electrical energy, there’s much less stress to innovate.

Roughly 95% of the power wants of Jersey are met by importing energy from France. The interconnector between the 2 jurisdictions is collectively owned with Guernsey Electrical energy. The steadiness of electrical energy for the island is bought from native turbines, with a tiny proportion produced by the corporate itself. With no exports, it’s going to by no means have to fret about Trump’s tariffs.

To my shock, though having monopoly standing, the corporate isn’t straight regulated. Nonetheless, its actions are overseen by Jersey’s competitors authority and the island’s authorities is the most important shareholder. However prospects get pleasure from decrease costs than their counterparts in mainland Britain.

A more in-depth look

With restricted alternatives to develop its buyer base, its earnings will likely be closely depending on the quantity charged by EDF in France. However Jersey Electrical energy is aware of that if its prices are rising, these could be handed on to prospects by way of increased tariffs.

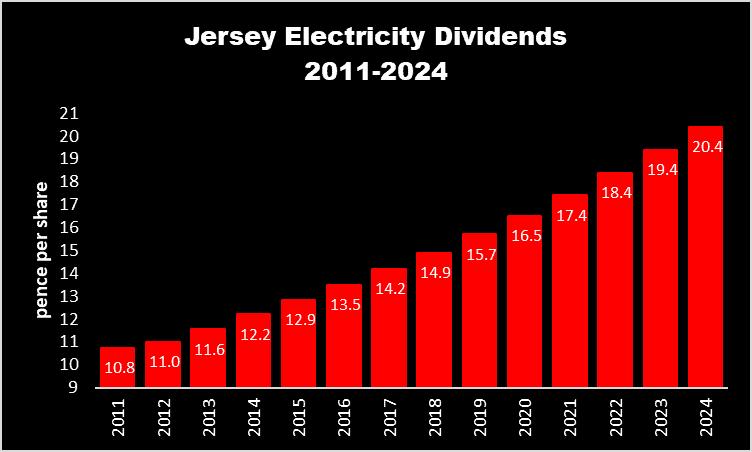

This certainty over earnings means dividend has been dependable. And because the chart under reveals, it’s elevated its payout for 13 consecutive years. The inventory presently yields a really respectable 4.8%.

Based mostly on its 2024 accounts, its price-to-book ratio is barely 0.2. In principle, if the Jersey authorities wished to purchase the 38% of the corporate that it doesn’t personal — assuming it provided a good price — it must pay shareholders greater than the present (10 March) worth of their shares.

What’s to not like about this inventory? Properly, with a market cap of simply over £50m, it lacks the monetary firepower to resist a significant shock. And I can’t see its share price rising considerably.

However principally as a consequence of is lack of publicity to the skin world and its wholesome dividend, I believe it’s a inventory that earnings buyers might think about including to their long run portfolios.